Fabio Mondini de Focatiis is the founding partner of Growth Capital , a tech-focused investment bank active across Italy, Spain, and the UK. After nearly a decade at one of Europe’s largest investment platforms, where he worked on hundreds of investments and exits, he now advises founders on growth-stage fundraising and M&A. In this post, Fabio breaks down what it really takes to raise a Series A in Italy and Spain, separating market realities from common myths.

Table of Contents

Watch the recording

How do Italy and Spain compare to other European markets at Series A stage?

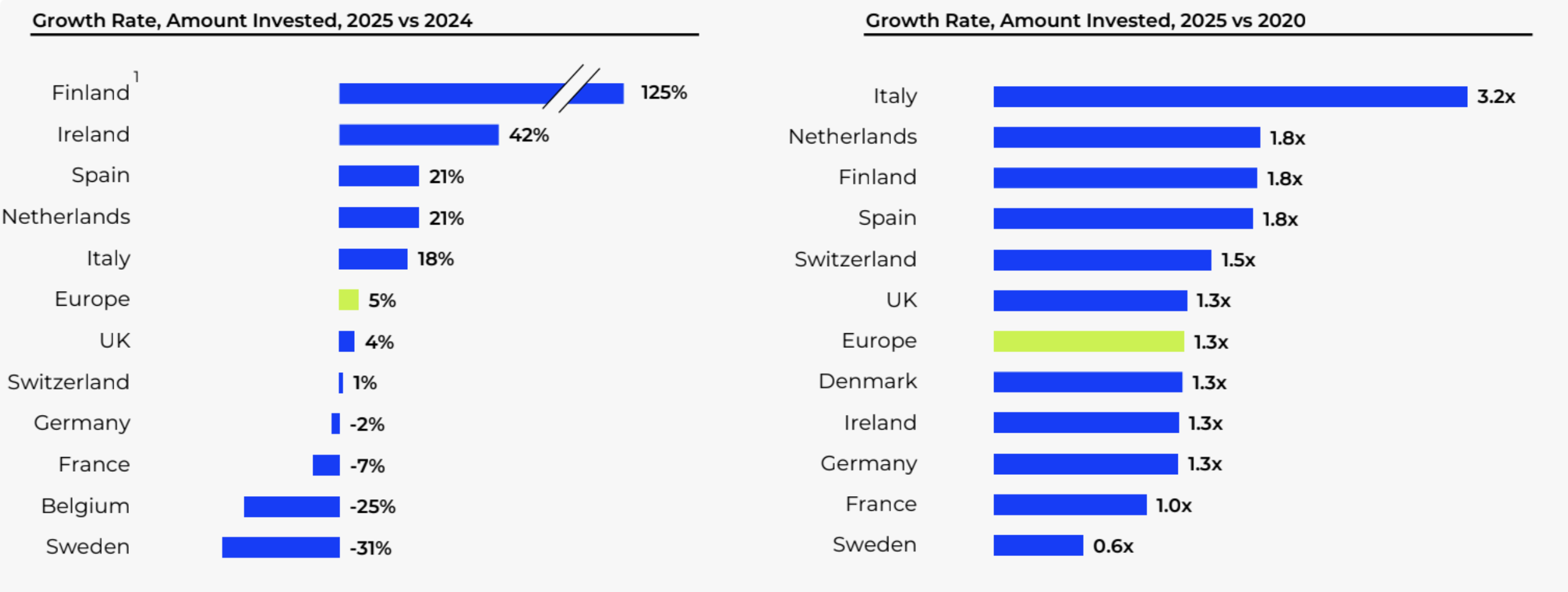

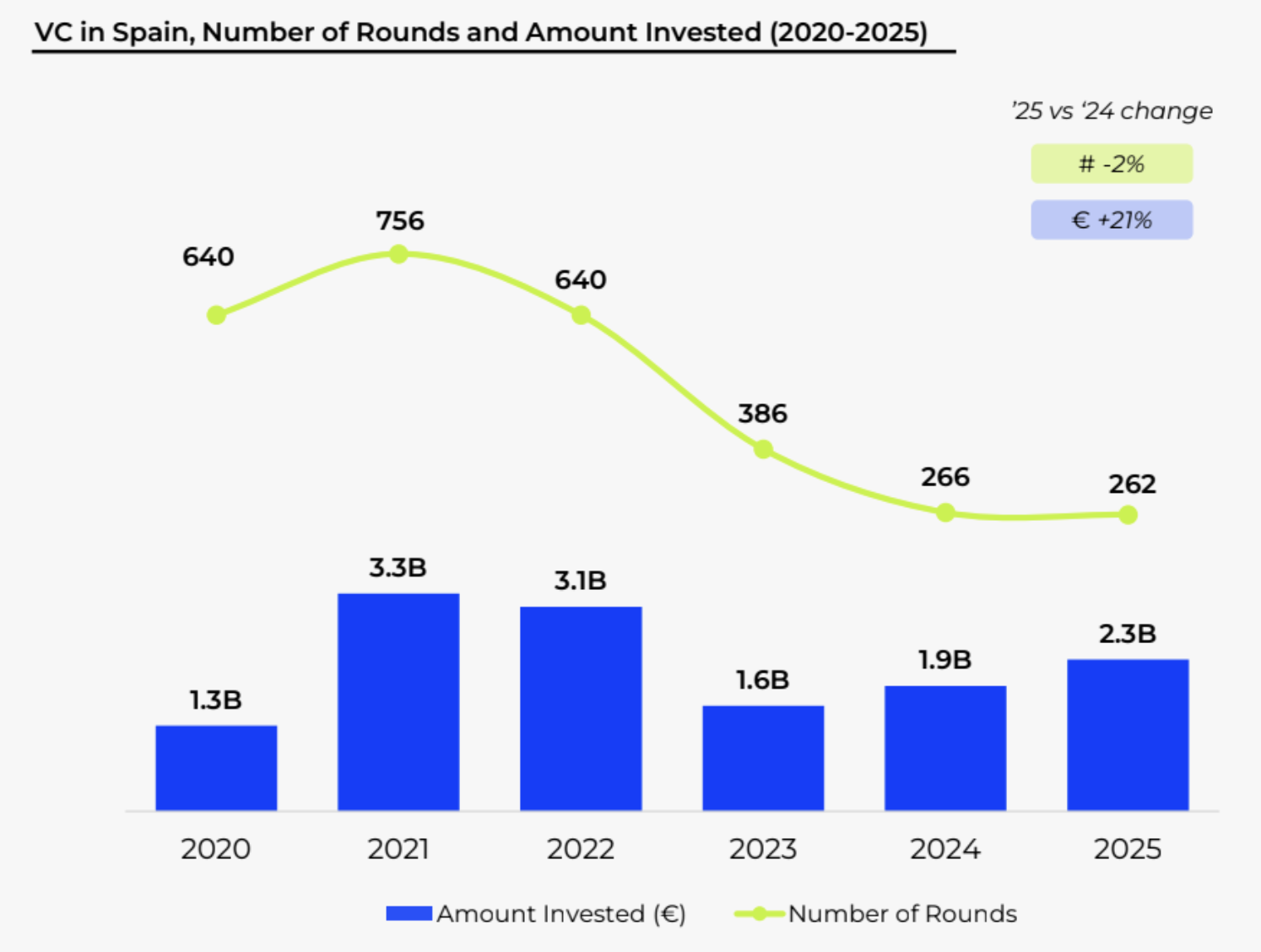

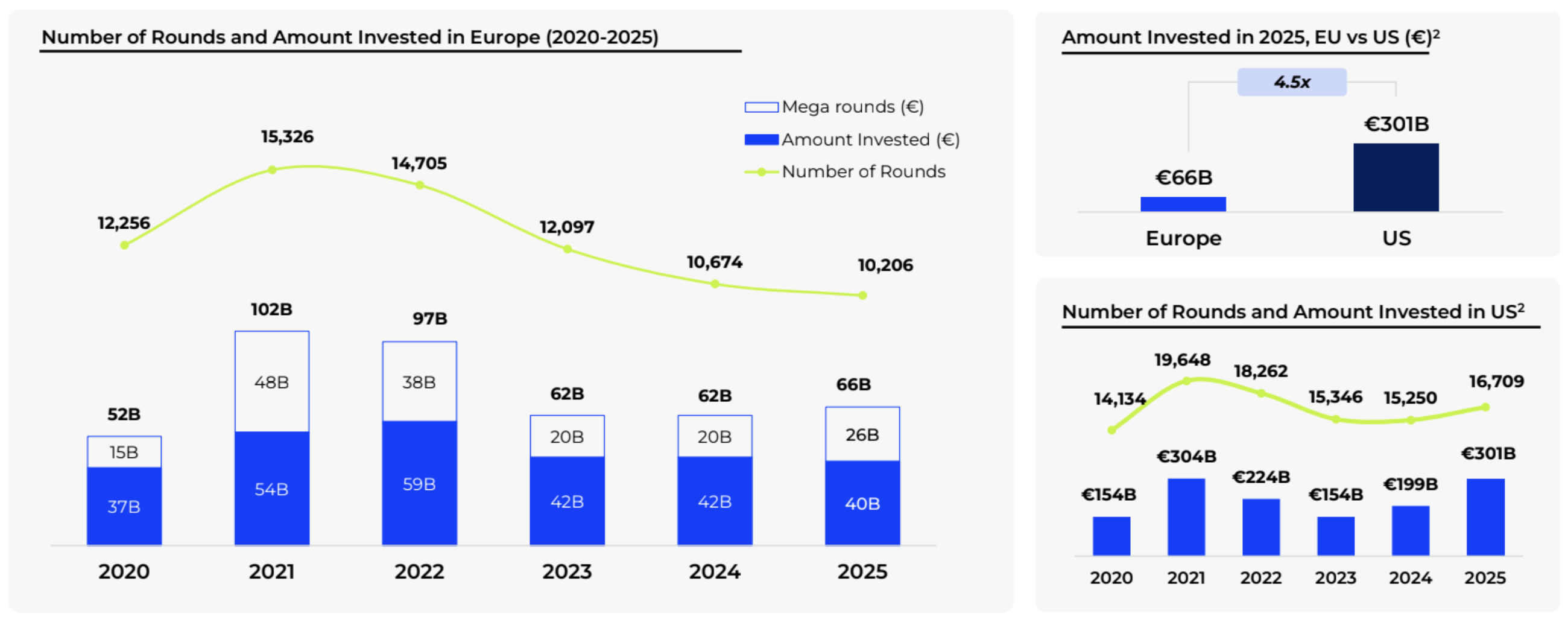

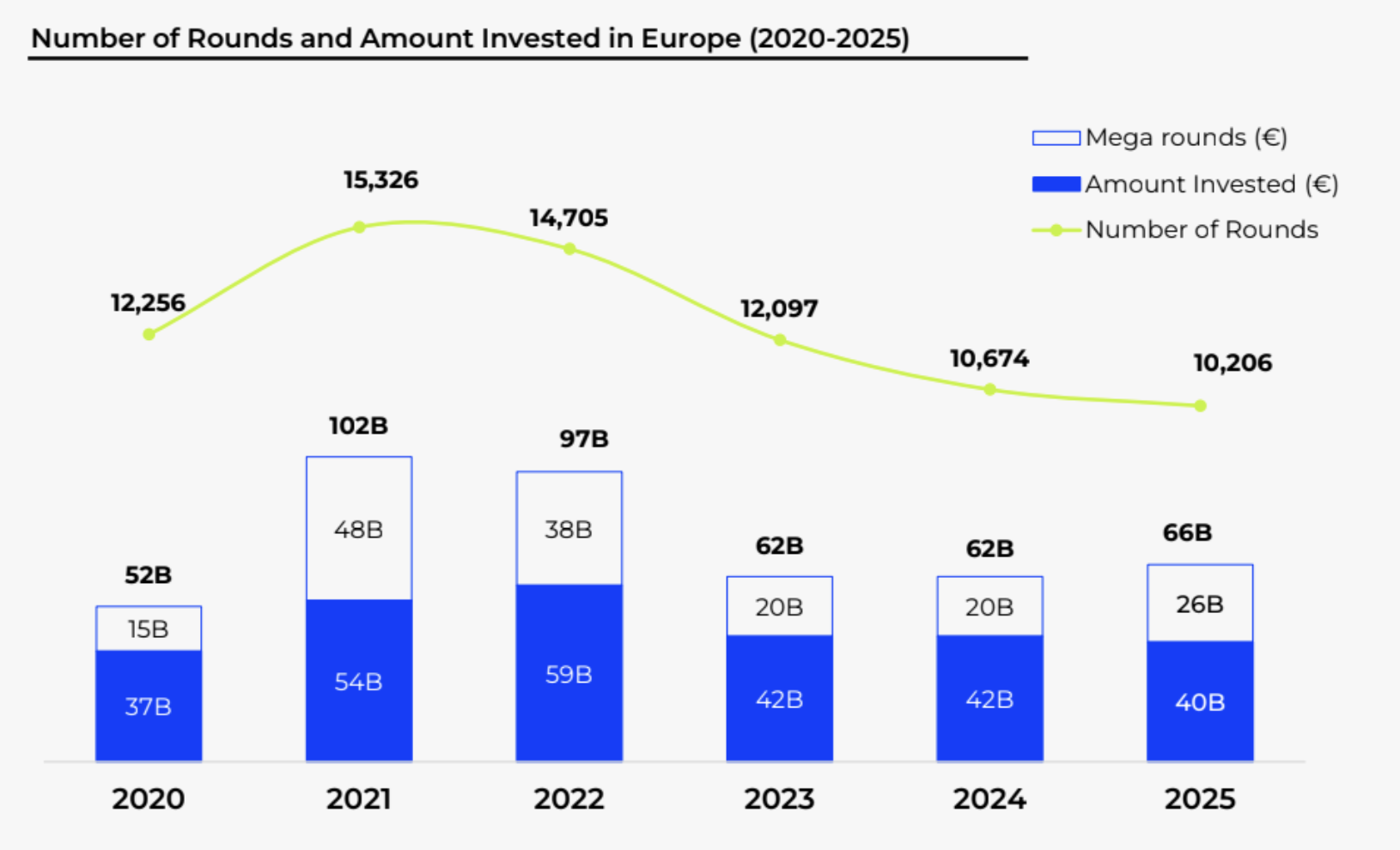

Italy and Spain are structurally different from more mature ecosystems like the UK, France, or Germany. They are younger markets, with smaller average rounds, but they are also among the fastest growing in Europe.

Over the past five years, total VC investment in Europe grew by roughly 30 percent. Over the same period, Italy grew by more than 300 percent and Spain grew by around 80 percent.

Italy is also unusual in that the number of rounds continues to grow year over year, while more mature ecosystems are seeing flat or declining deal counts.

For investors, this means companies may appear smaller or cheaper, but often offer more upside due to lower saturation and stronger growth dynamics.

Why are Series A rounds smaller in Italy and Spain?

