Due diligence is a critical step in the fundraising process.

A rigorous due diligence process can help investors avoid predictably bad investments and bring some sense back into decisions that can be highly emotional.

This guide is designed to help both founders and investors navigate the DD process.

Table of Contents

Introduction to Venture Capital Due Diligence

Understanding Due Diligence

Due diligence is a comprehensive appraisal process that venture capitalists (VCs) undertake to evaluate the viability and potential of an investment opportunity. This involves a thorough investigation of a company’s business model, financial health, legal compliance, market position, and other critical aspects. The goal is to uncover any potential risks or red flags and to validate the investment's potential returns.

Venture capital due diligence is a critical process in investment decisions, aiming to assess the viability and potential returns of an investment. This meticulous process is designed to identify risks, validate the company's potential for growth and profitability, and ensure that the investment aligns with the VC's strategic objectives.

Adequate due diligence minimizes the chances of investing in poorly conceived ventures and increases the likelihood of backing startups with solid growth prospects. It is the cornerstone of informed decision-making in volatile and high-stakes venture capital, safeguarding investors' money and nurturing long-term success.

Importance in Venture Capital

In the high-risk world of venture capital, due diligence serves as a safeguard against poor investment decisions. It helps VCs ensure they are making informed choices, aligning with their investment strategy, and protecting their capital. A rigorous due diligence process can differentiate successful investments from failures. Effective due diligence is essential for investors to make informed decisions and estimate the return on investment accurately. It helps mitigate risks, identify opportunities, and ensure that the investment aligns with the investor's goals and expectations.

The due diligence process typically spans several weeks to months and involves multiple stages, including preliminary evaluation, in-depth analysis, and final decision-making.

Preparing for Due Diligence in Venture Capital

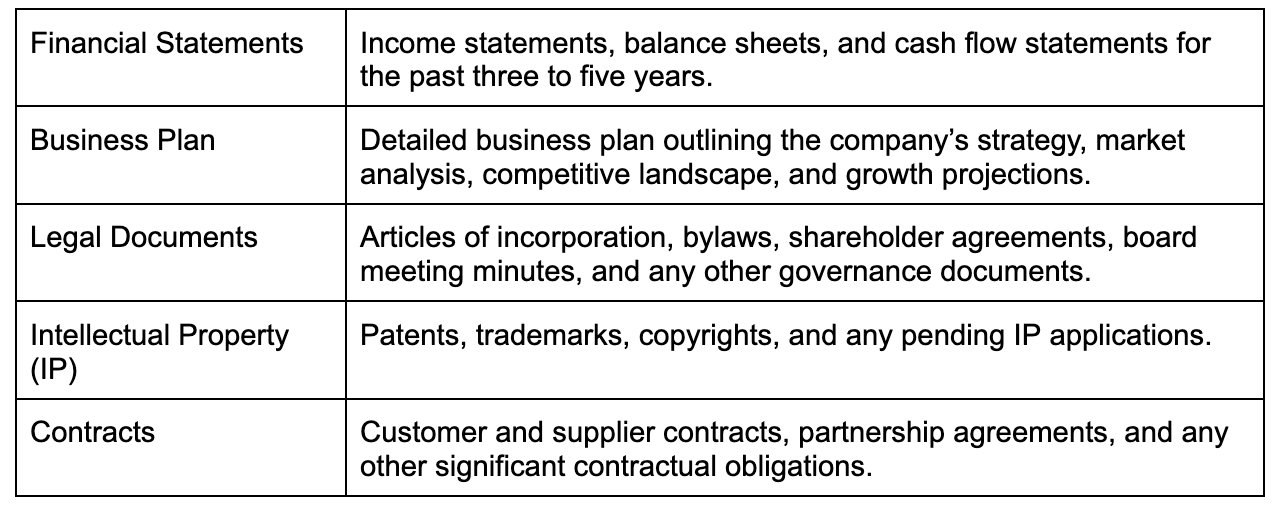

1. Gather Necessary Documents

The first step in preparing for due diligence is to compile all relevant documents that will be needed for the investigation. These documents provide a foundation for understanding the company’s operations, financial status, legal standing, and market position.

