Angel investing platforms cover a wide range of tools. Some focus on investor discovery, others on angel group access, others on research or infrastructure. Throughout the fundraising process, founders often touch several of them over the course of a raise, each serving a different role.

This article breaks down 7 platforms that come up most often when founders look for angel investors. For each one, we outline what it is, how it’s typically used, and where it tends to show up in an early-stage fundraising process.

Table of Contents

How Founders Typically Find Angel Investors Today

Most angel rounds don’t start online. They typically begin with your immediate network , or one step removed (former colleagues, operators they’ve worked with, early customers, advisors, or alumni networks). These conversations rarely cover an entire round, but they often set it in motion.

As founders look beyond their immediate network, in-person exposure often comes into play. Local angel groups, regional pitch events, demo days, and industry meetups are common paths, especially early on. The experience varies widely. Some groups are active and well-run, others are quiet or highly selective. Ultimately, geography and timing tend to matter more than most founders expect.

Cold outreach often gets written off, but it actually does work when done properly. Identify investors who are a true fit, and communicate with clarity. Pair that with a strong business foundation, and cold outreach becomes a viable path to capital.

Warm introductions run through nearly all of this. Advisors, other founders, operators, and community connections often play a role in opening doors, whether directly or by validating an intro before it happens.

Angel investing platforms usually enter the picture once the raise becomes more deliberate. Founders start building a real list of target investors and look for tools that help with discovery, outreach, deck sharing, and ongoing communication. These tools serve different purposes. Some focus on angel discovery, others on group applications or research.

At a certain point, ad-hoc outreach gives way to more structured approaches for finding, evaluating, and reaching relevant angels. That’s where purpose-built angel investing platforms tend to show up.

Top Angel Investor Websites and Platforms

Here, we feature several tools that startup founders can utilize to run a smarter, faster, more efficient raise from angel investors.

#1. OpenVC - A founder-first platform to find and reach out to angel investors

OpenVC is a free platform for finding and reaching investors, including angel investors, venture funds, accelerators, and more. It’s built for founders who want a clear view of who invests at their stage, where they invest, and how they prefer to engage. You can browse 1000+ solo angels and angel groups, then narrow your search by geography, stage, check size, and sector.

Beyond discovery, OpenVC includes tools for actually running a raise. Founders can share pitch decks, track investor conversations in a Fundraising CRM, and look for warm intro paths where available. The platform is designed to support the full workflow of an active raise, rather than just the first step.

Most of OpenVC’s core functionality is free. There are no hidden fees, no percentage of capital raised, and no carry taken on deals. Founders who want higher outreach limits and additional features can opt into a paid plan, with a discounted annual option. The platform is usable without upgrading.

OpenVC is built primarily for founders, but angels can also create free profiles to clarify what they invest in and make themselves reachable to relevant startups. This helps shape how founders experience the platform, especially when it comes to fit and responsiveness.

Find your ideal investors now

Browse 16,000+ investors, share your pitch deck, and manage replies - all for free.

Get Started Now

Key features

- Investor discovery across solo angels, angel groups, VCs, and accelerators

- Filters by geography, stage, check size, and sector

- Pitch deck sharing and investor engagement tracking

- Fundraising CRM to organize outreach and conversations

- Cold email outreach and warm intro finder

Best for

- Early-stage startups looking for angel investors

- Founders who want a structured way to find investors relevant to their startup

- Teams looking to run their entire raise in one place

Pricing

- Free plan: Yes (most core features included)

- Paid plan: Optional, with higher outreach limits and additional features

- No fees on deals

#2. AngelList - A full-fledged infrastructure for angel syndicates, SPVs, and deal execution

AngelList is a long-running platform in early-stage startup investing. While it originally gained traction as a place for startups to connect with investors, it has since evolved into a broader set of tools focused on how private-market investments are structured and administered.

Founders most often encounter AngelList through angel syndicates, SPVs, or roll-up vehicles used to consolidate multiple angel checks into a single cap table entry. The platform tends to come into play once an investor or syndicate lead is already interested and wants to formalize a deal, rather than during the initial discovery phase.

