The U.S. startup landscape has shifted more in the past five years than in the decade before it.

Talent is more distributed, capital is more selective, and founders are no longer defaulting to the same two ZIP codes. In 2026, deciding where to build matters just as much as deciding what to build, and geography can either accelerate your company or quietly slow it down. We wanted to cut through the noise, look past hype cycles, and evaluate the best startup cities based on what founders actually need to succeed today.

Are you ready? Let's dive in!

Our methodology to rank startup cities

We created this ranking to give founders a clearer, more realistic view of the best U.S. cities to build a startup in 2026. Our approach is simple: evaluate each city across the five factors that matter most to early-stage teams, score them on a 1–10 scale, and combine those scores into a total out of 50. This provides us with a structured way to compare ecosystems without pretending that any ranking can capture every nuance.

Our scale measures five core dimensions of a startup hub:

1. Funding Environment : The availability of active investors, round leadership, angel participation, and overall capital velocity.

2. Affordability : Cost of living, housing, salaries, and office costs that directly affect a startup’s burn.

3. Ecosystem & Support : Density of founders, accelerators, universities, industry clusters, mentors, and corporate adjacency.

4. Talent Pool : Access to engineering, product, design, GTM, and operational talent, plus retention and experience levels.

5. Quality of Life : Lifestyle, weather, transportation, culture, and day-to-day livability factors that impact you, your team’s performance, and retention.

We then combine the five category scores to produce a total score out of 50. It’s not meant to be a perfect or definitive ranking—no single list can decide where your company should be built. The right city depends on your industry, stage, team structure, and goals. Our goal is simply to offer a grounded, founder-focused overview of the top hubs and help you identify which environments might support your startup best.

We also made one important choice: we excluded Silicon Valley and New York City. These two ecosystems are in a league of their own in terms of capital, density, and global reach. Every founder already knows they’re the top two hubs by a wide margin, so including them would overshadow the nuance of what’s happening across the rest of the country.

Instead, we wanted to highlight the cities where founders actually have meaningful decisions to make, and where the next decade of U.S. startup growth is truly up for grabs.

#1. Boston, MA — 43/50

Boston is the closest thing the U.S. has to a third mega-hub after SF and NYC. It’s a city built on research, complexity, and long-term thinking, making it one of the most reliable places for founders who want to tap into technical depth and networking.

Highlights

- The undisputed biotech hub of the United States

- MIT and Harvard foster technical founders and cutting-edge research

- Local investors regularly lead early-stage rounds (rare outside SF/NYC)

- High concentration of second-time founders, scientific operators, and experienced advisors

Scores

Funding Environment — 10/10

Affordability — 6/10

Ecosystem Strength — 10/10

Talent Pool — 10/10

Quality of Life — 7/10

Total — 43/50

Why Boston is One of the Best Startup Cities

Boston’s funding landscape is one of the most sophisticated in the country, with local firms routinely leading seed and Series A rounds —especially in biotech, deep tech, and robotics. Investors here are patient, thesis-driven, and unusually comfortable underwriting multi-year R&D cycles, regulatory timelines, and scientific risk. The concentration of MIT, Harvard, and the Longwood Medical Area creates a continuous pipeline of technical founders and high-conviction research spinouts. You can browse the Boston Investor List to see the funds and angels most active in the region.

The talent ecosystem is equally deep. Boston is one of the few places where early-stage teams can hire ML researchers, robotics engineers, and domain-specific operators with decades of experience in biotech or regulated industries. Consumer GTM talent isn’t as concentrated here as in LA, but for scientific or defensible products, Boston is as good as it gets.

Founders trade affordability for density. Housing and office space are expensive, salaries trend coastal, and winters are unforgiving. But Boston compensates with walkable neighborhoods, a strong cultural scene, great food, and easy access to beaches and mountains across New England. The city’s long-term founder base creates a flywheel of mentorship and support that few ecosystems can replicate.

#2. Los Angeles, CA — 39/50

LA has quietly evolved into a full-scale, top-tier startup ecosystem with real funding depth, breakout companies, and a talent mix you won’t find anywhere else. It’s the rare city where creativity, engineering, and brand collide — a structural advantage few ecosystems can match.

Highlights

- Leading hub for AI, entertainment tech, gaming, climate, and consumer

- Operator pipeline from Snap, Riot Games, SpaceX, ZipRecruiter, Ring, and Hulu

- One of the best climates in the United States

- Quick access to Silicon Valley (about a 1-hour flight)

Scores

Funding Environment — 9/10

Affordability — 4/10

Ecosystem Strength — 8/10

Talent Pool — 9/10

Quality of Life — 9/10

Total — 39/50

What Makes LA a Strong Hub for Startups?

Los Angeles’ early-stage funding scene is far more active than many founders realize. Local LA venture firms and angels lead meaningful seed rounds across AI, gaming, creator economy, climate tech, and consumer — with a uniquely strong operator-driven network behind them. The ecosystem’s diversity is its power: entertainment, media, mobility, AI, gaming, and Web3 all live in the same orbit, supported by incubators, studios, and operator communities that have exploded post-pandemic.

LA’s talent market is equally distinct. Engineers often come from companies where product feel and user experience matter as much as technical execution. Operators skew toward storytelling and distribution — skills that give early teams a sharper edge in consumer-facing categories. Founders also hire far beyond LA County, often pulling talent from Santa Barbara to San Diego to build hybrid, Southern California–wide teams.

Of course, LA’s strengths come with tradeoffs: high cost of living, a fractured geography, and brutal traffic. You pay for the lifestyle — but for many founders, the weather, creative energy, and cross-disciplinary talent make the trade worthwhile.

