This is the fourth post in my series of clickbaity-posts-with-an-actual-message. You can read the others here: VCs aren't your friends , Venture capital isn't for the poor , and 15 ways to scam a founder raising funds .

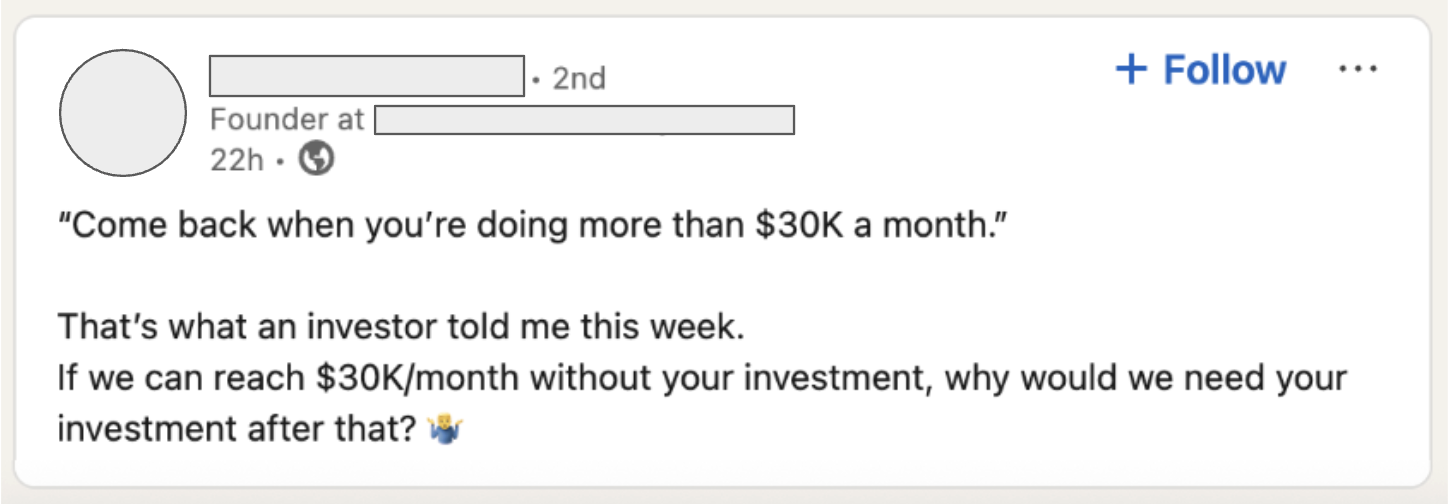

Yesterday, I came across this LinkedIn post.

Many founders think the same way:

“Why do investors want to see revenue? Aren't they supposed to bet on the team, take risks, and fund innovation?”

This is usually followed by:

“Anyway, when I'm at $30k/month, I won't even need them, so they are dumb.”

Are they dumb, though?

Today, I will play the devil's advocate and break down the 6 reasons why investors are, in fact, right to tell you this.