Much of AngelList’s functionality is built around investor workflows, including fund administration and investment vehicles that power syndicates and rolling funds. This shapes how founders typically use the platform: it’s commonly involved in executing and closing rounds, not in building an initial investor list or running outbound outreach.

For founders raising from angels, AngelList can be useful when a lead investor prefers to run the round on AngelList’s infrastructure or when a syndicate brings together many individual angel checks. It’s less commonly used as a standalone tool for identifying or reaching new angels.

Key features

- Startup profiles with company details and fundraising info

- Syndicates that allow lead investors to pool capital from other angels

- SPVs and roll-up vehicles for cap table consolidation

- On-platform investor commitments and capital collection

- Investor accreditation checks and compliance workflows

Best for

- Founders raising with a lead angel or syndicate already in place

- Teams expecting many small angel checks and wanting a simplified cap table

- Rounds where investors prefer AngelList’s execution infrastructure

Pricing

- Free plan: Yes. No cost to create a profile and appear on the platform.

- Founder subscription: No upfront SaaS subscription required to list or fundraise.

- Where fees apply: Fees typically apply at the fund, syndicate, or SPV level , paid by fund managers or lead investors.

- Fees on deals: AngelList earns revenue through fund administration fees , not as a percentage charged directly to founders in most cases.

#3. Gust - An intake and back-office system used by angel groups and accelerators

Gust is a platform used by startups, angel groups, and accelerators to manage company formation, fundraising paperwork, and investor intake. Founders most often encounter Gust in two ways: 1) as the system an angel group or accelerator uses to accept applications, and 2) as a back-office tool for incorporation, cap table management, and early fundraising documents.

For founders looking to raise from angels, Gust offers a searchable investor directory that includes angel funds, angel groups, and other early-stage VCs. This database is typically used for research and discovery rather than direct investor outreach, and many investor profiles ultimately route founders into formal application workflows rather than open conversations.

Beyond discovery, Gust’s core strength is operations. Founders can incorporate a Delaware C-Corp, manage equity and cap tables, create SAFEs or convertible notes, and handle basic legal documentation from a single account. These tools are often bundled into annual plans and are designed to support early fundraising mechanics rather than investor relationship management.

Because many angel groups and accelerators rely on Gust for deal intake and review, founders frequently end up creating a Gust profile regardless of whether they use it as their primary fundraising platform. Gust functions as a submission and operations layer more than a system for running outbound angel outreach.

Key features

- Searchable investor database for angel funds and groups

- Delaware C-Corp incorporation and registered agent services

- Cap table management and equity issuance

- Option plan and 409A valuation workflows (higher tiers)

- Application portals used by angel groups and accelerators

Best for

- Founders applying to angel groups or accelerators that already use Gust

- Teams that want integrated incorporation, equity, and fundraising documents

- Founders using Gust primarily for investor research and formal submissions rather than outbound

Pricing

- No free plan

- Paid plans: Annual subscriptions ($450/year- $3,500/year)