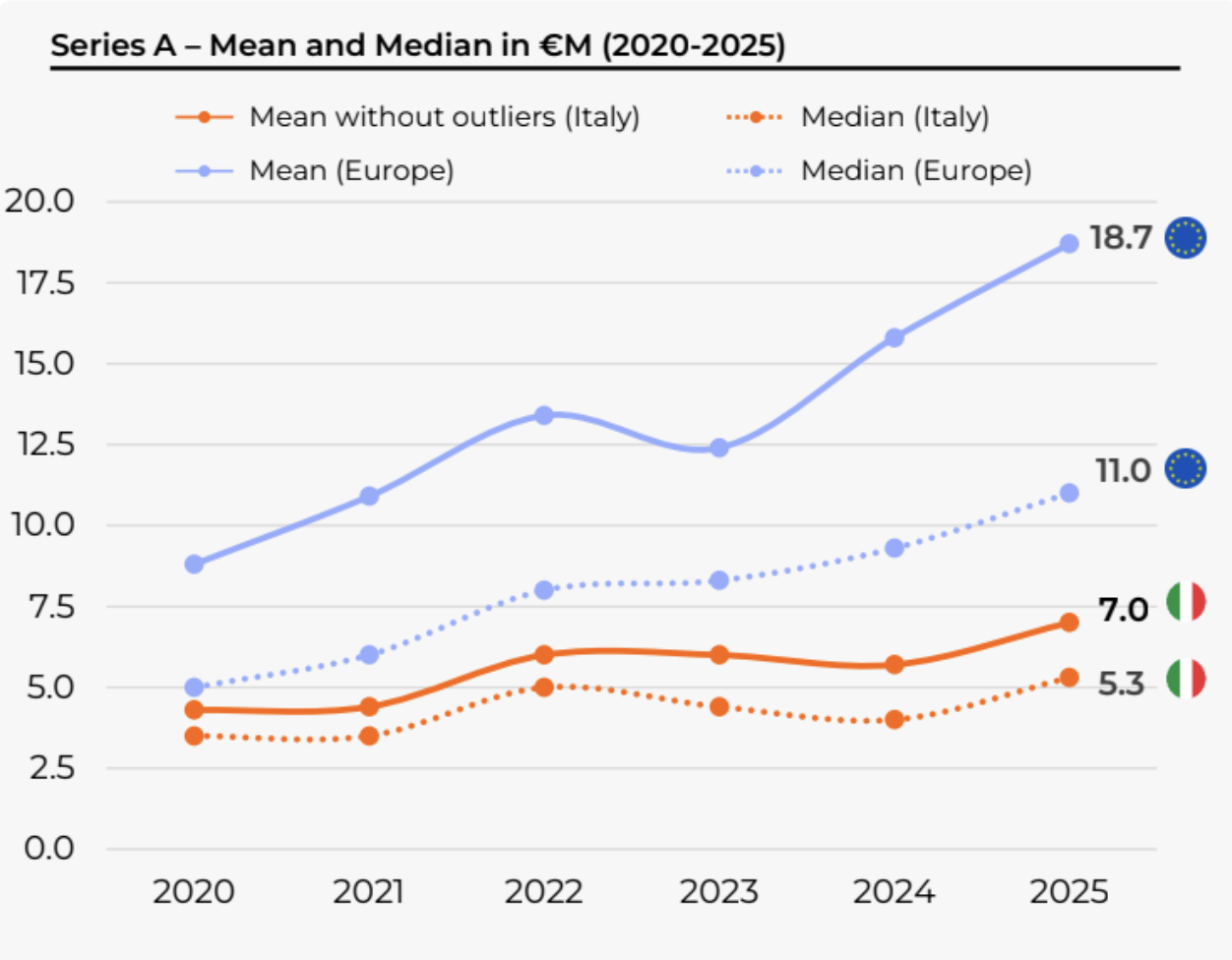

The main driver is fund size. In Italy, the average round size is about half the European average, and there are very few large venture funds. Only one fund manages more than €250M, and only a handful exceed €100M. Spain is slightly ahead, but still far behind markets like the UK or France.

This structure has direct consequences:

- Local funds cannot write €20M–€30M checks

- Nearly all rounds above €50M involve international investors

- Even rounds above €25M usually include foreign capital

As a result, €100M+ Series A rounds are effectively nonexistent in both countries.

What does “Series A ready” actually mean in Italy and Spain?

The core logic of Series A is similar across Europe, but expectations from Italian VCs and Spanish VCs are calibrated to smaller markets and more conservative valuations.

