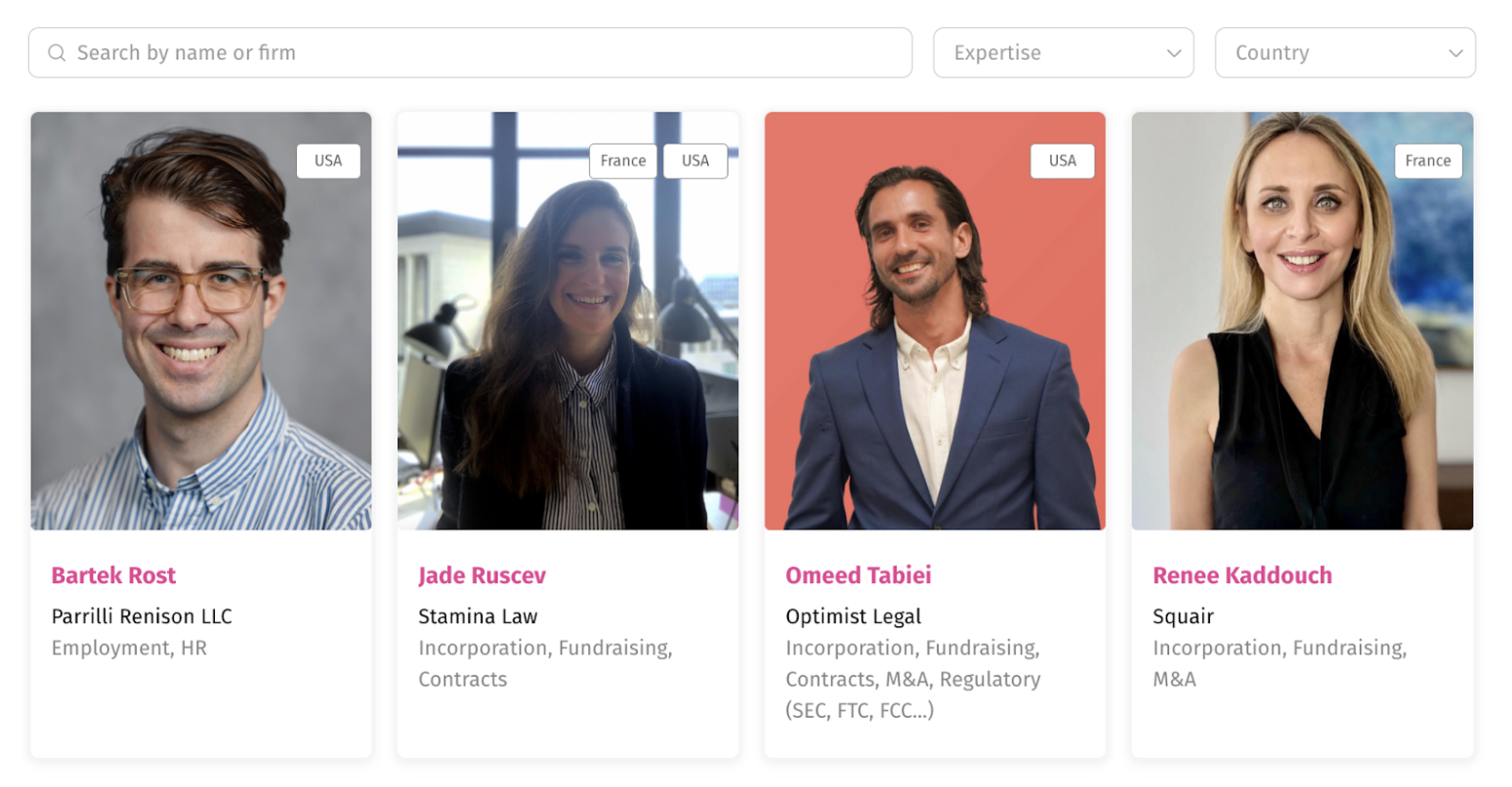

Omeed Tabiei is an attorney licensed in the United States and Managing Partner at Optimist Legal. He specializes in startup and venture law, including incorporations, fundraising, convertible instruments, and exits. In this post, Omeed breaks down the key legal concepts every founder should know before raising capital - from SAFEs to term sheets and SEC exemptions.