2. Assemble the Due Diligence Team

A multidisciplinary team is essential for conducting a thorough due diligence process. Each member brings specialized knowledge and expertise, ensuring that all aspects of the company are evaluated comprehensively. Key members of the due diligence team typically include:

- Financial Analysts: Responsible for evaluating the company’s financial health, historical performance, and future projections. They analyze key financial metrics and identify potential financial risks.

- Legal Advisors: Focus on reviewing the company’s legal standing, including corporate governance, IP, contracts, and compliance with relevant regulations. They identify any legal risks or liabilities.

- Industry Experts: Provide insights into the market landscape, competitive positioning, and industry trends. They assess the company’s market potential and strategic fit within the industry.

- Technical Consultants: Evaluate the company’s technology, product development processes, and R&D capabilities. They identify the strengths and weaknesses of the technology stack and innovation pipeline.

3. Run an initial assessment and spot red flags

This is the step that will save you a lot of time.

Before diving into detailed due diligence, it’s beneficial to conduct an initial high-level assessment to identify any obvious red flags that might disqualify the investment opportunity early on. This step helps save time and resources by filtering out unsuitable targets.

Common red flags to look for include:

- Inconsistent Financials: Discrepancies or irregularities in financial statements can indicate potential financial mismanagement or fraud.

- Legal Issues: Unresolved legal disputes, non-compliance with regulations, or problematic contracts can pose significant risks.

- Unclear Business Model: A business model that lacks clarity or coherence can signal underlying strategic or operational problems.

- Total Addressable Market (TAM): Estimating the overall revenue opportunity available if the company captures 100% market share. TAM provides a high-level view of the market’s potential.

Basically, spot the red flags before investing more time in the project.

4. Organize the Due Diligence Process

Effective organization is crucial for managing the due diligence process smoothly and efficiently. This involves:

- Creating a Due Diligence plan: Create a detailed due diligence plan outlining the objectives, scope, timeline, and responsibilities. This plan should include specific tasks for each phase of the due diligence process.

- Developing a DD checklist: A comprehensive checklist outlines all the areas to be investigated and the specific documents and information required. It serves as a roadmap for the due diligence process. Utilize a comprehensive checklist to ensure all critical areas are covered. This checklist should include financial, legal, operational, and market aspects to provide a holistic view of the target company.

- Establishing a Timeline: Setting clear timelines and milestones helps keep the due diligence process on track and ensures that all necessary tasks are completed in a timely manner.

- Assigning Responsibilities: Clearly defining the roles and responsibilities of each team member ensures that all aspects of due diligence are covered and that there is no duplication of effort.

- Stakeholders engagement: Regular communication and updates among team members and with the target company help address any issues or questions promptly, build trust, and keep the process transparent.

