This is one of the most common questions we get at OpenVC:

"Can I just pay a pro to raise funds for my startup?"

And yes, why not? After all, founders often lack investor connections and fundraising knowledge. This person will take care of your raise from start to finish and get paid on a success fee. Sounds like the perfect plan, right?

Unfortunately, it's not that simple.

Here's the whole truth about outsourcing your raise to a pro.

Table of Contents

I. Work with an investment banker (IB) at Series B+

1. Investment bankers raise big rounds from start to finish

Investment bankers are professionals who help companies raise capital - typically from Series B to pre-IPO.

Investment bankers take care of everything: preparing the deck, connecting with investors, and even negotiating the term sheets. The founder just shows up for key meetings and weekly check-ins. Very efficient.

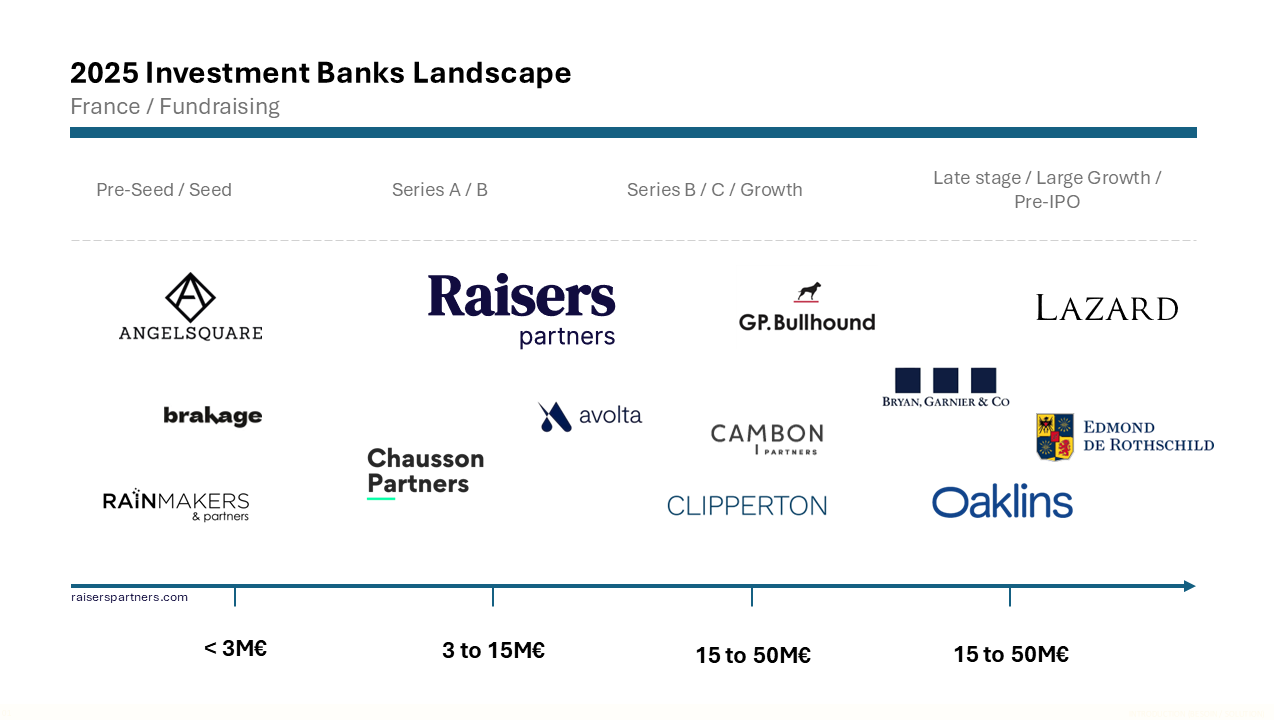

You know the big banks: JP Morgan, Rothschild, etc. However, there are many local investment bankers who also offer their services to founders.

For example, here's a landscape of the French investment banks in 2025 - big thanks to Augustin de Cambourg from Raiser Partners for this!

2. Investment bankers charge a fixed fee + a success fee

Investment bankers typically charge a fixed fee and a success fee:

- Fixed fee AKA "retainer": $5k/mo to $20k/mo depending on the bank and round size

- Success fee: 3% to 5% of the amount raised

Some bankers may want exclusivity. Some may want to be paid on the whole round - not just the amount they bring you. Some may deduct the fixed fees from the success fees. These terms are part of the negotiation and need to be clarified upfront.

Regardless, working with an investment banker is expensive.

