You have been working away on your startup for longer than you care to admit. You transformed what was a weekend side hustle to a real company, one that actually hit milestones and has key metrics to back up your wild claims. You bootstrapped for what felt like forever, found your first angel investor (thanks grandma), and maybe raised a pre-seed round from reputable investors who believed in you.

What’s next?

The seed stage.

The term comes from the fact that the capital invested during this round will transform the business from a tiny seed into a mighty and healthy tree. At least that is what the founder and investors hope will happen.

This article aims to help you avoid the wasteland of startup failures by having you understand everything you need to know about the seed stage. For a full list of funding stages, you can read our post on it here.

It’s time to plant, let’s begin.

Table of Contents

What is the Seed Stage?

The seed stage is often referred to as the first official fundraising stage. Or if you want to get technical, Crunchbase defines it as “the first rounds of funding a company will receive, generally while the company is young and working to gain traction.”

Like the pre-seed round, investors may include friends, family, and angels. However, venture capitalists are a more viable option in this round.

Why?

Because seed stage companies are more mature than their angel and pre-seed counterparts. For the first time, they are ready for "institutional investors".

In fact, some of the biggest VC firms have dedicated seed funds. This includes big names like Khosla Ventures, Greylock, and Andreessen Horowitz.

Pre-Seed Funding vs. Seed Funding

Founders often blur the line between pre-seed and seed rounds — and that’s fair. The difference isn’t always about how much you raise; it’s about how far along you are.

Pre-seed is usually about proving there’s something worth building — early validation, a prototype, or a first hire. You’re raising from believers who buy into the vision.

Seed is about showing there’s something worth scaling. You’ve got traction, real users, and early signs of product-market fit. Now investors expect data, not just conviction.

Are You Ready for Seed Funding?

At the seed stage, the company should not only have its minimum viable product (in beta with actual users, leave the alpha and prototype to the bootstrap and pre-seed stages), but should also have clearly demonstrated that it works and that there is a demand for it. I.e., you should have found Product-Market Fit.

There is revenue, traction, signs of increasing growth (signups, user registration, demand from vendors and/or enterprise clients), and the team and key personnel are in place. More importantly, the startup should have a compelling argument on why they are the solution to the problem that they are attempting to solve.

In other words, not just hopes, plans, and unrealized dreams.

While there is no way to accurately tell if you are ready for a seed round, here are a few questions founder’s should have answers to, especially when approaching investors.

- Is the story compelling?

- How strong is the product/market fit: retention, growth, usage?

- Can the company effectively compete on its core use case?

- What is the monthly revenue? This can be calculated as MRR (for SaaS), GMV (for ecommerce, marketplaces), GTV (for fintech), etc.

- What is the burn rate? How much money does the company burn through each month?

- What is the runway? How long can the company last with X amount raised?

- Can the founding team deliver on its goals?

- Are the market and opportunity real and sufficiently large?

- Is there one clear predictable, repeatable distribution channel?

Find your ideal investors now 🚀

Browse 10,000+ investors, share your pitch deck, and manage replies - all for free.

Get Started

Who Invests in Seed-Stage Startups?

Once deemed too early or too risky, seed stage companies are in vogue. Khosla was a seed stage investor in GitLab, InstaCart, DoorDash, and QuantumScape while Andreessen Horowitz made seed investments into Stripe, Lime, and Robinhood.

In 2022, Tiger Global has made over 18 seed deals globally and Andreessen Horowitz has over a dozen, according to Crunchbase.

But why do investors want to get in at the seed stage of a startup?

Simple.

The lead investor of a seed round is usually the first to get a board seat. It allows them to have an influence and a vote in paramount decisions at an early stage of the company. Seed investors may also get pro-rata rights, which gives them the right to invest in the next round or rounds next to the new investors. If your company is successful, this is a valuable option for investors who like to "double down" on the winners.

But venture capitalists aren’t the only people to approach in order to raise a seed round. Other sources of seed funding include:

- Angel Investors. Like the pre-seed stage, angel investors continue to play a pivotal role during the seed round, especially the bigger ones dubbed as "super angels".

- Angel Networks. Platforms such as AngelList allow angel investors to come together in a syndicate or SPV and provide capital as part of a group. For founders who need a small seed round, this may be the perfect solution to help them grow.

- Accelerators. Accelerators allow early stage startups to grow and provide not only funding, but networking, guidance, mentoring, and even a workspace. They take a small amount of equity in return for their services.

- Venture Debt. Venture debt is a loan to an early stage company that provides liquidity to a business for the period between equity funding rounds. This allows the company to have cash on hand for growth, hiring, and unforeseen issues. It is not a long term solution as the loan is often repaid within eighteen months (with interest). Banks that work with and understand the complexity of startups are often the right fit for venture debt.