Table of Contents

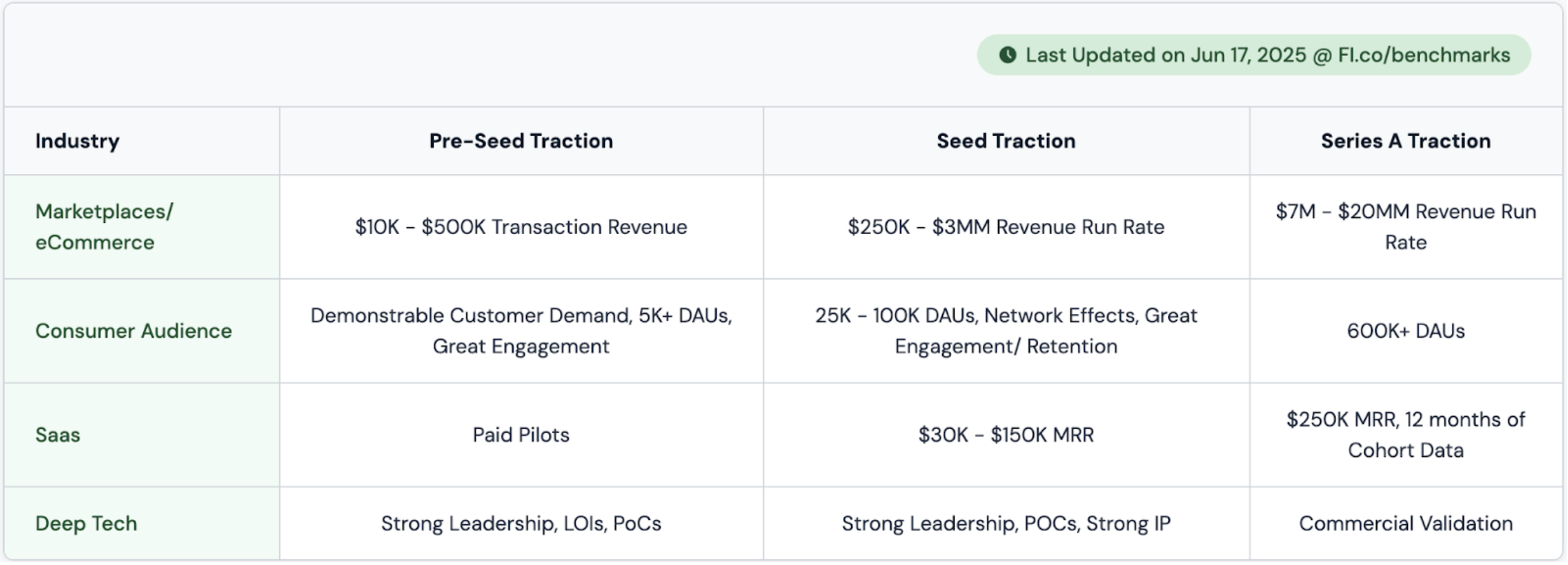

Reason #1: You are confused about stages

The first reason is trivial.

Investors specialize by stage. If you're raising a seed round, you should speak to seed investors.

“I have a team and a MVP, so I'm raising seed, right?”

Wrong.

A typical seed startup shows $250k+ in monthly GMV (for a marketplace) or $30k+ in MRR (for a SaaS).

Sounds obvious, yet many founders fumble with funding stages.

Reason #2: You fall for VC marketing

What if the investor says “We want to be the first check in”? Don't they mean they invest pre-revenue?

Unfortunately not. In many cases, it's just PR puffery.

Investors like saying they invest super early. It sounds cool. It's also a good way for them to fill their CRM with decks and show their LPs that they have access to many deals.

By the way, it's the same with “We are responsible investors", "We back outliers" and the oh-so-famous "Let me know how I can be helpful".

It's all VC marketing. Don't fall for it.

Reason #3: Your team doesn't have enough track record

“But founder X raised from that same investor with just a pitch deck!”

Sure, but look at the founder: Wharton MBA, serial entrepreneur, 2 previous exits.

There is a nuance first-time founders fail to grasp. Yes, VCs will invest at the idea stage… in a proven founder with a strong track record.

You've got to read between the lines.

Actually, team and traction are the two variables of your fundability:

- A team of nobodies with strong traction will raise

- A team of exited founders with just an idea will also raise.

When an investor says your revenue is too low, they are also saying that your team is not “proven enough" to compensate for that relatively weaker traction.