A 4% success fee on a $10M raise amounts to $400,000 for a few months of work. Add to that the retainer: even if the raise fails, you're still on the hook for anywhere from $10k to $100k in fixed fees.

So is it worth it? Let's model a few scenarios.

Here are my key takeaways:

- If you're a "hot deal" with investors throwing themselves at you, raising alone is probably fine. You'll likely get a great outcome regardless. A banker might still be valuable to streamline the process and free up founder's time, but that's pretty much it.

- If you're a "normal deal", that's where a banker adds most value. By running a tight process, a banker can get you more interests and ultimately better terms. It's better to have a "great outcome with a banker" than a "good outcome alone". But it's a bet.

- If you're a "bad deal", you probably shouldn't raise at all, but especially not with a banker, because the fixed fees will bury you into a grave. Any honest banker should tell you upfront if they think you're a poor VC case; unfortunately, they are not all honest.

What's the likelihood that a banker will get you better terms than what you could have gotten on your own? Is it really worth all that money? That's for you to decide.

3. Investment bankers will NOT raise your pre-seed

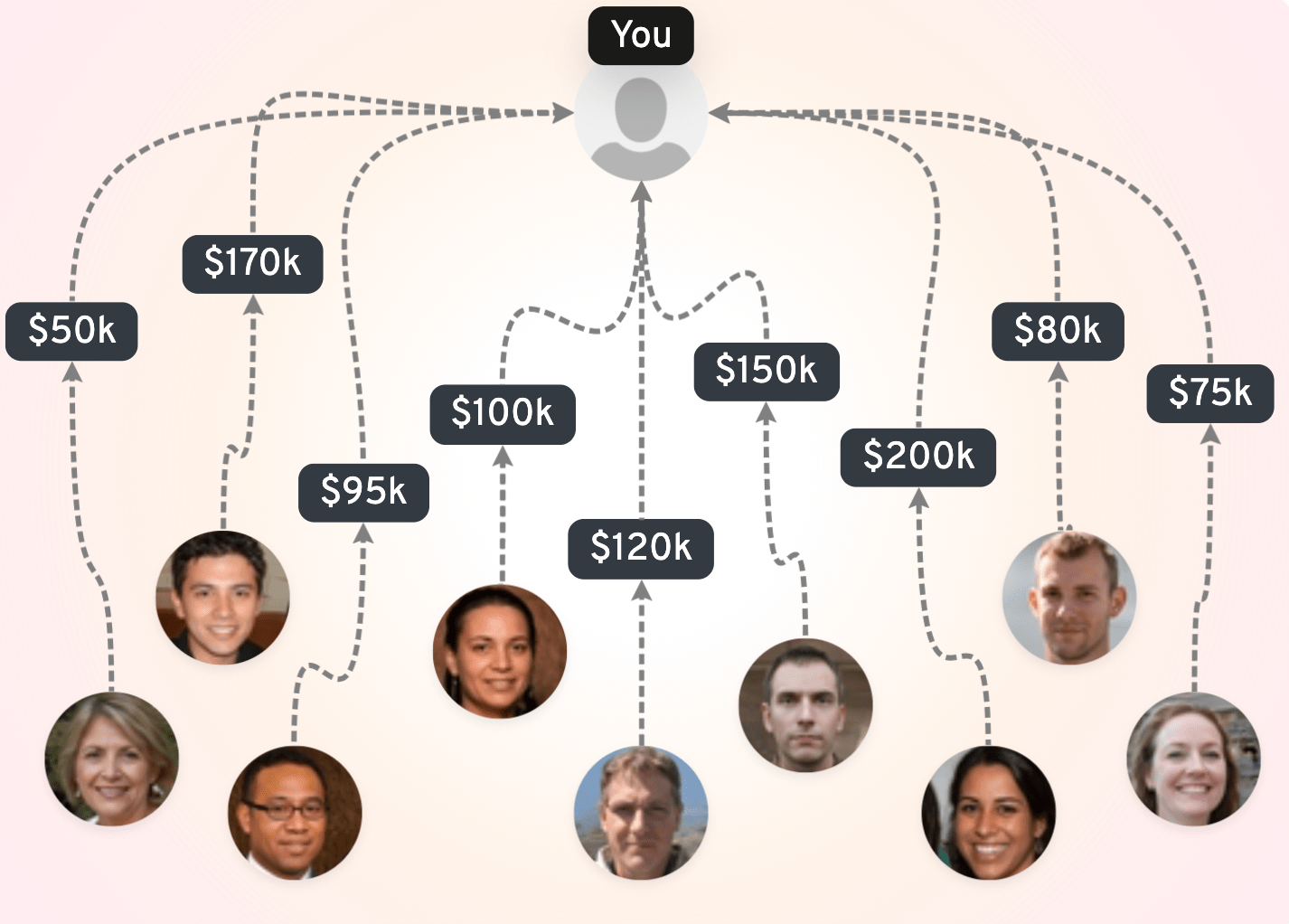

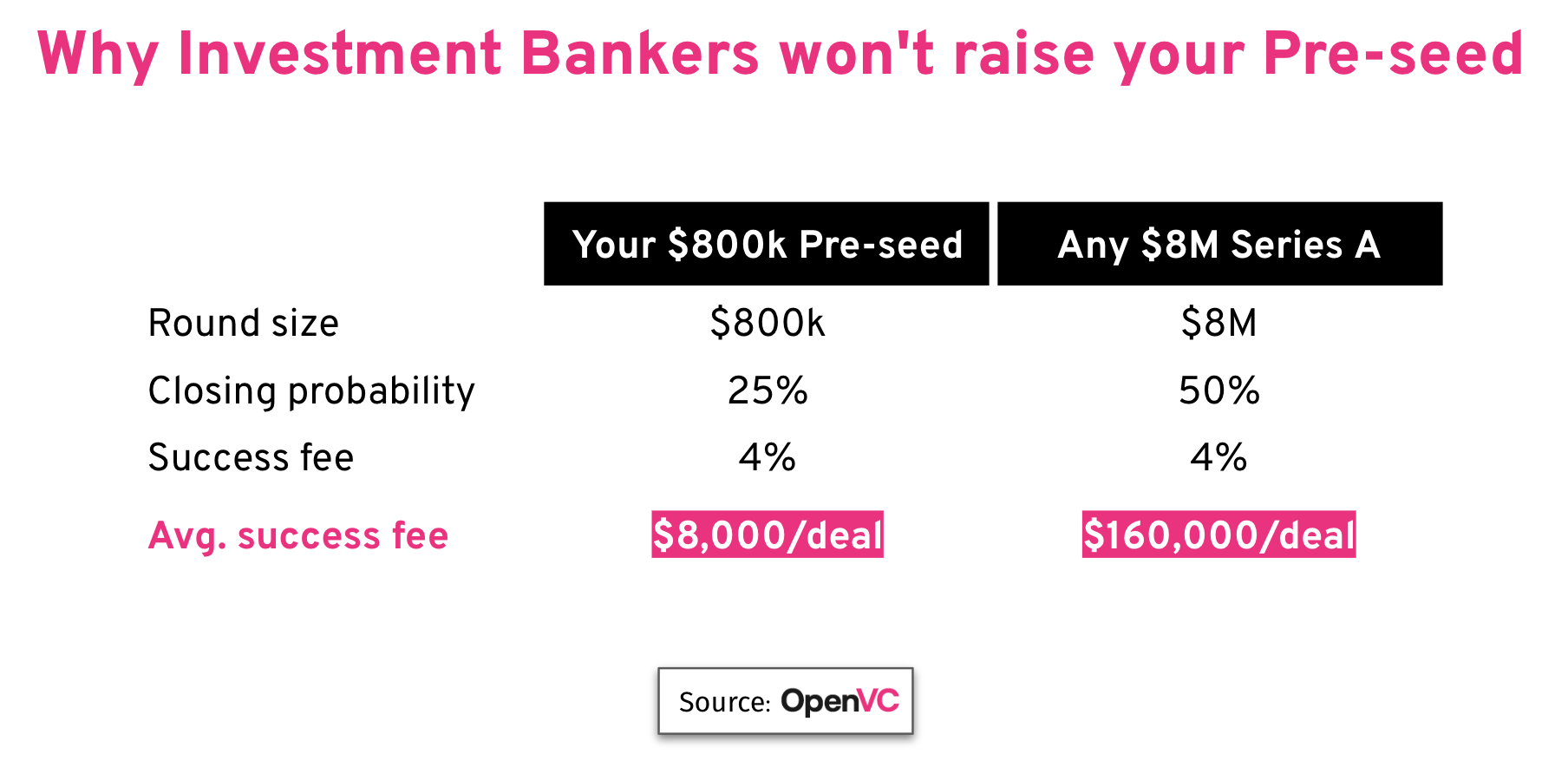

Investment bankers don't usually raise for early-stage startups. It's just too much work and not enough money for them:

- Pre-seed founders are often inexperienced. The banker would have to do a lot of handholding and spend time explaining the basics. => Too much work

- Pre-seed rounds have a high rate of failure. The success fee on a $500k round is mechanically 10x smaller than a $5M round. => Not enough money

Instead, they focus on bigger rounds: Series A, Series B... all the way to IPO.