- Corporate Seed Funds. Large corporations across the world have seed funds that invest in companies within their wheelhouse. For example, Maersk invests in companies with a logistics focus while Airbus Ventures focuses on deep tech companies in the sustainability sector.

- Anyone with an interest viacrowdfunding. There are hundreds of crowdfunding platforms with different qualifications. Some require accredited investors while others allow anyone with an account to invest. They are a popular source of seed funding as founders get exposure and can not only raise funds via equity, but also by providing rewards as an incentive.

- The founders themselves. If the founders can afford to do so, they can continue to use their own personal savings to fuel their business AKA "skipping the seed rounds". This allows them to maintain control of their equity and avoid taking on any debt. Companies such as Spanx and Mailchimp continued to bootstrap their way to successful exits.

How Much Money Do You Get Raising a Seed?

The valuation of a seed stage startup varies. Seed valuations of U.S. startups typically range from $4-20 million, with check sizes varying between $1M to $5M.

Checks are occasionally getting bigger, with many companies raising “supergiant” seed rounds. Yugalabs raised a $450 million seed round while Canadian fintech Fraction raised a CAD $219 million seed round. That's what we call the Pool Party effect.

But before you get too excited, most companies never make it past the seed stage. These supergiant seed rounds just provide more capital to burn through as they fall.

Terms Beyond Valuation

When raising seed money for an early-stage startup, valuation often gets all the attention, but the terms attached to the investment can be just as important. These details affect how much control you retain, what obligations you have to investors, and how the economics play out if things go well (or if things don’t).

Here are a few key terms founders should understand at the seed stage:

Convertible notes / SAFEs / Priced Rounds – The main structures used in seed rounds. Each works a little differently, but all determine how investor capital converts into equity and the rights attached. For example, SAFEs are a popular early-stage instrument that simplifies the process of converting investment into equity.

Liquidation preferences – Determine who gets paid first if the company is sold. Typical seed rounds use 1x non-participating preferences.

Pro-rata rights – Allows venture capital firms and angels to maintain their ownership in future rounds if they choose.

Board/observer seats – Rare at seed, but some investors ask for board observation rights.

How Long Does it Take to Get Seed Funding?

Although there is no set time limit, the seed round should take up to 6 months to complete and raise funds. This is also dependent on the founding team, their relationships, and previous startup history - including any significant exits.

Uses of Seed Capital

The use of proceeds from a successful seed capital raise will differ depending on the need and nature of the startup. In most cases, it will be used to make additional key hires, increase marketing, expand market share, further product iteration, extending the runway, lowering costs, obtaining critical facilities or equipment, and ultimately to continue to fuel and grow the business.

Here's how Transferwise described their use of funds in their seed deck in 2011.

How to Find Seed Investors

Finding the right seed investors won’t come from aimlessly cold emailing 300 funds. You set yourself up for success by building a targeted pipeline of people who actually write checks for companies like yours. The north star isn’t booking a meeting.” You want to find genuine alignment between investors who get your market, your startup, and your timeline.

Let’s discuss where founders actually find seed investors — the proven paths that consistently lead to real conversations and checks.