- Fees on deals: No percentage taken on funds raised through the platform

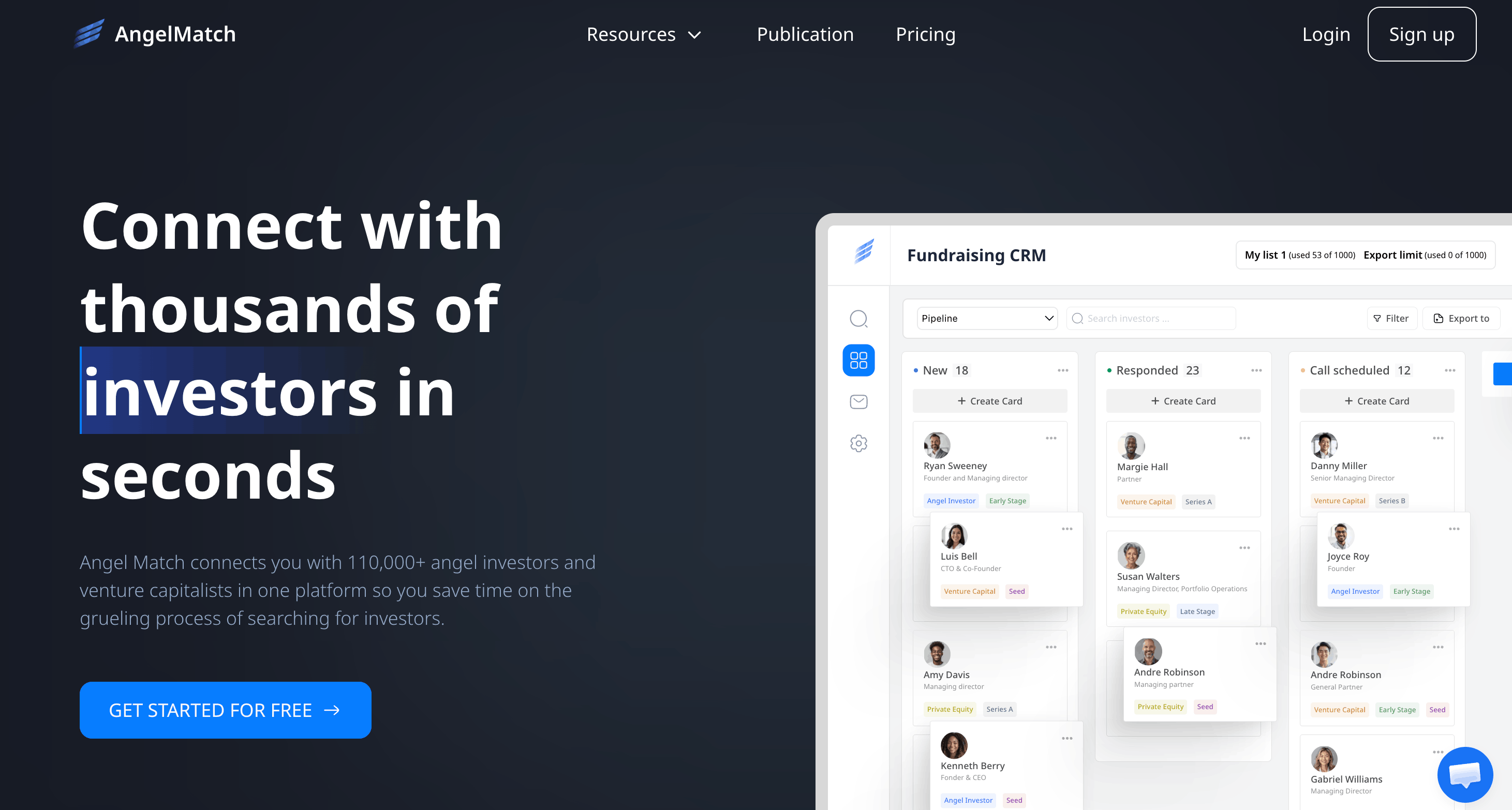

#4. AngelMatch - A database for angel investor research

AngelMatch is a database-driven platform focused on investor research and outbound fundraising. Founders generally use it when they want direct access to a large set of active angel investors and early-stage funds, without going through formal application processes or investor-led intake systems.

The platform centers on a searchable database of accredited investors. Founders can filter investors by geography, stage, sector, and investor type, then review profiles that outline investment focus and prior activity. The information is typically used to decide who might be relevant, rather than how to approach them.

Outreach on AngelMatch is handled either by exporting investor lists or by using the platform’s built-in email tools, depending on the plan. Conversation tracking is basic and designed to support outbound volume rather than long-running fundraising workflows. There are no tools for deal execution, legal structuring, or managing capital once an investor commits.

AngelMatch also includes a small collection of secondary resources, such as a pitch deck library and calculators. These features are adjacent to the core product and tend to be used sporadically rather than as part of a broader system.

AngelMatch functions as a research and outreach layer. It provides access to investor data and a way to organize outbound efforts, but founders are responsible for messaging, follow-up strategy, and everything that happens after initial contact.