Table of Contents

Watch the recording

SAFE, notes, priced round.. What are the main fundraising instruments founders should know?

There are three primary instruments every founder must understand:

-

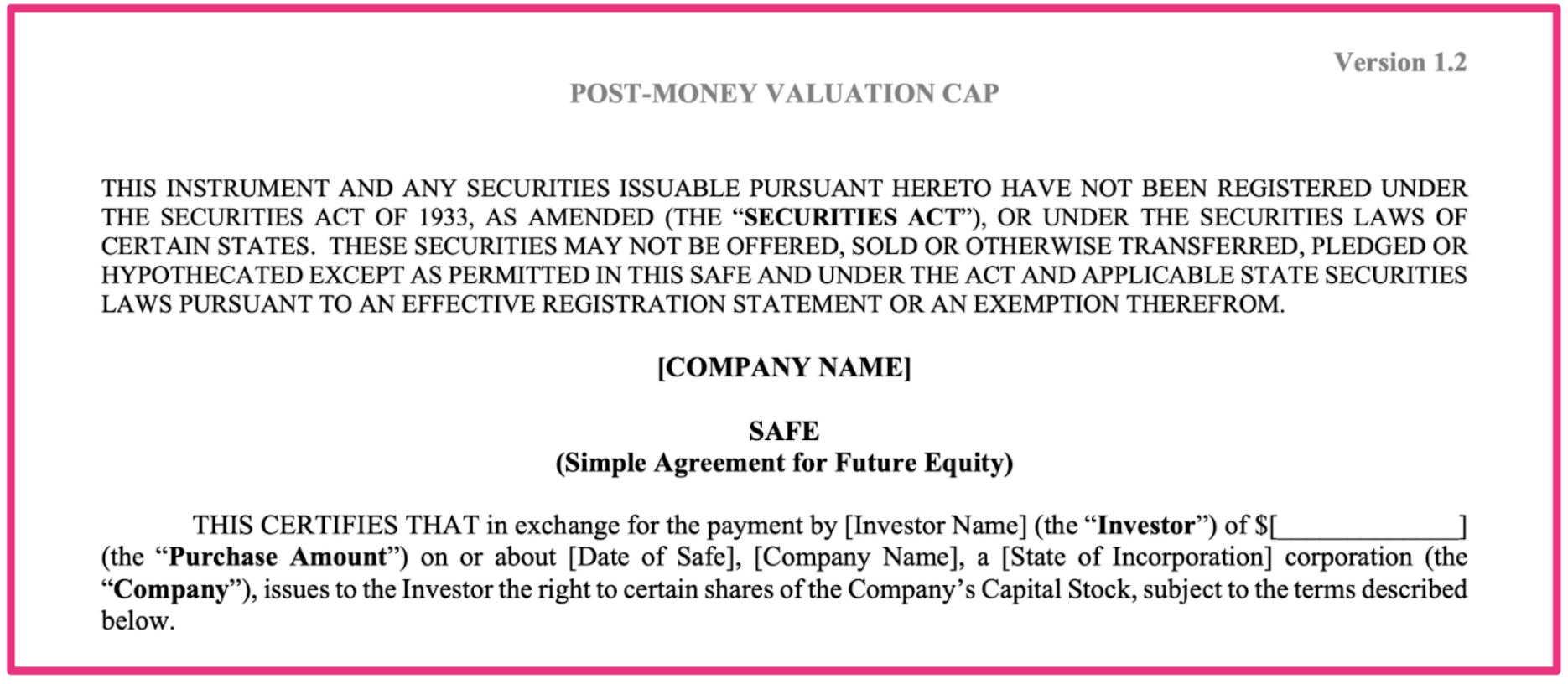

SAFE (Simple Agreement for Future Equity) - The most common early-stage contract, created by Y Combinator.