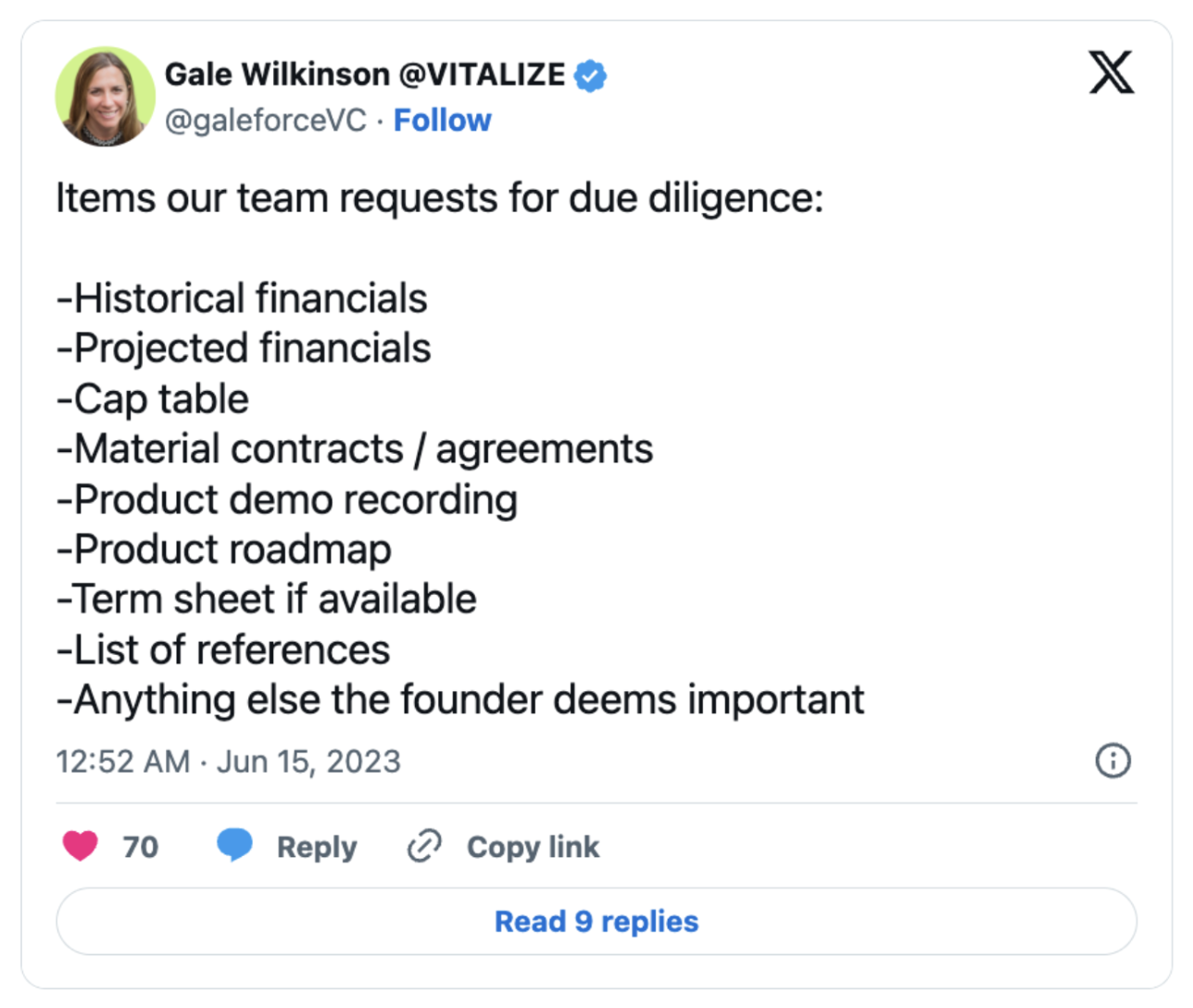

5. Set Up a Data Room

A data room is a secure online repository where all the gathered documents and information are stored and organized. It facilitates easy access and sharing of information among the due diligence team.

Typically, the founders will have prepared a data room ahead of time, but you want to make sure that it's in good order before diving in.

Key considerations for setting up a data room include:

- Security: Ensuring that the data room is secure and that access is restricted to authorized personnel only.

- Organization: Organizing documents logically, typically by categories such as financials, legal, operational, etc., to make it easy to locate specific information.

- Access Control: Setting permissions to control who can view, download, or edit documents, based on their role in the due diligence process.

- Audit Trail: Maintaining an audit trail to track who accessed which documents and when, ensuring accountability and transparency.

You can read how to set up a winning data room here.

Part I: Team assessment

Although assessing the management team is no scientific process, you can still define and measure specific criteria that make a team great.