Key features

- Searchable database covering solo angels, angel groups, and early-stage funds

- Filters by geography, stage, sector, and investor type

- Investor profiles with background and investment focus

- Exportable investor lists (plan-based limits)

- Built-in email outreach and engagement tracking

Best for

- Founders running outbound angel fundraising

- Startups comfortable managing cold outreach independently

Pricing

- No Free plan: But they do offer a 3-day free trial.

- Paid plans: Monthly, annual, and lifetime subscriptions.

- No fees on deals: AngelMatch does not take a percentage of capital raised or charge success fees.

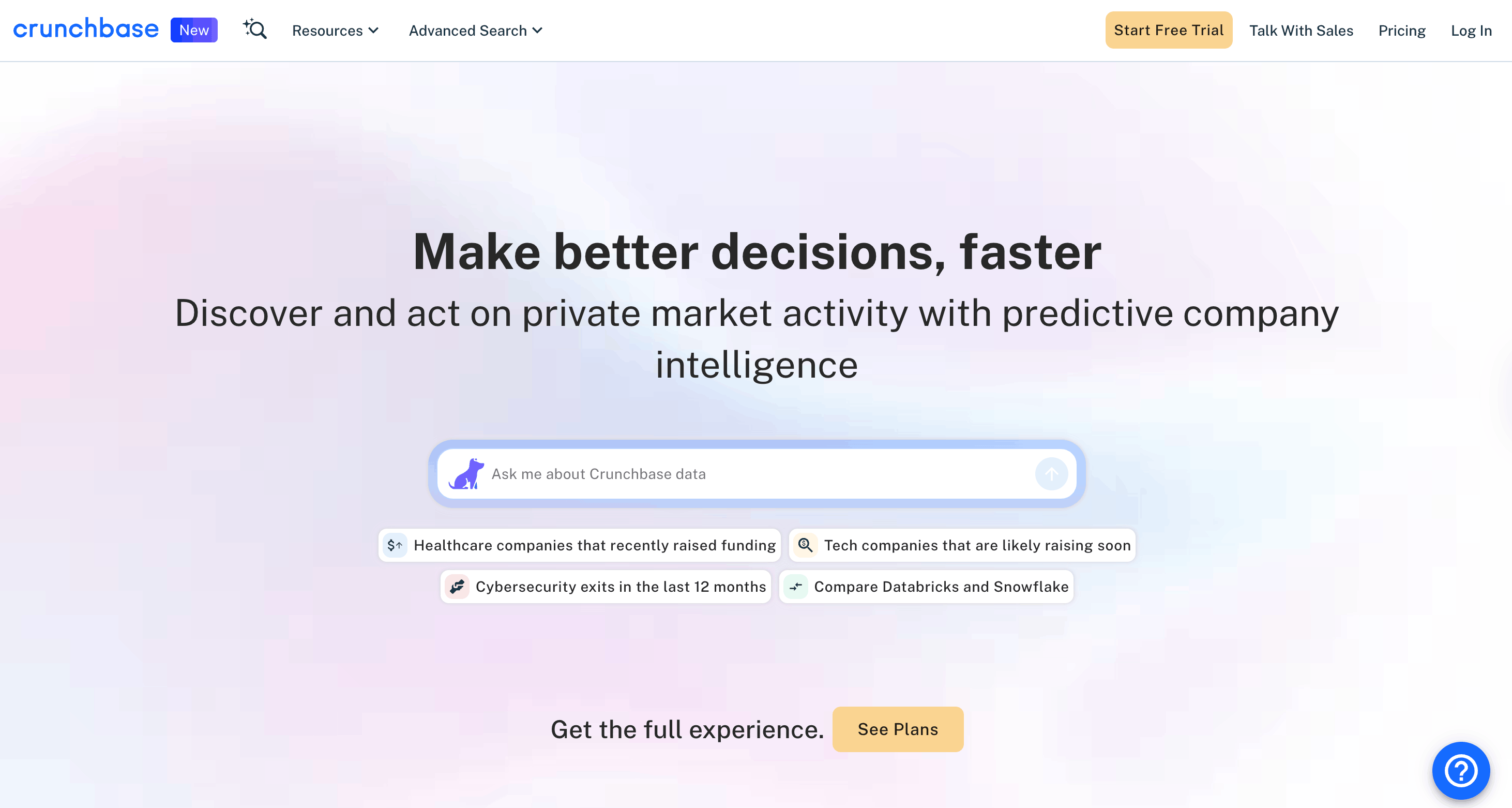

#5. Crunchbase - A database to identify angels backing similar startups

When it comes to angel fundraising, Crunchbase is most useful as a mapping tool, not a sourcing engine. Founders don’t typically use it to discover angels directly. They use it to understand patterns: who invests in companies like theirs, who shows up repeatedly at the pre-seed and seed stages, and which angels are still active versus long inactive.