1. Start with Who Already Believes in You

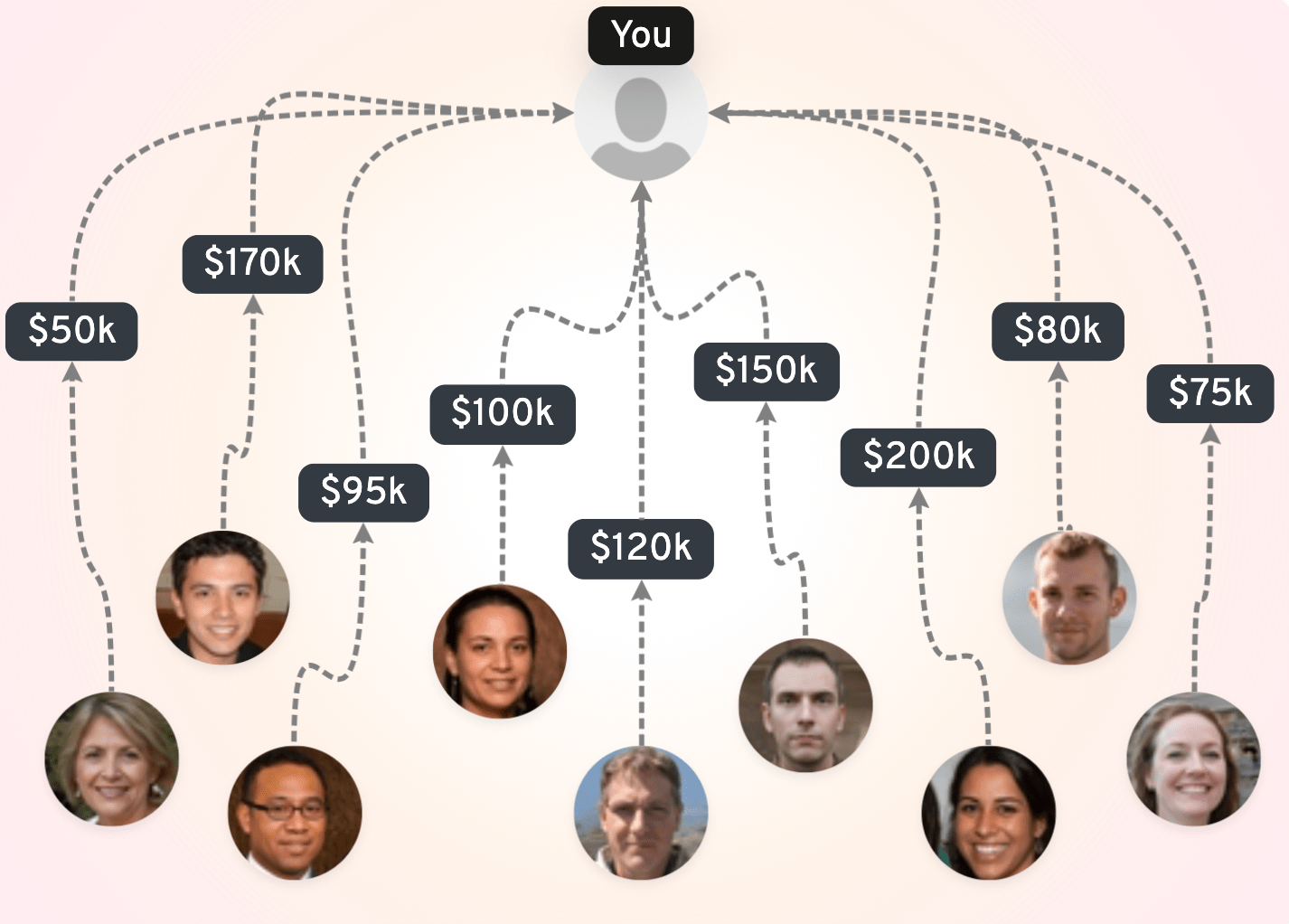

Founders often secure seed funding from their existing network — people you’ve worked with before, angels you met at demo days, or even your pre-seed backers who want to double down. Start there. A warm intro from someone who’s already invested in you or worked with you will always outperform a cold message.

If you don’t have that network yet, start building social proof now. Share progress updates publicly (LinkedIn, X, entrepreneur communities) so that when potential investors do find you, they already know what you’re building and why it’s gaining traction.

2. Tap into Accelerators and Incubators

Accelerators and incubators can shortcut your path to credible venture capital — especially if you don’t have an existing VC network. Programs like Y Combinator, Techstars, and 500 Global each have hundreds of active alumni investors who routinely back new batches.

But don’t stop at the big names. Regional programs like Station F in Paris or Startupbootcamp across Europe and Asia connect startup founders with seed funds in their ecosystems. Even smaller local accelerator programs often have tight relationships with micro-VCs and angels who trust their vetting process.

Pro tip: If you don’t want to give up equity for an accelerator, look for non-dilutive incubators or university programs. The mentorship and investor access can still open the same doors.

3. Use Platforms That Centralize Investor Discovery

This is where modern tools make fundraising 10x more efficient. Instead of scraping old venture capital lists or scrolling through Twitter threads, you can use dedicated investor directories that stay up to date.

OpenVC is purpose-built for this stage. You can filter through thousands of verified investors by round (seed), industry, check size, and geography. Each profile shows their thesis, recent investments, and whether they’re currently open to pitches — saving you from cold-emailing dead leads.

Other useful tools include Crunchbase (Pitchbook), Signal by NFX, and AngelList.

The trick isn’t to use every tool in the toolkit. Avoid complexity as often as possible, and focus onbuilding one clean investor pipeline. Start with 30–50 highly relevant investors, personalize your outreach, and track each interaction. That’s what separates founders who raise efficiently from those who burn out chasing random leads.