- Leadership Assessment : Evaluate the experience, track record, and capabilities of the management team. Leadership quality is often a predictor of the company's future performance.

- Organizational Culture : Assess the company’s culture and team dynamics. A strong, cohesive team can significantly impact the company’s ability to execute its strategy.

- Skill Set Analysis : Review the team's collective skills and expertise. Identify any gaps in critical areas such as technology, marketing, or finance. A well-rounded team with complementary skills is better equipped to navigate challenges and capitalize on opportunities.

- Adaptability and Learning Agility : Evaluate the team's ability to adapt to changing market conditions and their willingness to learn and grow. Teams that can quickly pivot and embrace new strategies have a significant advantage in today's fast-paced business environment.

- Succession Planning : Assess the company's approach to developing future leaders and ensuring continuity. A robust succession plan demonstrates foresight and reduces risks associated with key person dependencies.

- Communication and Decision-Making : Examine how effectively the team communicates and makes decisions. Clear communication channels and efficient decision-making processes are crucial for executing strategies and responding to market changes promptly.

Part II: Market and Competition Analysis

1. Understanding Market Dynamics

Market dynamics refer to the forces that impact the supply and demand of products and services within a market.

A thorough understanding of these dynamics is crucial for evaluating the potential success of a venture. Key aspects include:

- Market Trends : Identifying current trends and future projections that influence the market. This includes consumer behavior changes, technological advancements, and shifts in economic conditions. For example, the growing demand for sustainable products is a significant trend in many industries.

- Economic Indicators : Assessing macroeconomic factors such as GDP growth, inflation rates, employment levels, and consumer spending patterns. These indicators provide context for the overall health of the market and potential growth opportunities.

- Regulatory Environment : Understanding the legal and regulatory landscape that governs the market. This includes industry-specific regulations, general business laws, and international trade policies. Regulatory changes can significantly impact market conditions and the operational feasibility of a business.

2. Assessing Market Size and Growth Potential

Evaluating the market size and growth potential is essential to determine the revenue opportunities and scalability of the venture.

This process involves:

- Market Segmentation : Breaking down the market into distinct segments based on factors such as demographics, geographic location, behavior, and psychographics. This helps in identifying target audiences and tailoring strategies to specific market needs.

- Total Addressable Market (TAM): Estimating the overall revenue opportunity available if the company captures 100% market share. TAM provides a high-level view of the market’s potential.

- Serviceable Available Market (SAM ): The portion of TAM that the company’s products or services can realistically serve. SAM accounts for market segments that are accessible given the company’s capabilities and resources.

- Serviceable Obtainable Market (SOM): The subset of SAM that the company can capture, considering competitive dynamics and market penetration strategies. SOM provides a realistic estimate of achievable market share.

3. Competitive Landscape Analysis

A comprehensive competitive landscape analysis helps in understanding the target company’s position within the market and identifying key competitors.

This involves:

- Competitor Identification: Identifying direct and indirect competitors. Direct competitors offer similar products or services, while indirect competitors meet the same customer needs through different means.

- Market Share Analysis: Determining the market share held by the target company and its competitors. This provides insight into the competitive intensity and the company's relative position in the market.

- Competitive Advantage : Assessing the unique strengths and weaknesses of the target company compared to its competitors. This includes evaluating proprietary technology, brand reputation, customer loyalty, cost structure, and operational efficiencies.

- SWOT Analysis: Conducting a SWOT analysis (Strengths, Weaknesses, Opportunities, and Threats) to systematically evaluate the competitive positioning. Strengths and weaknesses are internal factors, while opportunities and threats are external

Part III: Legal assessment

A strong legal review protects the investment by ensuring the startup’s assets are secure, operations are compliant, and risks are minimized. Key areas to focus on include:

-

Intellectual Property (IP): Verify ownership, registration, and protection of patents, trademarks, copyrights, and trade secrets.

-

Brand Protection: Review trademarks, domain names, and branding assets to ensure proper registration and protection.