-

Convertible Note - A loan that converts into equity later, often used for bridge rounds.

-

Priced Round (Stock Purchase Agreement) - A full equity sale at a defined valuation.

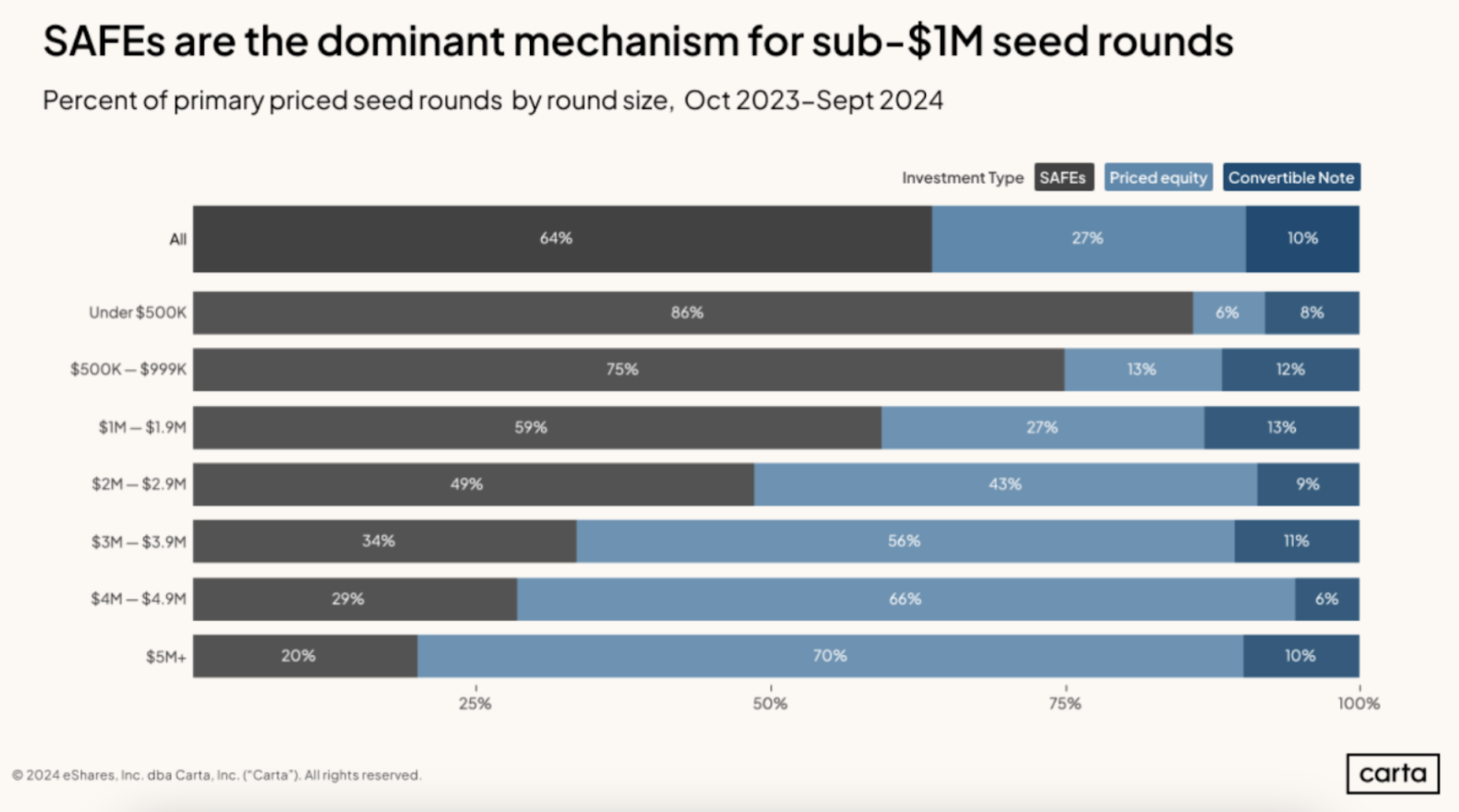

In the US, the majority of rounds under $2 million are now raised using SAFEs. Convertible notes are less common but still useful for certain bridge scenarios. Priced rounds typically appear at the seed or Series A stage, once the company has traction and valuation clarity.