Typical benchmarks vary by business model:

- SaaS companies generally need around €1M in ARR

- Marketplaces are evaluated on GMV and liquidity , often requiring several million euros in transaction volume

- Deep tech companies must show proof of concept and early market validation , even without revenue

- Biotech and medtech startups are judged on scientific and regulatory milestones , such as clinical trial progress

The bar is not lower, but the absolute numbers are.

What is truly non-negotiable at Series A, and what tends to be overkill?

What investors ultimately care about is credible, capital-efficient growth. European investors, particularly in Italy and Spain, have long emphasized discipline, and that mindset remains intact.

Founders need to show three things: growth that clearly outpaces competitors, responsible use of capital, and a strong, complete founding team

Overkill typically shows up as excessive storytelling, over-engineered financial models, or decks optimized to perfection without corresponding traction.

How do funding dynamics differ from the US?

Some companies that raise easily in the US struggle in Italy or Spain. Capital-intensive businesses with valuations disconnected from current KPIs are a typical example. In the US, it is sometimes possible to raise significant capital based largely on narrative or pedigree. In Southern Europe, this is extremely rare unless the founder has an exceptional track record.

At the same time, certain sectors perform surprisingly well locally:

- Deep tech and industrial innovation in Italy, supported by a strong manufacturing base

- Biotech and medtech with credible scientific foundations

- Spanish startups with business models that scale naturally into Latin America

Understanding these local strengths can significantly improve fundraising outcomes.

Who leads Series A rounds, and when do international investors get involved?

In Spain, Series A rounds are usually led by local generalist funds. International investors at this stage are relatively uncommon, largely because small round sizes make cross-border investments less attractive.

Italy shows a slightly different pattern. Sector-focused funds are more common, and while local investors can lead Series A rounds, international funds typically join at later stages.

Pan-European, French, German, or UK funds usually engage once companies demonstrate meaningful international traction, with a growing share of revenue outside the home market and a round size that justifies cross-border attention.

What do Series A round sizes, ownership, and timelines look like today?

Definitions have evolved in recent years. A €1M round was once considered a Series A in Italy, but that is no longer the case. Today, Series A typically starts around €2–3M , moving closer to European norms.

Investors typically target 20–25 percent ownership.

Founders should expect 7–10 months from first meeting to closing The process usually involves multiple meetings, extended due diligence, and a gradual close

Planning for a long timeline is essential to avoid damaging execution.

How much do grants and public funding really matter?

Public funding can help extend the runway, but it rarely changes Series A fundamentals. Italy focuses heavily on tech transfer and vertical accelerators, while Spain emphasizes regional development and R&D-linked incentives.

Compared to the UK or France, incentives are less generous, and investors still prioritize traction, growth, and execution over public support.

How should founders handle stalled momentum during a raise?

When momentum slows, founders should first try to understand why. If there is a warm introducer, that person can often provide honest feedback. Without one, it is usually worth asking directly.

If the process is truly stuck, restarting with a refined pitch and a better-targeted investor list is often more effective than pushing forward without traction.