-

Contracts and Agreements: Analyze customer, vendor, partnership, and confidentiality agreements for obligations, risks, and unusual terms.

-

Freedom to Operate (FTO): Conduct an FTO analysis to confirm no infringement on third-party IP rights.

-

Regulatory Compliance: Assess compliance with industry regulations, privacy laws (e.g., GDPR, CCPA), and corporate governance standards.

-

Licenses and Permits: Confirm the startup holds all necessary licenses, permits, and certifications to legally operate.

-

Employment Law Compliance: Review employee and consultant agreements, stock option plans, IP assignment clauses, and non-compete policies.

-

Litigation and Disputes: Investigate any ongoing, past, or threatened litigation, claims, or regulatory investigations.

- Corporate Structure and Governance: Examine formation documents, the cap table, board composition, and shareholder agreements for legal integrity.

Part IV: Operational assessment

When conducting venture capital due diligence for a tech startup, operational assessment is a crucial pillar to understand the company's ability to execute its vision and scale effectively. Here's what to focus on:

- Operational Reports: Review operational reports, business plans, and market research documents to gain insight into the startup’s day-to-day operations, strategic roadmap, and market positioning.

- Key Performance Indicators (KPIs): Analyze key metrics such as customer acquisition cost, churn rate, and revenue growth against industry benchmarks to assess operational efficiency and competitiveness.

- Process Efficiency: Evaluate how effectively the company manages its supply chain, logistics, and procurement processes, as these areas directly impact profitability and customer satisfaction.

- Technology Infrastructure: Assess the startup’s IT systems, software platforms, and cybersecurity protocols to ensure they can support current operations and future scalability.

- Risk Management: Identify operational risks, including regulatory compliance, and review the company's frameworks for risk identification, mitigation, and crisis management.

- Human Resources: Examine HR strategies, including hiring practices, retention rates, and corporate culture. A strong, aligned team is a critical driver of operational success.

- Scalability: Analyze the company’s operational readiness to handle growth in customer base, geographic expansion, or increased production without sacrificing quality or performance.

- Operational Workflows: Map out key workflows and processes, paying attention to the use of automation and technology integration, which can drive efficiency and reduce costs.

- Quality Control: Evaluate the startup's quality assurance measures to ensure products or services consistently meet or exceed industry standards and customer expectations.

Part V: Financial Due Diligence

Financial due diligence is a critical component of the venture capital investment process, focusing on the target company's financial health, historical performance, and future projections. The primary objective is to validate financial information, assess the viability of the business model, and identify any potential financial risks.

1. Historical financial performance

- Revenue and Profit Trends: Historical trends in revenue, gross profit, and net income.

- Expense Analysis: Breakdown of major expenses and cost structure.

- Cash Flow: Historical cash flow statements to assess liquidity.

2. Financial projections and modeling

- Revenue Projections: Analyzing the assumptions behind revenue growth.

- Cost Projections: Evaluating the sustainability of the cost structure.

- Financial Models: Building and stress-testing financial models to predict future performance.

3. Key financial ratios and metrics

- Profitability Ratios: Gross margin, operating margin, and net margin.

- Liquidity Ratios: Current ratio, quick ratio.

- Solvency Ratios: Debt-to-equity ratio, interest coverage ratio.

4. Practical Steps for Conducting Financial Due Diligence

- Step 1: Document Collection

- Gather financial statements (income statement, balance sheet, cash flow statement) for the past three to five years.

- Obtain detailed records of major expenses, capital expenditures, and any outstanding liabilities.

- Step 2: Analysis and Verification

- Verify the accuracy of financial statements through audits or third-party verification.

- Analyze trends and anomalies in financial performance to identify potential red flags.

- Step 3: Projections Review

- Scrutinize the assumptions behind financial projections, including market growth rates, pricing strategies, and expense forecasts.

- Conduct sensitivity analysis to evaluate how changes in key assumptions affect financial outcomes.