A common workflow starts with companies, not investors. Founders identify startups that look similar to their own (by stage, sector, or geography). Then, they work backward through those companies’ funding histories to surface angels and early backers. Over time, this reveals a short list of individuals and small funds that consistently show up in comparable deals.

Crunchbase is also used to validate investor activity. By filtering funding rounds by stage, date, and sector, founders can sanity-check whether an angel or early-stage investor has written checks recently, and in what contexts. This helps avoid outreach to investors who are technically “angels” but no longer investing or only participating opportunistically.

While Crunchbase does offer contact data and prospecting features on paid plans, most founders treat this as a secondary layer. The platform is better suited for research than for running outreach. It doesn’t replace warm intros, and it doesn’t provide a structured way to run an active raise.

Crunchbase plays an upstream role in angel fundraising. It helps founders narrow the universe, spot repeat behavior, and build conviction around who is worth pursuing before switching to other tools for outreach and execution.

Key features

- Company and funding round database with historical investment data

- Investor profiles linked to past angel deals and portfolio companies

- Filters by funding stage, sector, geography, and activity date

- Funding round search to identify recent pre-seeds and seeds

Best for

- Founders researching angels behind similar startups

- Teams mapping investor patterns before starting outreach

- Founders validating investor activity and focus areas

Pricing

- Free plan: Limited. Basic company and investor profiles are accessible, but search depth, filters, and exports are restricted.

- Paid plans: Required for serious fundraising research. Pro plans typically start around $49–$99 per month, with higher tiers for teams and advanced data access.

- Paid access unlocks: Complete company info, data exports, growth insights, and integrations.

- No fees on deals: Crunchbase does not take a percentage of capital raised.

#6. Angel Capital Association (ACA) - A global directory of member angel groups by region

Angel Capital Association (ACA) is a membership-based industry organization that represents angel investors, angel groups, and early-stage investment networks. It plays a structural role in the angel ecosystem by supporting organized angel groups and setting standards for how many of them operate.

For founders, ACA is most useful as a directory and discovery layer. It helps surface angel groups by geography, which founders can then research individually to understand investment focus, application processes, and pitch requirements. ACA itself does not facilitate fundraising, introductions, or deal execution.

Because many established angel groups are ACA members, founders often use it as a way to identify credible groups they may want to apply to. Any actual interaction, pitching, or follow-up happens outside ACA, directly with the angel group.

From an investor perspective, ACA functions as a professional association. It provides education, events, research, and peer connection for angel investors and group leaders. Founders are not its primary audience, and fundraising is not its core function.

Key features

- Public directory of ACA member angel groups

- Geographic browsing of organized angel networks

- Educational resources on angel investing structures and best practices

- Industry events and conferences (primarily investor-focused)

Best for

- Founders looking to identify organized angel groups by region

- Teams planning to apply to multiple angel groups with formal intake processes

- Founders seeking ecosystem orientation rather than direct investor access

Pricing

- Free plan: Founders can browse public resources and the angel group directory at no cost.

- Paid plans: Membership fees apply to VCs, angel groups, platforms, and affiliates—not founders.

- Founder access: Founders do not pay ACA to apply, pitch, or contact angel groups.

- No fees on deals: ACA does not take any percentage of capital raised and is not involved in transactions.

#7. Angel Investment Network - A marketplace matching founders with angel investors

Angel Investment Network operates as an open marketplace where startups publish fundraising profiles, and investors browse and reach out directly. Founders create a public-facing pitch outlining their business, funding goals, and minimum investment size, and investor conversations happen through the platform’s messaging system.