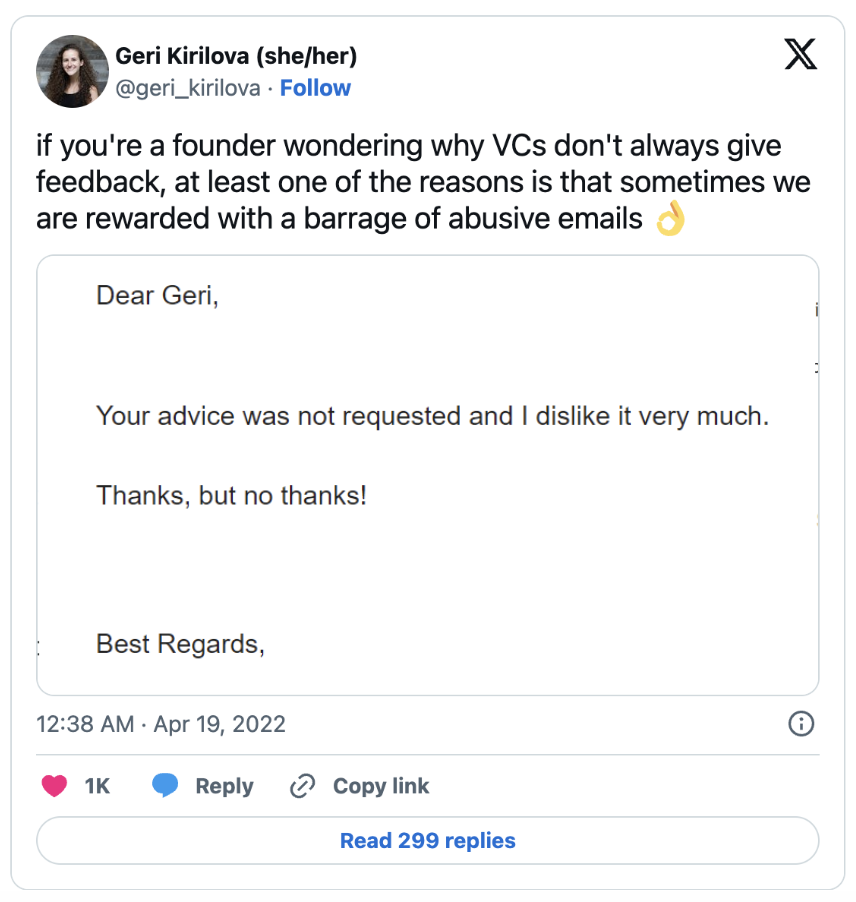

Reason #4: You are being given a polite pass

Some founders take it poorly when they get rejected.

They become passive-aggressive, or even just outright aggressive.

For that reason, investors often don't give a clear “no”.

Instead, they tell you to “come back when you're doing $30k a month” or any other excuse that softens the blow.

It's the VC equivalent of saying “it's not you, it's me”.

Reason #5: The others are building more

It's never been easier to build.

You incorporate with Stripe Atlas, build a MVP with Replit, host your data on AWS, accept payments with Stripe, reach clients with Google Ads, hire freelancers on Upwork, get advice from ChatGPT, and find investors on OpenVC.

Not so long ago, you had to raise $100k to buy servers, put them in your garage, and then start building. Today, you can build, sell, and hit PMF in weeks, if you know what you're doing.

The bar to build is very low. Therefore, the bar to raise is very high.

Investors expect to see revenue earlier, because well... everyone else is doing more with less.

Keep in mind that fundraising is a zero-sum game: you must be the best (perceived) deal amongst 500 others that an investor will see in a span of ~6 months.

If you can't get to $30k a month, but someone else can, the check will go to them over you.

Reason #6: You're ignorant or delusional

Let's look at the second part of the statement:

“If we can reach $30k/month without your investment, why would we need your investment?”

From a VC perspective, that's wrongthink.