- Step 4: Ratio Calculation

- Calculate key financial ratios and compare them to industry benchmarks to assess the company’s financial health relative to peers.

- Identify areas of financial strength and weakness.

- Step 5: Risk Assessment:

- Identify financial risks, such as high debt levels, inconsistent cash flow, or reliance on key customers or suppliers.

- Develop strategies to mitigate identified risks.

Part VI: Risk Assessment and Mitigation

Risk assessment and mitigation are critical components of the venture capital due diligence process.

They involve identifying potential risks that could impact the target company's performance and developing strategies to minimize or manage these risks. The goal is to ensure that all significant risks are understood and addressed before making an investment decision.

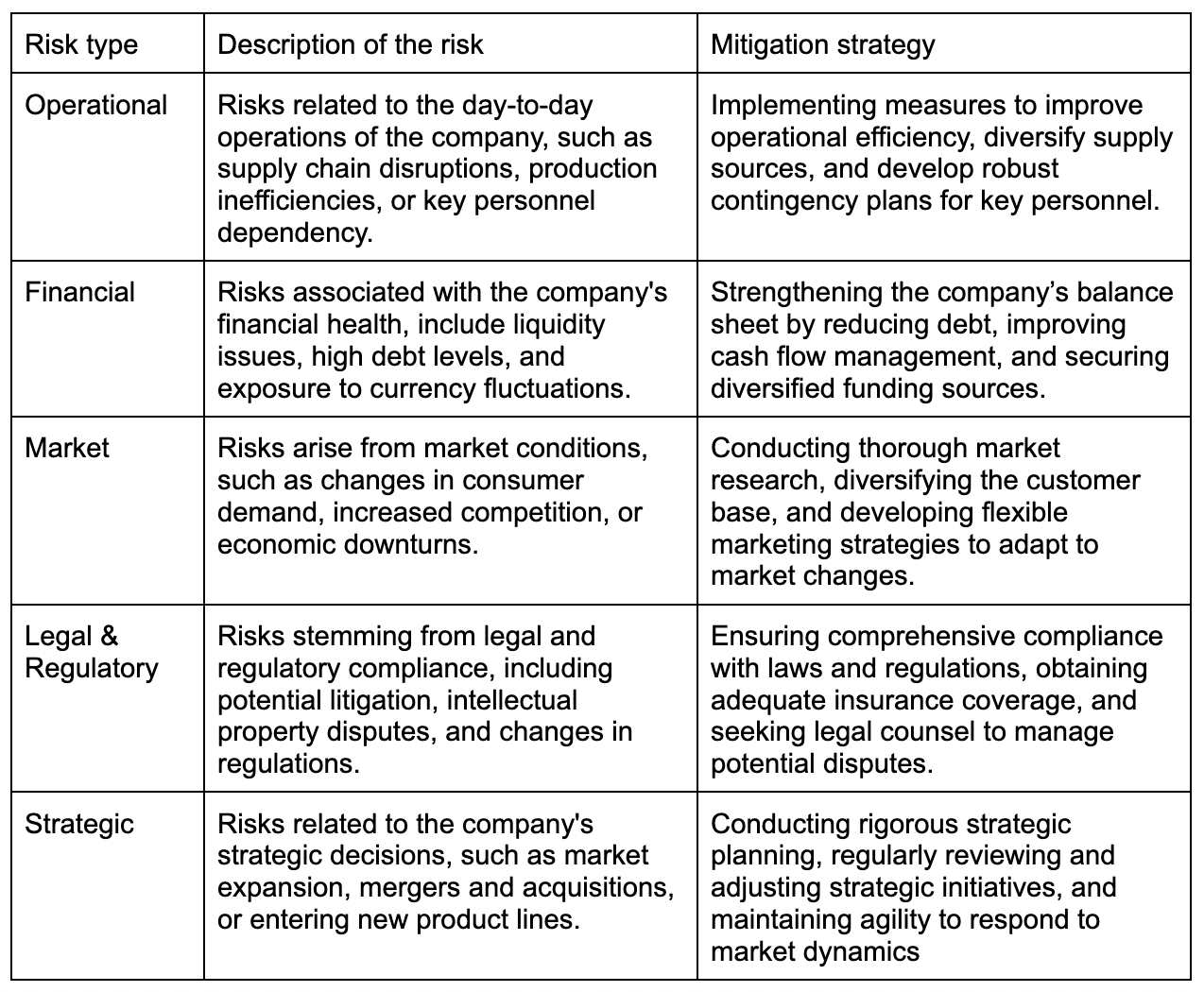

Some of the major pointers that need to be understood are as follows:

1. Identifying and mitigating risks in due diligence

Five major types of risks and the associated mitigation strategies

2. Practical steps for conducting risk assessments and mitigation

- Risk Inventory:

- Create a comprehensive list of potential risks by consulting with stakeholders, reviewing industry reports, and analyzing past incidents.

- Categorize risks based on their nature (e.g., operational, financial, market).

- Risk Prioritization:

- Assess the likelihood and potential impact of each risk.

- Prioritize risks based on their severity and the company’s ability to manage them.

- Risk treatment/Mitigation Planning:

- Developing detailed plans for high-priority risk

- Establish protocols for crisis management, including communication plans, decision-making processes, and roles and responsibilities during a crisis.