Here's the napkin math if you don't believe me:

Bottom line: it's 20x better for investment bankers to work with bigger rounds. That's where their economic model makes sense.

So how can early-stage founders get the help they need?

Unlock the secrets to startup fundraising 🚀

Use our FREE, expert-backed playbook to define your valuation, build VC connections, and secure capital faster.

Access now

II. Work with a Fundraising Advisor (FA) at early-stage

1. Fundraising advisors specialize in early-stage startups

Fundraising Advisors ("FAs") are professionals who help you raise funds at early stage, typically from angel round to Series A.

(NB: Fundraising Advisor is not a standard industry term, it's my own lingo).

These FAs offer similar services to investment bankers. They run the whole process with you from start to finish. They are investment bankers in all but name.

You can find many FAs listed with prices and references at FundraisingAdvisors.app.

2. Most Fundraising Advisors won't work on a success fee

If you listen to founders, they want to pay success fees only:

Sorry founders, most FAs charge a fixed fee!

As explained before, the maths doesn't work for success fees at early-stage. Round size is too small, failure rate is too high. But there's another reason.

Charging a success fee is highly regulated in common law countries: the US, the UK, Singapore, etc.In many cases, it's just illegal for a FA to charge a success fee.

Sure, there are exceptions. You may find an occasional Fundraising Advisor who works for success fee, especially in civil law countries (France, Switzerland, etc) where regulations are more lax. However, this is rare and those FAs are either extremely selective or unproven and inexperienced.

Either way, not a great option for most founders.

3. Paying a Fundraising Advisor in equity is... tricky

Some FAs may accept payment in the form of equity.

To be frank, I don't love the idea. Equity is supposed to incentivize and lock in people who continuously add value to the company over time e.g. key executives or employees. A FA provides value once, so it makes more sense to compensate them in cash for the work they perform and keep a clean cap table.

💡 About accelerators: An accelerator invests cash in exchange for equity, so they don't count as a FA. If an "accelerator" asks for equity but doesn't invest cash in return, they're not really an accelerator - they are a Fundraising Advisor! Read more here.

Bottom line - if you want help from a FA, you will have to pay them in cash.

Mayne founders are salty about it. They want the help, but they don't want to pony out the money. Maybe that's the reason there's so much hate against FAs?

Is it justified, though? Let's review the main criticisms and assess their merits.

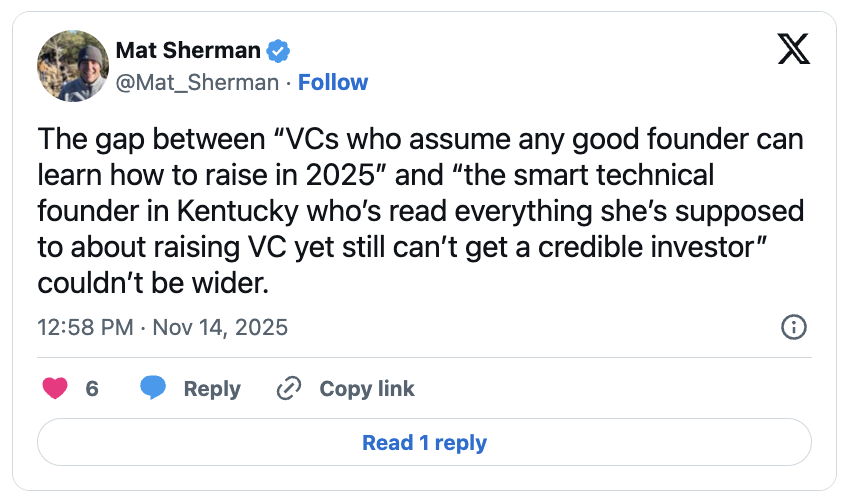

4. "Founders should learn how to raise funds themselves!"

True.

Fundraising is a learning curve every founder has to climb. By outsourcing the raise to a FA, you miss out on an important part of your "CEO education".

However, working with a professional is an acceptable way to learn.

Treat it as peer learning. Get involved in every step of the process, and this will be an accelerated fundraising class for you.

5. "Using a Fundraising Advisor is bad signal for investors!"

It depends.

The FA is supposed to have existing connections with investors. His or her name is supposed to add value to your raise, not the opposite. As long as you get intros to in-network investors who trust the judgment of your FA, it's a plus.