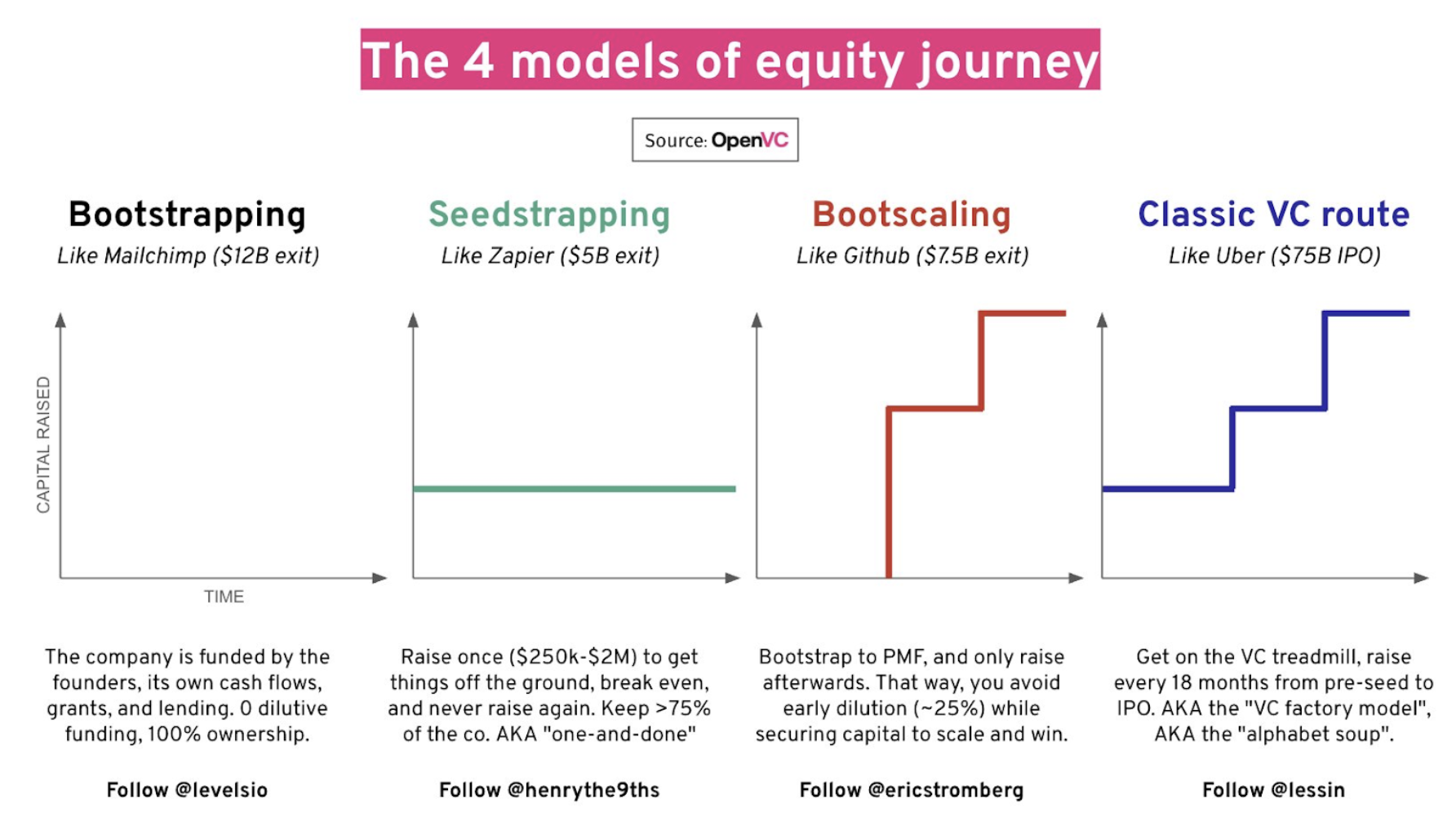

If you raise VC money, you're expected to grow to $100M+ in annual revenue within 7 to 10 years. To do that, you are expected to raise more. Actually, you're expected to raise multiple times long after you hit $30k a month.

Series A, Series B, Series C, Series D… Once you're on the VC treadmill, you raise until you exit or die.

- If you didn't know that, then you're poorly informed. You should probably learn more about venture capital before chasing investors, lest you pass for ignorant.

- If you knew that, then you're claiming you can sustain hypergrowth on your own cash flows. Maybe you can (see seedstrapping below). But most investors won't buy it and will regard you as delusional.

Either way, don't just shout “I won't raise past $30k/month”. You're sending a negative signal for your current raise.

Conclusion: Who *really* needs early-stage funding?

The last point calls for a broader conversation.

If one can truly bootstrap to $30k a month, is there still a need for pre-revenue investors?

Well, there are some products you can't vibecode.

Biotech, hardware, blockchain, paytech, medtech… All these categories require massive upfront investments before you can even ship a MVP.

“Come back when you're doing $30k a month” doesn't apply to hardtech.

But for vanilla software… one may wonder.

Find ideal VCs for your startup today 🚀