Crowdfunding platforms allow entrepreneurs to raise capital from “the crowd” in varying amounts. In return, investors get compensated with equity in the company or other rewards.

Compelling, right?

However, the crowdfunding space is complex to navigate, especially for a first-time founders. So here are the top 20 crowdfunding platforms for your company!

PS: If you spot inaccuracies, please email us at steph@openvc.app and we'll fix it ASAP.

Table of Contents

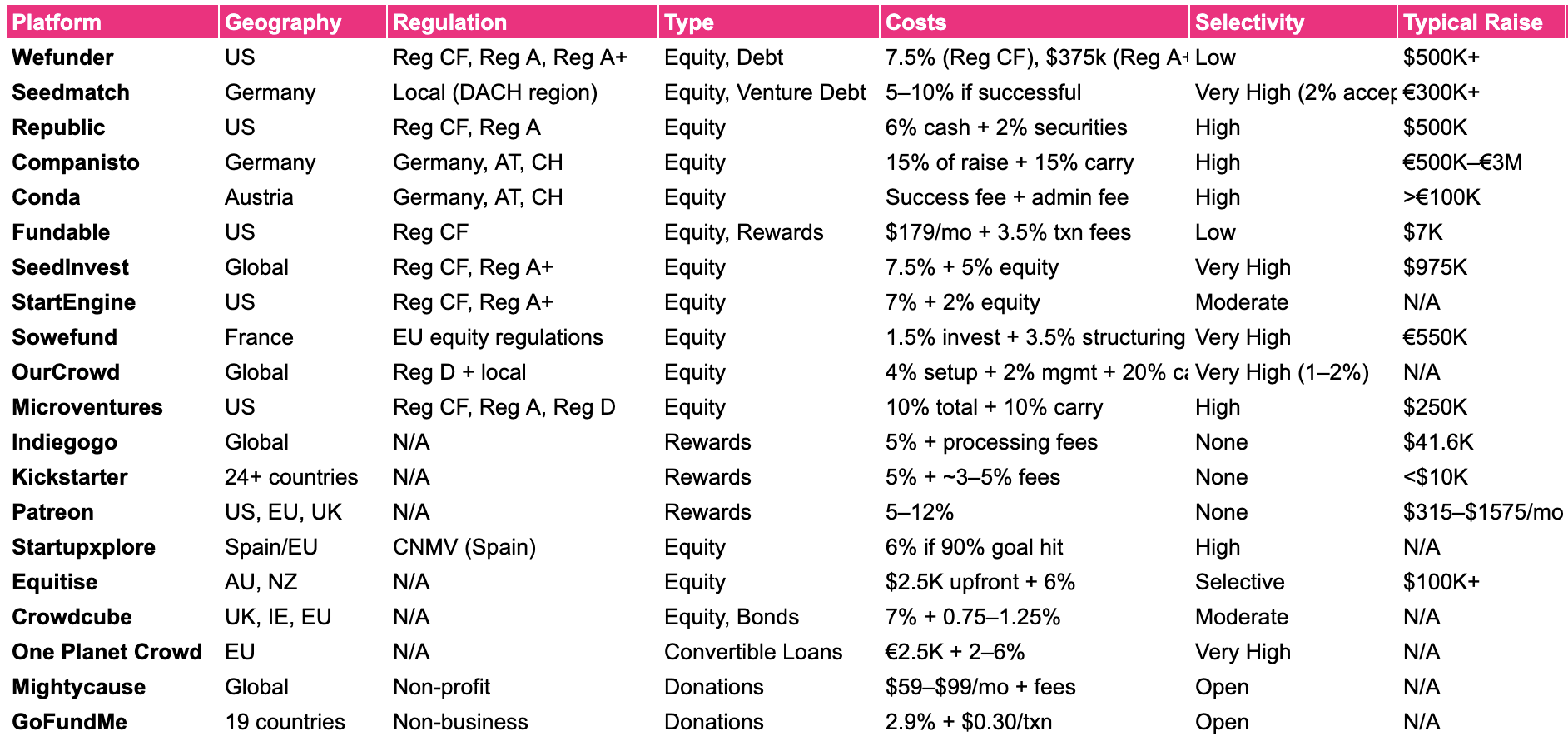

WEFUNDER - Equity and debt crowdfunding for U.S. startups

Wefunder allows for not only equity crowdfunding but debt crowdfunding as well (meaning that founders must pay back the amount they fundraise). They offer investors everything from moonshot ideas and YC backed companies to entertainment and alcohol startups. They have over one million users of their site that have invested in over 2,000 founders.