How does a SAFE actually work?

A SAFE lets you raise capital without setting a valuation. It’s a template contract that investors already know and trust, which means little to no negotiation.

Key terms include:

-

Valuation Cap: The highest valuation at which the SAFE converts. A lower cap gives investors more equity; typical caps for early-stage startups are $5–10 million.

-

Discount: A percentage reduction on the valuation of the next priced round - usually 20 percent.

-

Pre-Money vs Post-Money: Determines whether dilution is calculated before or after the new funds enter. Post-money SAFEs give clearer visibility into ownership changes.

Sometimes a SAFE includes both a cap and a discount; in that case, the investor gets whichever gives them the better deal.

Conceptually, a SAFE rewards early investors for taking extra risk - they’re essentially getting an advance on the future priced round, with better terms than later investors.

Should founders still care about convertible notes?

Yes. Even if you never use one, you should understand convertible notes. They are technically debt instruments that convert to equity under certain triggers, such as a priced round. Because they accrue interest and have maturity dates, they’re often used in bridge rounds between larger raises.

Knowing how they work gives you more flexibility and credibility when structuring financing.

What happens in a priced round?

A priced round is where you actually sell shares at a defined valuation - it’s the classic venture round.

The process begins with a term sheet , which summarizes:

- The company valuation (the “price” of the company)

- Investment amount

- Investor rights, such as board seats

- Liquidation preferences and voting rights

Once the term sheet is signed, the deal is about 90 percent done , even though it’s technically non-binding.