4. Go Where Investors Already Hang Out

Venture capitalists tend to move in predictable circles. Join curated founder communities (like OnDeck, Hacker News, Product Hunt, and YC Alumni forums) and engage authentically. Ask questions. Share updates. Many first checks start as casual DMs between peers before they become term sheets.

Offline still works, too. Local pitch events, demo days, and ecosystem mixers are underrated. You may only meet one or two serious investors per event — but one right investor can syndicate the rest of your round.

Be social. Get your name out there. Make genuine connections with people, without the first interaction even mentioning fundraising.

How to Pitch Seed Investors

Let’s kick things off with rule #1: clarity beats drama every time.

An investor should understand what problem you’re solving, who it’s for, and why your team is the one to solve it. That must translate from every touchpoint, whether that be your emails, pitch decks, or meetings.

Next, we’ll cover exactly what founders do to effectively deliver their message to VCs.

Focus on the Slides That Actually Matter

In your startup pitch deck, you don’t need to provide a dissertation for every aspect of the business. At the seed stage, VC investors are looking for proof of understanding, execution, and capital efficiency. Keep it concise, but don’t cut it too short where you aren’t answering the obvious questions.

Focus on the slides that actually drive decisions:

- Problem Slide – Be specific and urgent. Paint the pain your customers actually feel.

- Product Slide – Show your product or MVP visually. Demonstrate how it solves the problem without overloading with features.

- Business Model Slide –Explain how you make money and why it scales.

- Traction Slide – Revenue, users, engagement, pilots — whatever proves you’re learning fast and moving forward.

- Ask Slide – Exactly how much you’re raising and what milestones the money enables.

Everything else (market size, team, competition) is useful for context, but the deck exists to remove objections, not impress with slides.

Talk Like a Builder, Not a Brochure

Seed investors sniff out fluff instantly. Replace generic buzzwords like “huge potential” or “disruptive solution” with real evidence. Even if your traction is small, highlight what you’ve learned and how that shapes the business plan.

Keep numbers and learnings concrete. Investors respond to reality more than vision statements.

Run the Meeting Like a Conversation

Your deck is a blueprint, not a script. Lead with your story, pause for questions, and let investors engage naturally. Keep control of the flow: start with the problem, walk them through traction, and close with the ask. Treat each meeting like a qualification process, both for you and them.

Follow-up matters as much as the pitch itself. Send a short recap email highlighting key metrics and updates, and keep the investor in the loop as your milestones hit.

Lastly, you can practice in the mirror all you want. But genuine confidence and presentation skills come in real-world situations. It’s okay to be nervous, but always be aware of what went well and where you can improve (and don’t be afraid to ask investors for feedback).

Seed Venture Capital Funds

Here at OpenVC, we currently have thousands of early-stage venture capital firms on our platform that invest at the seed stage. With check sizes averaging $1M, connecting with the right investor for your startup just got easier. Some of these funds include:

- Contrarian Ventures

- Bluestein Ventures

- Story Ventures

- Vera Equity

- StartFast Ventures

As always, make sure that your company fits their investment thesis before submitting your deck.

How to Use OpenVC for Seed Fundraising

Raising a seed round is messy. You’re juggling research, outreach, pitch decks, and follow-ups — all while building your company. OpenVC is designed to make this chaos manageable, giving founders a single hub to find investors, share decks, and track conversations.

Here are 3 key features we provide founders looking for seed startup funding (all for free!):

1. Investor Search

Start by finding investors who actually match your stage, sector, and check size. OpenVC gives you access to one of the largest investor databases online — 6,000+ VCs, angels, accelerators, and incubators. With robust filters, you can zero in on the investors most likely to engage, so you’re spending time on the right conversations instead of guessing.

2. Pitch Deck Sharing & Tracking

Sending decks via email is fine, but knowing who opened it, how many times, and what investors clicked is game-changing. OpenVC lets you share your pitch deck securely and track engagement, so you can prioritize follow-ups based on real interest, not guesswork.

3. Fundraising CRM

Think of fundraising like sales. You’re selling your startup, one conversation at a time. The OpenVC Fundraising CRM keeps your pipeline organized: log notes, set reminders, track engagement, and follow up strategically.

Combine all three, and fundraising stops being random emails and scattered spreadsheets. Instead, it’s a repeatable, data-informed process that actually drives real funding opportunities.

Conclusion

The seed stage is where most companies come to die. But it is also where companies can grow, mature, and truly shine. By making it to the seed stage, you are proving that the opportunity is there. Not only is your team counting on you, but so is your 7th grade lab partner who invested in the earlier round.

Unlock the secrets to startup fundraising 🚀

Use our FREE, expert-backed playbook to define your valuation, build VC connections, and secure capital faster.

Access now