What to know:

- Geography: U.S. formed companies only.

- Regulatory framework: Reg CF, Reg A, and Reg A+ offerings.

- Type: Equity funding.

- Costs: Wefunder takes a 7.5% fee of the total fundraise only if successful. This is for REG CF offerings. For REG A+ offerings are charged a $375,000 flat rate.

- Selectivity: Very little scrutiny in the application stage and no initial fee.

- Other: Various rules and regulations to participate. For example, founders must disclose their financials to the public.Founders have access to additional resources such as legal and crowdfunding support.

SEEDMATCH - Germany’s first startup crowdfunding platform

Seedmatch is Germany’s first platform for crowdfunding. They provide equity, venture debt, or securities (for mature companies) They offer investors opportunities to invest in companies that are scalable, innovative, and have a proof of concept. Since launch, they have invested over 70 million Euros from more than 78,000 users in 179 financing rounds.

What to know:

- Geography: Germany

- Regulatory framework: Company must be founded and is located in the DACH region.

- Type: Equity crowdfunding, venture debt, and securities.

- Costs: Free. Companies only pay if they reach their crowdfunding goals. Seedmatch takes a fee of 5-10% of the total amount raised.

- Selectivity: Selective process. Companies must have a capital requirement of at least 300,000 Euros, a competent team, a proven concept that is both innovative and scalable. Only 2% of applicants received are allowed on the platform.

- Typical amount raised: N/A but some of the most successful campaigns have raised over a million Euros.

- Other: Minimum investment is 250 Euros and the maximum investment per individual is 25,000 Euros.

REPUBLIC - U.S. platform democratizing access to startup investments

Republic democratizes private market investing by offering equity crowdfunding opportunities in startups, real estate, crypto, and video games. The platform allows investors to invest as little as $10. Founded in 2016, Republic has facilitated over $2.6 billion in investments across 2,000+ companies, serving a community of 2.5 million members in 150 countries.

What to know:

- Geography: U.S. companies.

- Regulatory framework: Reg CF and Reg A.

- Type: Equity funding.

- Costs: Republic takes 6% of cash raise and 2% of securities issued.

- Selectivity: Very selective with a strict application process.

- Typical amount raised: Average successful raise is $500,000.

- Other: Large investor network with an 89% success rate.

COMPANISTO - Equity crowdfunding with a strong investor network

Companisto is an equity crowdfunding platform based out of Germany. They boast a network of 120,000+ investors (which includes prominent investors and angels) who have invested in 250+ funding rounds. They pride themselves on multiple success stories which include many of their investments having an exit event. Investments begin at €250.

What to know:

- Geography: Germany

- Regulatory framework: Companies must be founded in Germany, Austria, or Switzerland and open to equity crowdfunding.

- Type: Equity funding.

- Costs: Free. Startups pay 15% of the total raise if successful and a 15% carry fee of any future distributed profits.

- Selectivity: Selective with the application process taking a month and going through five phases with the focus being on the business plan and financial model. Startups must require €500,000 to €3,000,000. Larger sums are available for stock corporations.

- Typical amount raised: In the millions of Euros.

- Other: Offers an internal club for angel investors on their platform.

CONDA - Austria-based platform focused on innovative startups in the DACH region

Conda is Austria’s premier crowdfunding platform. They have over 40,000 investors globally and have successfully funded more than 179 projects, raising €55 million. They place a high focus on innovative and profit focused companies, offering startups, SMEs and real estate. Investments begin at €100.

What to know:

- Geography: Austria, Germany, and Switzerland.

- Regulatory framework: Companies must be founded in Germany, Austria, or Switzerland and open to equity crowdfunding.

- Type: Equity crowdfunding.

- Costs: No fees for investors. For business owners, Conda charges a success fee and an administrative fee after the conclusion of a successful campaign. If the funding amount is not reached, all funds will be returned to investors.

- Selectivity: Companies must require more than €100,000 in investment, have a proof of concept, be innovative and attractive to investors and a motivated team. ,

- Other: Not open to U.S. investors.

FUNDABLE - Dual-mode crowdfunding (rewards and equity) for U.S.-based startups

Fundable allows for rewards-based crowdfunding as well as equity and debt crowdfunding. $568 million has been committed on their platform.

What to know:

- Geography: Companies registered in the U.S.

- Regulatory framework: Reg CF.

- Type: Equity funding or rewards based. Equity crowdfunding is available only to accredited investors. Reward based crowdfunding is open to everyone.