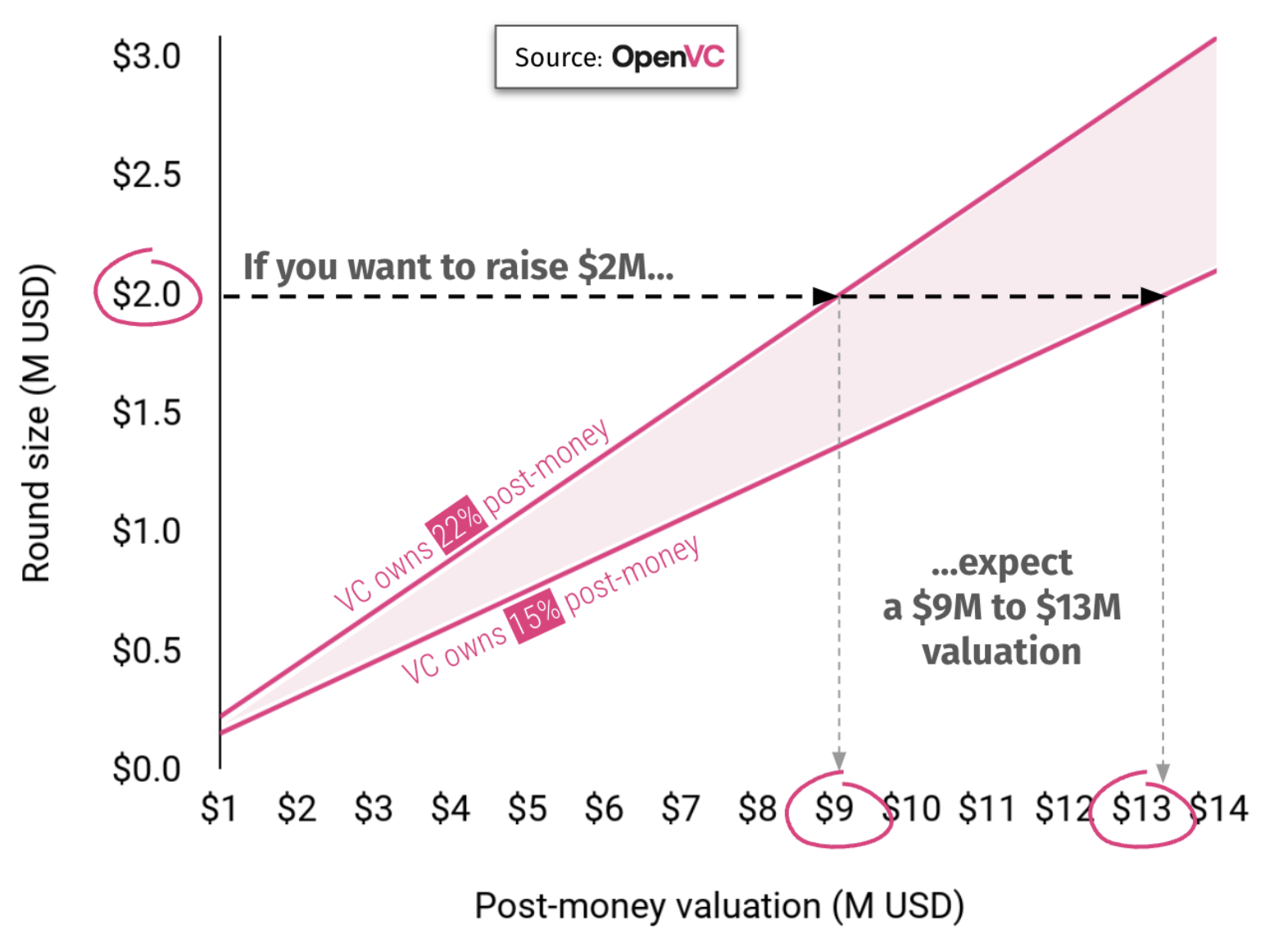

Valuation setting can be tricky.

Founders typically benchmark against comparable companies or prior rounds. But remember: while a higher valuation looks great, it’s only valuable if the terms are clean - bad clauses can wipe out your equity later.

What are the dirty clauses I should watch out for?

Two clauses appear often and can severely harm founders:

-

The Option Pool Shuffle

Investors may ask you to expand your employee option pool before they invest. This dilutes you and makes their own shares more valuable. You can counter this by preparing a hiring plan that justifies a smaller pool (e.g. 10 percent instead of 20 percent) and showing the investor that it covers your next few years of hires. -

Participating Preferred, or “Double Dip”

This lets investors recover their entire investment and still participate in remaining profits. In practice, it means they can make more from an exit than the founder.

Founders often fall into these traps AKA “dirty clauses” because they chase high valuations and neglect the fine print. It’s better to accept a fair valuation with clean terms than a vanity valuation that costs you control or exit proceeds later.

What legal documents are included in a priced round?

Priced rounds use the NVCA (National Venture Capital Association) standard templates, which keep deals predictable.

The main documents are:

- Stock Purchase Agreement (SPA): The contract that sells shares and includes warranties about the company’s condition.

- Amended and Restated Certificate of Incorporation: Creates the preferred stock class that investors receive, defining liquidation and conversion rights.

- Investor Rights Agreement: Covers information rights, registration rights, and participation rights for future rounds.

- Voting Agreement: Establishes how votes are shared between common and preferred holders.

- Right of First Refusal and Co-Sale Agreement: Gives investors first-buy rights if founders sell shares.

-

Management Rights Letter: A compliance document often required by institutional investors.

These contracts collectively define how investors, founders, and employees coexist legally after the round.

Should I ask investors to sign an NDA before sharing my deck?

No - asking for an NDA before initial discussions is one of the fastest ways to lose investor interest.

Instead:

- Use a virtual data room (like Papermark or Notion) to control what you share.

- Phase your disclosure - the pitch deck should be high-level and public-safe; only share sensitive data after a term sheet.

-

Do your own due diligence on investors, just as they do on you.

Term sheets will include confidentiality clauses later on, but in early outreach, NDAs signal inexperience. Professional investors review hundreds of startups - they won’t sign one just to read your deck.

What are SEC exemptions, and which one should I use?