However, if the FA doesn't have a pre-existing relationship with a specific investor, it's different. In that case, the outreach should come from you (the CEO), nit them. The FA can help in the background, by reaching out from your email address for instance.

On top of that, there are big cultural differences.

- In the US, early-stage investors typically dislike fundraising advisors as a rule.

- In Europe, it's a mixed bag - some FAs are recognized and a few are even appreciated.

- In China or the Middle East, FAs are quite common and an active part of the ecosystem.

6. "Fundraising Advisors will take your money and run away!"

Maybe.

Fundraising has a high failure rate. Even a good FA may fail to raise, and leave you in a worse situation than when you started. It's a risk you accept when you work with them. There's no 100% guarantee.

However, the high failure rate is also a convenient excuse for scam artists who take advantage of desperate founders, charge them a hefty fee, and don't deliver. Before signing with a FA, compare a few of them, google their names, do a background check (including contacting previous founders who worked with them), and listen to your guts.

💡 The first call with a FA should always be free. Ask your questions and assess the FA. A good FA will reject you if they feel they cannot help. A bad FA will accept you without second thought because they are after your money, not your success. To learn more, read this.

6. "They are parasites! This should be free!"

Some people see fundraising advisors as parasites, "gatekeepers" who monetize access to the investors and by doing so, destroy value in the startup community.

I used to think like that, but not anymore. Here's why:

- The prep work (coaching, materials, strategy, etc) is tangible work and deserves to be paid as such. Some founders think they just need intros to succeed. The truth is many founders are a mess, and it takes work to make them investor-ready.

- Access to investors is also work. Someone has spent 5 to 10 years building access, maintaining a network of relationships and a "knowledge graph", building a brand and a reputation. You haven't. They are lending you their social capital. That's what you're paying for.

At the end of the day, you're not entitled to anyone's time or network. If you want help, you pay for it.

III. Raise funds yourself - but do it the right way

Most founders raise on their own. No banker, no advisor.

Here's how you can do it, too.

1. Teach yourself the fundraising playbook

Your first enemy is "unknown unknowns".

If you've never raised funds before, there's a lot of stuff you don't know and you need to learn ASAP.

Here are some resources we recommend:

- Read blog posts, starting with "How to raise money in 14 steps"

- Watch Youtube videos, especially the YC School series.

- Join the OpenVC webinars every month - check out the next sessions.

If you prefer a more structured approach, you can pay to join in-person or online bootcamps.

Of course, if you're an OpenVC Premium member, you already have access to our amazing Fundraising Masterclass that covers all the important stuff in a practical way with examples.

2. Pay for tools & support based on your needs

Some founders buy small tools and services based on their specific needs:

- Hire a pitch deck designer if you suck at design.

- Buy an investor list. instead of starting from scratch.

- Get a template for your financial model

That way, you're in control of your raise but still get a little edge.

You can even hire freelancers who specialize in investor outreach. They will focus on one thing only: landing your pitch in as many investor inboxes as possible. That way, you focus on getting intros while the cold outreach is taken care of.

And of course, use OpenVC to streamline the whole raise process.

3. Leverage brokers opportunistically

Some countries are extremely relationship-driven. In China or the Gulf countries, investors are difficult to access. You won't find them on LinkedIn or Twitter. They may not even have a website.

For that reason, being a middleman is completely accepted. Everyone is a broker. Taking a cut by making intros is a normal thing.

These people are pure brokers, though: they won't do any work other than shooting a message or forwarding your deck to the investor (and getting a commission for that).

If that's your fundraising environment, then roll with it.

Watch our for scammers, though...

Conclusion: what's the best option for you

Start with an honest self-assessment: how fast can you learn and be proficient at fundraising? Do you need a little help? A lot of help?

Remember: anybody who guarantees a successful raise is lying. If you choose to work with an investment banker or a fundraising advisor, speak to a few and make sure to vet them fully.

In any case, you will be heavily involved in the raise. A FA will assist you, but never replace you. Don't expect to have it easy because you're paying - it's just not happening.

As a closing thought, it's important to acknowledge that early-stage venture is a cash-poor environment. First-time founders need help the most, yet they are the least likely to be able to afford that help. It's just what it is, and part of the struggle.

At OpenVC, we try to make this journey a little easier.

Wanna react to this post? Join the conversation on Twitter or Linkedin!

Find your ideal investors now 🚀

Browse 10,000+ investors, share your pitch deck, and manage replies - all for free.

Get Started