- Costs: Free to get started and $179 per month during the fundraising period. For rewards based campaigns, a 3.5% + 30¢ per transaction fee is charged.

- Selectivity: Very little scrutiny in the application stage.

- Typical amount raised: $7000.

STARTENGINE - Broad U.S. equity crowdfunding platform with $540M+ raised

StartEngine allows for equity crowdfunding for a variety of different companies and products. They have raised 750+ rounds totaling over $540 million and have over 800,000 users.

What to know:

- Geography: U.S. based companies only.

- Regulatory framework: Reg CF and Reg A+

- Type: Equity

- Costs: 7% of the raise plus another 2% in equity. Minimum fundraising goal of $10,000.

- Selectivity: Application process isn’t as strict as other sites.

- Other: Not suitable for investors looking for quick returns.

SOWEFUND - French co-investment platform for retail and professional investors

Sowefund is a French crowdfunding platform that bills itself as the first co-crowdfunding platform, allowing users to invest alongside business angels and VCs. They have raised €59,019,322 from 95,295 members to fund 66 startups.

- Geography: France

- Regulatory framework: European Union equity crowdfunding regulations.

- Type: Equity.

- Costs: Investors pay a 1.5% of the amount invested as well as 3.5% to cover direct entry costs or costs associated with creating a holding company.

- Selectivity: Very selective. Companies must face a rigorous multi-stage selection process (that includes an analysis of the business plan and a financial audit) and meet with the Sowefund team. Sowefund pays particular focus to the team, the concept, and the future.

- Typical amount raised: €550k

- Other: Sowefund’s site provides multiple resources for both founders and investors.

OURCROWD - Global equity crowdfunding for accredited investors

OurCrowd is an equity crowdfunding platform that allows investments in global companies that improve the way people heal, travel, shop, and work. They have a network of 192,000 registered investors in 195 countries and have made investments in 322+ companies located in Israel, the US, Canada, the UK, India, Hong Kong, Singapore and Australia.

What to know:

- Geography: Global.

- Regulatory framework: Regulation D in the U.S., which requires each investor to be an accredited investor. Global investors must also be accredited under the laws of their local jurisdiction.

- Type: Equity

- Costs: Takes fees on capital invested. For startups this includes a one time, 4% (capped until exit) for direct reimbursement of SPV’s expenses, 2% management fee for four years, 20% on profits up to 5x of the amount invested. Fees for funds include a management fee between 1.5% - 2.5% over the life of the fund on committed capital, direct reimbursement of fund expenses (typically uncapped), and 20% carried interest on fund profits after return of capital.

- Selectivity: Very selective. Only 1-2% of companies are selected.

- Other: Can invest in startups or venture funds. Global pool of investors.

MICROVENTURES - U.S. crowdfunding and secondary market platform

Microventures is a full service investment bank that offers not only equity crowdfunding in startups, but accredited investing and secondary trading. They have transacted over $450 million with 900+ investment opportunities and over 200,000 investors.

What to know:

- Geography: Companies must be registered in the United States.

- Regulatory framework: Reg CF, Reg A, and Reg D.

- Type: Equity.

- Costs: Microventures takes a 10% fee (5% from the issuer and 5% from investors) from each successful raise plus 10% carry. If the full amount of an offering is not raised, then all investor money is returned.

- Selectivity: Highly selective. Must have a good idea, a solid team with experience, and market traction.

- Typical amount raised: $250,000 with some outliers raising over $1 million.

- Other: Companies should be looking to raise $150,000 to $1,000,000 in capital.

INDIEGOGO - Global rewards-based crowdfunding pioneer

Indiegogo was one of the first websites to offer crowdfunding. It currently hosts 19,000 crowdfunding campaigns per month, both rewards based and equity based. Since 2008, it has helped fund over 800,000 ideas across the world.

What to know:

- Geography: Platform is open to 235 countries and territories across the world.

- Regulatory framework: No equity crowdfunding.

- Type: Rewards.

- Costs: Charges a 5% platform fee plus a third-party payment processing fee.

- Selectivity: Not-selective, limited requirements.

- Typical amount raised: $41,634

- Other: Can utilize Google, Twitter, and Meta to promote campaigns but very difficult to break out due to the thousands of available campaigns.

KICKSTARTER - Iconic platform for creative rewards-based crowdfunding projects

Kickstarter has over 69 million pledges and a total of more than 6.7 billion U.S. dollars has been pledged to projects between 2012 and 2022. This funded 224,775 projects.

What to know:

- Geography: Available in the U.S. and 24 other countries.