This model is very different from directories or research tools. Rather than helping founders narrow down a targeted list of angels, Angel Investment Network emphasizes visibility. Startups are listed alongside many others, and investor interest is largely inbound and self-directed. Any due diligence, negotiation, or capital transfer happens off the platform.

Unlike ACA’s group directory, which helps founders identify organized angel networks and then apply elsewhere, Angel Investment Network hosts the pitch itself. Founders post a profile and wait for investor engagement, with relatively limited filtering or matching beyond broad categories like geography and industry.

Because of this structure, founders' experiences vary widely. Some use the platform as an additional exposure channel alongside more targeted fundraising efforts. Others treat it as an early experiment to gauge investor interest before refining their approach. There are no tools for managing an active raise, qualifying investor fit, or coordinating follow-ups beyond basic messaging.

Key features

- Create your pitch using their deck template

- Investor browsing and shortlisting of startup pitches

- Direct messaging between founders and investors

- Paid options for increased visibility and promotion

Best for

- Founders seeking broad exposure to a wide investor audience

- Very early-stage teams testing inbound investor interest

- Startups comfortable handling investor qualification independently

Pricing

- Free plan: No free founder plan for active fundraising.

- Paid plans: Founder subscriptions start around $229 per month (US-only), with higher tiers for global exposure and increased promotion.

- Investor access: Investors use the platform for free. All platform fees are paid by founders seeking exposure.

- No fees on deals: Angel Investment Network does not take a percentage of capital raised. All investments are handled off-platform.

Find and Close Angel Investors with OpenVC

Angel fundraising usually starts messy. A few introductions. A couple of inbound messages. Some cold outreach. Maybe an angel group application or two. What makes the difference is not which single platform you use, but whether you have a system to pull everything together and move it forward.

That’s where OpenVC fits.

OpenVC is built to support the entire angel fundraising journey, from discovery to close. You can browse and filter thousands of angel investors and angel groups by geography, stage, check size, and sector. You can build a real investor list, not just collect names. You can share pitch decks with tracking, manage conversations in a purpose-built fundraising CRM, and identify warm intro paths when they exist.

Most importantly, OpenVC removes friction. There are no hidden fees, no percentages taken on your raise, and no artificial paywalls just to get started. The core tools founders need to run an effective angel round are available for free.

If you’re serious about raising from angels, the fastest way to start is to build your investor list and put a real system behind your outreach.

You can do that by joining OpenVC today !

Find your ideal investors now

Browse 16,000+ investors, share your pitch deck, and manage replies - all for free.

Get Started Now

FAQs

What is angel investing?

Angel investing is when individuals invest their own capital into early-stage startups, typically at the pre-seed or seed stage. Angels often invest smaller checks than venture capital firms and may bring industry experience, introductions, or operational support, especially in sectors like AI, fintech, or SaaS. For founders, angel rounds are usually the first institutional step before scaling the business further.

How can I find an angel investor for free?

The most reliable free paths are your existing network, warm introductions through advisors or operators, and platforms like OpenVC that allow investor discovery without upfront fees. OpenVC lets founders browse and filter angel investors and angel groups by geography, stage, check size, and sector at no cost, making it easier to vet potential investors and build a real angel investor list without paying for access.

What are the best angel investor sites?

The best angel investor sites depend on your stage and how you plan to raise. OpenVC is best for angel fundraising, combining investor discovery with tools to run a raise end-to-end, helping founders leverage multiple channels in one place. Platforms like AngelList and Gust are often used for legal infrastructure and managing SPVs or structured rounds, while Crunchbase is commonly used to research and vet investors. Some founders also diversify their approach with crowdfunding platforms like Wefunder or StartEngine, which are more investor-driven than founder-led.

How does OpenVC help with angel investing?

OpenVC helps founders run an organized, end-to-end angel raise. You can discover relevant angels and angel groups, build and manage your investor list, share pitch decks with tracking, manage conversations in a fundraising CRM, and surface warm intro paths when they exist. This allows founders to leverage warm and cold outreach in parallel while staying organized as they scale their fundraising efforts. There are no hidden fees and no percentage taken on funds raised.