- Ensure that the company can continue operations during and after a disruptive event by having robust business continuity plans in place

- Conduct regular drills and simulations to ensure preparedness.

- Monitoring and Review:

- Implement a system for ongoing risk monitoring and review.

- Regularly update risk assessments and mitigation strategies based on new information and changing conditions.

3. Scenario Planning and Stress Testing

Scenario Analysis: Develop various scenarios (e.g., best-case, worst-case) to understand potential outcomes and impacts. This helps in preparing for different future scenarios.

Stress Testing: Test financial models and business plans against adverse conditions to assess resilience and robustness. This ensures the business can withstand unexpected challenges.

Three best practices for VC due diligence

1. Leveraging Technology for Due Diligence

Due Diligence Tools: Utilize advanced due diligence tools and software for data collection, analysis, and reporting. These tools can streamline the process and enhance accuracy. Examples include DealRoom, DD360, Nexis Diligence, Affinity, PitchBook, and CB Insights

Data Analytics: Apply data analytics to uncover patterns, trends, and anomalies that may not be apparent through traditional methods. Advanced analytics can provide deeper insights into the company’s performance.

AI-Powered Solutions: Implement AI-driven automation and algorithms to accelerate the due diligence process. AI can analyze vast amounts of data, including historical market trends, regulatory compliance, and social media content, to provide comprehensive risk assessments.