The SEC (Securities and Exchange Commission) regulates the sale of securities. Any time you issue equity or SAFEs, you’re selling securities. Startups, however, are exempt from full SEC registration if they meet certain conditions.

The two main exemptions are:

-

Rule 506(b) - “B for Buddies”

You can raise from people you already know - friends, family, and existing contacts - but you cannot publicly advertise your raise. -

Rule 506(c) - General Solicitation

You can publicly promote your raise (for example, on Twitter or your website), but every investor must be accredited - meaning they earn over $200K/year (or $300K jointly) or have over $1 million in net assets.

For both, you must file a simple Form D with the SEC, and often additional Blue Sky filings at the state level. Even a small $25K SAFE from a family member technically requires filing.

In short:

- 506(b): private raise, known investors

- 506(c): public raise, accredited investors only

These rules exist to protect the public from scams, ensuring that only sophisticated or wealthy investors can take on startup risk.

Do founders really need a lawyer, and how much does it cost?

Yes. Both SAFE and priced rounds have legal and regulatory components that are too risky to handle alone.

Typical legal fees:

- SAFE round: $2,500 - $5,000

-

Priced round: $35,000 - $50,000

Fees vary depending on the number of investors, their locations, and any SEC or Blue Sky filings required. Most lawyers get paid after the round closes , so you can use part of the raise to cover costs.

If you’re raising from unaccredited investors or across multiple states, working with a lawyer isn’t optional - it’s a legal necessity.

Do founders have to pay the VC’s lawyer fees too?

Often, yes.

It’s a standard practice, especially in Series A and later rounds, for investors to require that their legal fees be paid out of the round proceeds.

Whether you can negotiate depends on your leverage - if multiple investors want in, you have room to push back; if not, expect to cover it.