- Regulatory framework: No equity crowdfunding.

- Type: Rewards.

- Costs: Charges 2.9% payment fees; 3% + $0.20 per pledge; 5% + $0.05 per pledge under $1.

- Selectivity: Not-selective, limited requirements.

- Typical amount raised: The majority of successful campaigns raise less than $10,000.

- Other: Campaigns must be under one of Kickstarter’s pre-selected categories. Kickstarter is extremely competitive.

PATREON - Monthly support platform for creators

Patreon supports 200,000 creators and has brought in $3.5 billion in funds. It allows creators to be supported by their fans and new startups to be supported.

What to know:

- Geography: Available in the U.S., Europe, and the U.K.

- Regulatory framework: No equity crowdfunding.

- Type: Rewards.

- Costs: Fees start at 5% and go up to 12%, depending on the plan level chosen.

- Selectivity: Open to all.

- Typical amount raised: $315-$1575 monthly earnings based on a following of 30,000.

- Other: Software integrations are available with Vimeo, MailChimp, and others. Not ideal for high growth startups.

STARTUPXPLORE - Curated Spanish equity crowdfunding

Startupxplore is an equity crowdfunding platform for those who don’t like equity crowdfunding platforms. To date, they have raised over €15 million from 101,312 investors and have invested in 65 startups.

What to know:

- Geography: Spanish and European startups.

- Regulatory framework: National Securities Market Commission (CNMV in spanish) approved.

- Type: Equity.

- Costs: Charge 6% of the investment in the startup only if the campaign reaches at least 90% of the target amount.

- Selectivity: Strict investment criteria.

- Other: Invests in seed stage to scale up stage.

EQUITISE - Equity crowdfunding for Australian and New Zealand startups

Equitise is an Australian based equity crowdfunding platform that invests in Australian and New Zealand based startups. They have raised $75 million from 55,000 investors and made 20,000 investments.

What to know:

- Geography: Open to Australian and New Zealand based startups.

- Regulatory framework: N/A

- Type: Equity.

- Costs: Upfront fee of $2500 and 6% of total funds raised.

- Selectivity: Selective process that is followed by an expression of interest (EOI) campaign.

- Typical amount raised: N/A

- Other: A minimum of $100,000 is required for a rise.

CROWDCUBE - UK-based equity and bond crowdfunding platform with EU access

Crowdcube is a U.K. based equity crowdfunding platform with over 6,500 investors part of their platform.

What to know:

- Geography: Companies must be U.K. based or an Irish limited company. Certain European based companies can apply for crowdfunding on their platform.

- Type: Equity. Also offers bonds.

- Costs: 7% of funds raised if you meet your fundraising goal, and a 0.75% to 1.25% completion fee. Payment processing fees vary.

- Selectivity: Must have a website or App.

ONE PLANET CROWD - Impact crowdfunding via convertible loans

OnePlanetCrowd is a European crowdfunding site that specializes in startups with health, social, or environmental impact.

What to know:

- Geography: Europe

- Regulatory framework: N/A

- Type: Works with convertible loans rather than equity.

- Costs: Startups must pay a €1250 analysis fee, a €1250 publication fee, and a placement fee between 2-6%.

- Selectivity: Very selective.

- Other: Startups must contribute to one or more Sustainable Development Goals.

MIGHTYCAUSE - Donations platform for nonprofits

Mightycause is a fundraising platform that has raised over $600 million for nonprofit causes since 2006.

What to know:

- Geography: Global. Supports nonprofits using the USD, EUR, GPB, CAD, AUD, and NZD currencies.

- Regulatory framework: Non-profit.

- Type: Donations.

- Costs: $59-$99 a month plus processing fees. People keep 98.8% of donations collected.

- Selectivity: Very open.

- Other: No goal requirement so you can keep whatever donations you receive, despite not meeting your fundraising goal.

GOFUNDME - Donations for personal and charitable causes

GoFundMe is the go to site for personal crowdfunding needs. They have brought in more than $5 billion from over 50 million users.

What to know:

- Geography: Supports 19 countries.

- Regulatory framework: Non-business.

- Type: Donations Can raise money for charities, friends, or your own personal needs.

- Costs: Charges a processing fee, which is 2.9% and $0.30 per transaction. 0% platform fee.

- Selectivity: Very open.

- Other: 24/7 technical support available.

Conclusion

Whether you are working on a unique SaaS offering or a flying car, there is a crowdfunding platform out there for you. This list should help alleviate the pains of fundraising and help you as a founder find your tribe of investors.