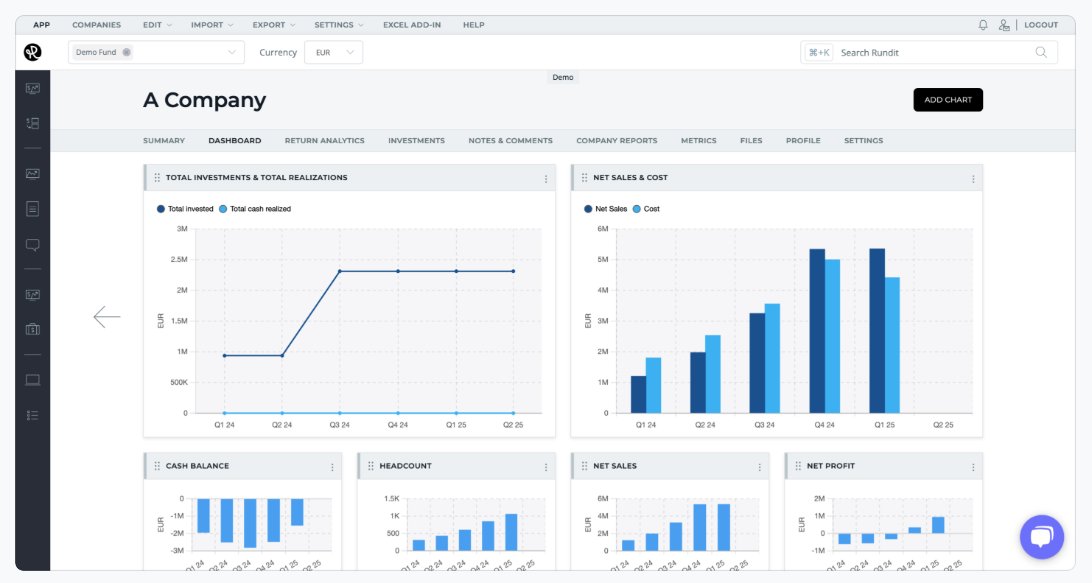

2. Monitoring the investments continuously

After an investment is made, it is essential to implement systems for ongoing monitoring of the portfolio company's performance. This includes regularly tracking key performance indicators (KPIs), financial metrics, and operational benchmarks to ensure alignment with expected outcomes.

In addition to automated tracking, periodic reviews should be conducted to assess progress, identify emerging risks, and refine strategic direction if necessary. Such proactive oversight helps ensure that the investment stays on course and enables timely interventions when needed.

3. Learning from Past Investments

Reviewing past investments is essential to improving future due diligence. Analyze both successes and failures to identify key lessons and strengthen your evaluation framework. Look for patterns in what led to strong outcomes or underperformance, and use these insights to refine your approach.

On top of that, regularly benchmark your due diligence process against industry standards to ensure it remains effective and up to date. This ongoing learning helps build a more disciplined and informed investment strategy.

Conclusion

A structured due diligence process, encompassing thorough documentation reviews and a multidisciplinary team, lays the foundation for a comprehensive evaluation. This systematic approach ensures all critical aspects—financial, legal, operational, and market—are meticulously examined.

A multidisciplinary team, comprising experts in finance, law, operations, technology, and market analysis, brings diverse perspectives and specialized knowledge to the table. Their collaborative efforts lead to a more holistic and in-depth assessment of the target company. Thorough documentation reviews are essential for validating the company's claims and identifying potential red flags. Scrutinizing financial statements, legal documents, and operational reports provides a clear picture of the company's health and potential risks.

Evaluating the management team and organizational culture is crucial, as strong leadership and cohesive team dynamics often predict future success. Understanding market dynamics and the competitive landscape further informs the assessment, helping to identify growth opportunities and competitive pressures. Risk identification and mitigation are vital components of due diligence. A comprehensive risk inventory and the development of mitigation strategies ensure that potential risks are proactively addressed, enhancing the investment's resilience.

Incorporating advanced strategies like data-driven decision-making, scenario planning, and leveraging technology enhances the due diligence process. Continuous monitoring and regular post-investment reviews ensure ongoing alignment with investment goals. ffective stakeholder engagement and learning from past investments are also crucial. Transparent communication with investors and collaboration with the target company's management build trust and ensure accurate information gathering.

By implementing these best practices and strategies, venture capitalists can conduct thorough and effective due diligence. This disciplined approach not only safeguards investments but also paves the way for sustained growth and success, maximizing returns and contributing to the long-term success of investment portfolios.

About the author

Jori Karstikko is the CEO and Co-founder of Rundit, a portfolio management and reporting solution to help investors increase transparency and efficiency in a few simple steps.

With Rundit, you can access your portfolio data all in one place, eliminating the need for cumbersome spreadsheets. Our solution offers automated dashboards and interactive portfolio reports, enabling your team to manage investments in a modern and efficient manner. Learn more at www.rundit.com.

Interested? Feel free to book a call with us here