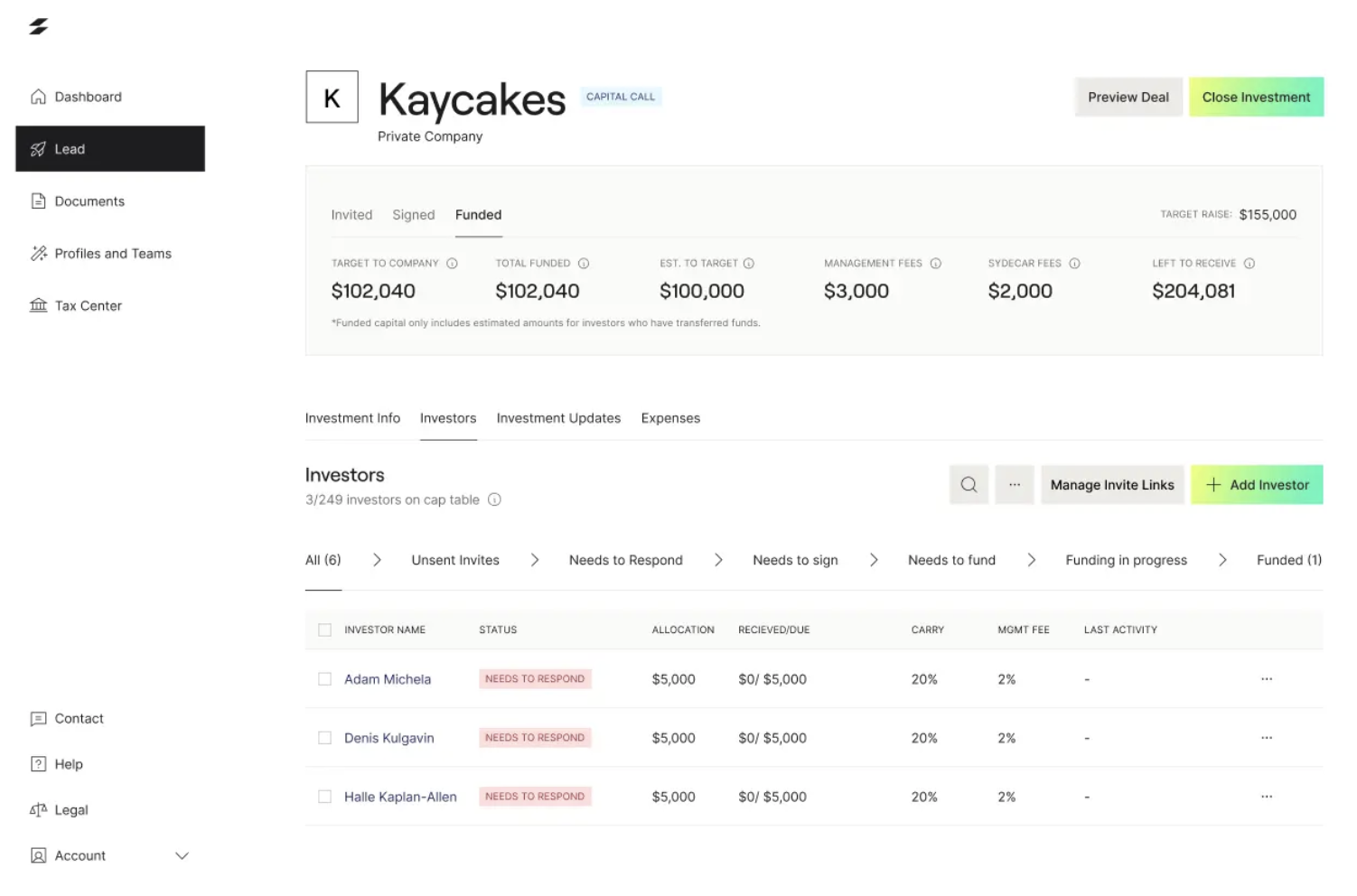

What’s the difference between an SPV and a SAFE?

They’re completely different tools that work together.

- A SAFE is the contract between the company and each investor.

- An SPV (Special Purpose Vehicle) is a legal entity that pools many investors into a single entry on your cap table.

For example, if 40 angels invest via SAFEs, you might later combine them into one SPV to simplify your cap table before a Series A.

When do I need a 409A valuation?

A 409A valuation determines the fair market value of your company’s common stock and is required when issuing stock options to employees.

It’s not necessary for SAFEs or priced rounds unless you’re granting options afterward.

You can obtain one from platforms like Carta or Pulley for about $3,000. It’s required under the Safe Harbor provision of SEC regulations to ensure compliance with option pricing rules.

Can I pay introducers or brokers a success fee?

No - unless the person is a licensed broker-dealer , paying success-based commissions for investor introductions violates SEC rules in the US. Both you and the investor could face penalties.

If you need help connecting with investors, structure it as a flat consulting fee or monthly retainer for investor relations work, not as a percentage of funds raised.

Culturally, in the US, paying introducers is also frowned upon. Early-stage investors expect the CEO to handle fundraising directly; they see it as a test of leadership and communication.

Delegating to a “fundraising advisor” or “investment banker” is more accepted in other geographies (Middle East, China…) and at a later stage (Series B+).

How many investors are too many in a pre-seed round?