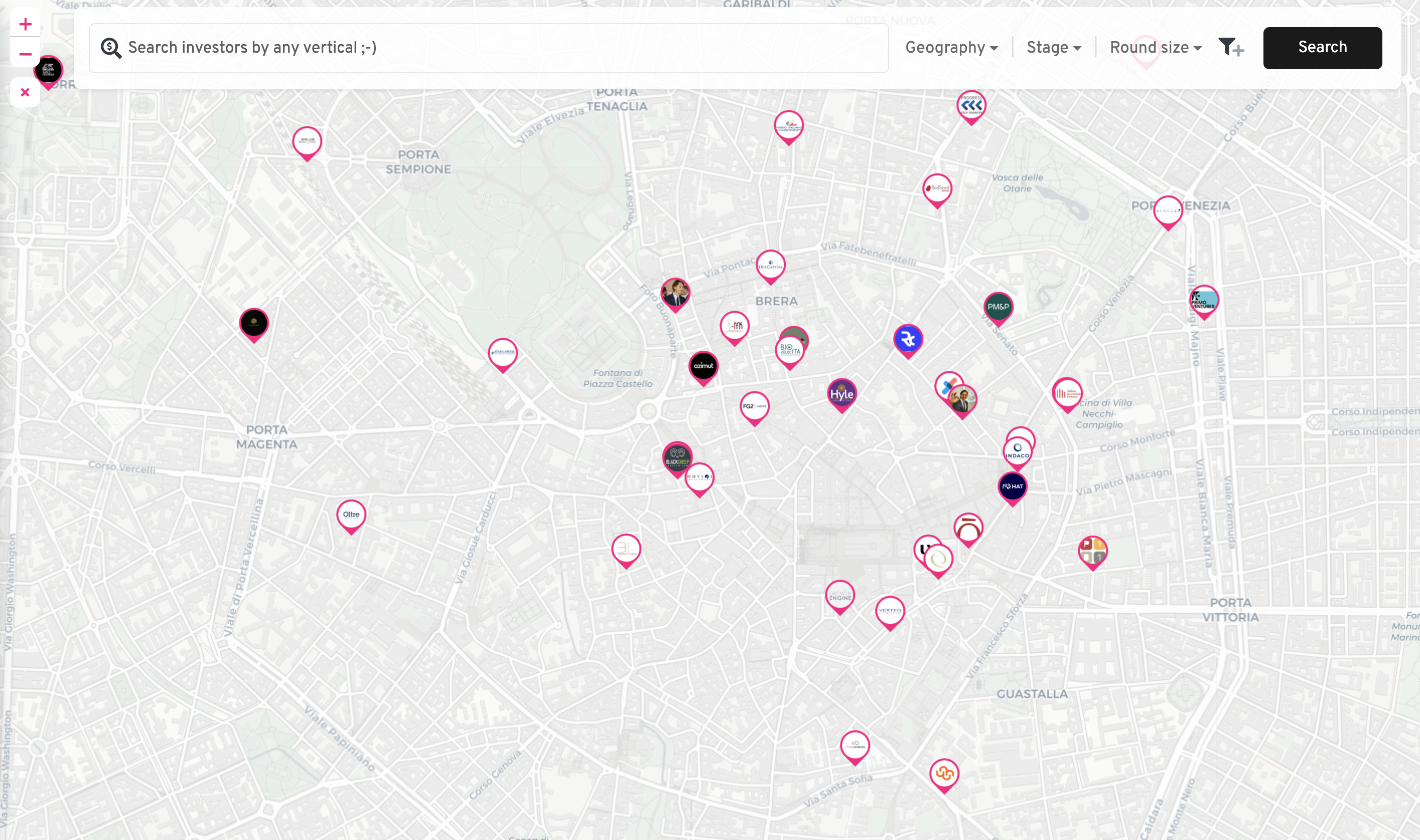

Milan has the highest concentration of VC firms in Italy

Should founders use fundraising advisors at Series A?

There is no universal answer.

Advisors can be extremely helpful when the investor pool is large and international, or when fundraising would otherwise consume too much founder time.

They are less necessary when the company operates in a narrow vertical with a short, well-defined investor list. The key question is whether using a fundraising advisor improves focus and execution during a critical growth phase.

Final thoughts from Fabio

Fundraising is not the goal, building a great company is.

Series A works best when it follows real progress, clear focus, and disciplined execution, not when it tries to compensate for their absence. Founders who understand their market, prepare properly, and respect the process dramatically increase their chances of raising the right round with the right partners.

About the author

Fabio Mondini de Focatiis is the founding partner of Growth Capital , a tech-focused investment bank active across Italy, Spain, and the UK. After nearly a decade at one of Europe’s largest investment platforms, where he worked on hundreds of investments and exits, he now advises founders on growth-stage fundraising and M&A. I