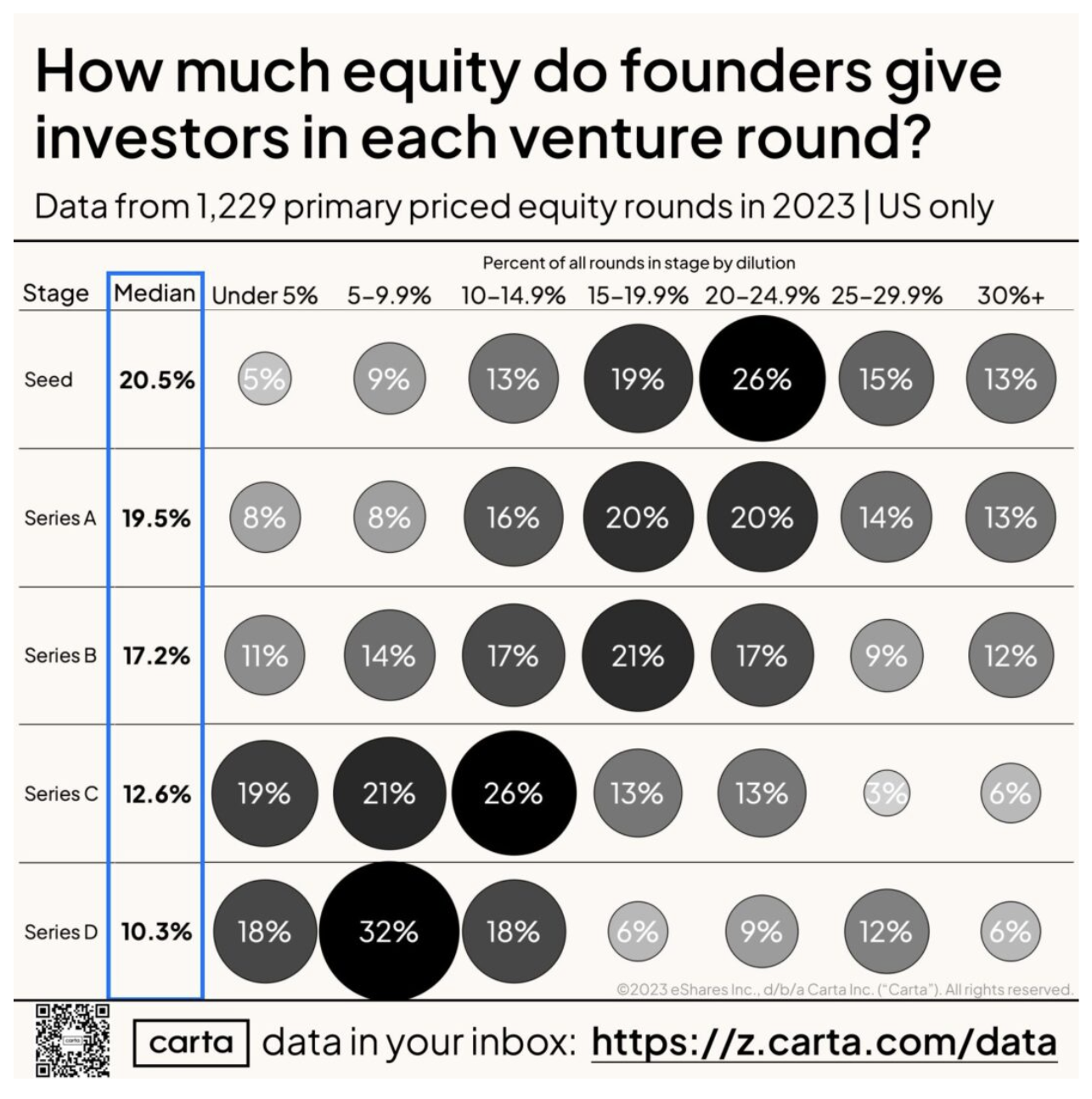

It’s less about the number of investors and more about dilution.

Aim not to give away more than 20 percent of your company in your pre-seed round.

If you end up with a messy cap table - say 50 small angels - you can later consolidate them into an SPV. What really matters to future investors is that you’ve preserved meaningful founder ownership and kept governance simple.

Should I patent my IP before contacting investors?

If you’re in deeptech, biotech, or hardware, maybe.

Otherwise, probably not. For software companies, patents rarely add early-stage value. What matters more is your IP strategy - a plan showing how you’ll protect your technology after raising capital. Patents can be pursued later, once you have funding to cover the high filing costs.

At the time of exit, patents can increase valuation because they represent transferable assets, but early on, focus on execution and traction.

Final thoughts from Omeed

Founders who understand their financing instruments, avoid toxic clauses, comply with SEC rules, and work with the right legal partners save themselves years of pain later.

If you’d like to dive deeper, connect with me on LinkedIn and ask for my Fundraising Guide - it walks through everything we covered today, with negotiation tips and practical templates.

Good luck with your fundraising. Go out there and build something great.