#3. Seattle, WA — 38/50

Seattle has quietly become one of the best cities for startups in the entire world thanks to its technologically advanced ecosystem. It’s a city shaped by decades of engineering culture from Amazon, Microsoft, and the region’s deep research institutions. Now, the rise of AI is rapidly accelerating growth across the Pacific Northwest.

Highlights

- One of the strongest engineering and AI talent pools in the U.S.

- Home to tech giants like Amazon, Microsoft, Allen Institute for AI, and dozens of AI labs

- Highly active angel ecosystem led by senior operators and alumni from Seattle’s tech giants

- Exceptional depth in B2B SaaS, cloud, AI infrastructure, and dev tools

Scores

Funding Environment — 9/10

Affordability — 5/10

Ecosystem Strength — 9/10

Talent Pool — 8/10

Quality of Life — 7/10

Total — 38/50

What Makes Seattle One of the Top Tech Hubs

Seattle’s funding environment is quieter than SF or LA, but significantly more sophisticated than outsiders realize. Local firms regularly lead early-stage rounds in AI, infrastructure, and enterprise SaaS, and the city’s operator-angel community is one of the best in the country. Many seed rounds in Seattle are powered by ex-Amazon and ex-Microsoft leaders who deeply understand scaling, cloud architectures, and technical moats.

But Seattle’s strongest asset is its talent. Decades of Amazon and Microsoft dominance have produced one of the densest engineering and ML talent markets anywhere. Founders routinely recruit from the AI2 Institute, the UW computer science ecosystem, and teams working on cutting-edge cloud and LLM research. This is one of the few U.S. markets where you can build a technical founding team without competing with Bay Area salaries at every turn.

The cons are affordability and weather. Seattle is cheaper than SF, but still costly, and the gray, rainy climate isn’t for everyone. For founders who prioritize engineering depth, technical rigor, and access to serious operators, Seattle is a top tech startup hub to consider.

#4. Austin, TX — 37/50

Austin has been one of the fastest-growing startup ecosystems of the past decade, with founders and operators pouring in from across the country. Even after the post-pandemic correction, the city continues to attract billions in early-stage funding each year and remains a magnet for builders who want momentum, community, and room to operate outside coastal pressure.

Highlights

- Substantial early-stage tech community

- Deep engineering base from Dell, Apple, Tesla, Oracle, Google, and Meta

- High density of AI, dev tools, fintech, and climate founders

- One of the fastest-growing hubs in the world this decade

Scores

Funding Environment — 8/10

Affordability — 6/10

Ecosystem Strength — 8/10

Talent Pool — 7/10

Quality of Life — 8/10

Total — 37/50

Why Founders Choose Austin as a Startup Hub

Austin didn’t become a startup city because of one industry or employer. Entrepreneurial activity rose when thousands of ambitious people decided they wanted to build somewhere that felt lighter and more accessible than SF or NYC. The hype era of 2021 brought its own chaos, but the correction clarified what actually makes Austin work: a tight-knit community, constant founder movement, and an ecosystem where it’s easy to meet collaborators without gatekeepers in the way. You’ll find AI and dev tools teams spun out of Google or Apple working next to fintech and climate founders who moved here specifically for Austin’s pace and culture.

The city has a strong and growing early-stage funding scene, powered by a mix of new funds, operator-angel activity, and the continued presence of Big Tech. OpenVC’s Austin Investor List has grown to include nearly 100 funds, angels, PE firms, and more.

What sets Austin apart is its energy. Meetups happen nightly. Coworking spaces feel alive. Transplants form communities quickly. There’s a sense of shared ambition that makes it easier to push through the grind of the early days.

Unfortunately, Austin hasn’t stayed cheap. There are rising costs, but being in Texas still offers far better burn efficiency than coastal hubs, alongside a lifestyle that keeps founders grounded and motivated.

#5. Miami, FL — 37/50

Miami is the rare U.S. city that reinvented itself in real time. What started as a pandemic-era migration wave turned into a durable ecosystem with real founder density, active capital, and one of the most diverse talent markets in the country.

Highlights

- One of the fastest-growing startup hubs in the U.S. post-2020

- Strong presence across fintech, AI, crypto, and healthtech

- Massive inflow of founders and operators from New York, SF, and Latin America

- Deep culture of hustle, speed, and cross-border business

Scores

Funding Environment — 8/10

Affordability — 6/10

Ecosystem Strength — 8/10

Talent Pool — 7/10

Quality of Life — 8/10

Total — 37/50

What Makes Miami a Best Startup City

Miami became a landing pad for founders leaving New York, operators relocating from SF, and Latin American entrepreneurs looking for a U.S. base that felt culturally aligned.

Early-stage funding is active and more diverse than outsiders assume. Miami’s top investors include institutional funds, family offices deploying real checks, and one of the strongest angel communities in the country. Speed matters here. Deals move quickly, networks form fast, and founders who know how to operate without bureaucracy tend to thrive.

Miami’s talent pool reflects its identity. The city excels in sales, product, and generalist operator roles; engineering is available but often blends local talent with remote and LATAM-based teams. That hybrid style is a part of Miami’s playbook. Many of the city’s top tech startups run distributed teams anchored by Miami-based leadership.

Then there’s the lifestyle. Sunshine, ocean, culture, diversity, and a level of energy most cities can’t match. Miami is fun, alive, and motivating, and at times, chaotic. Founders who need structure above all else may feel off-balance here. Founders who thrive on ambition, instinct, and velocity often feel right at home.

If you want to learn more about the city’s venture ecosystem, check out our OpenVC Guide to Miami.

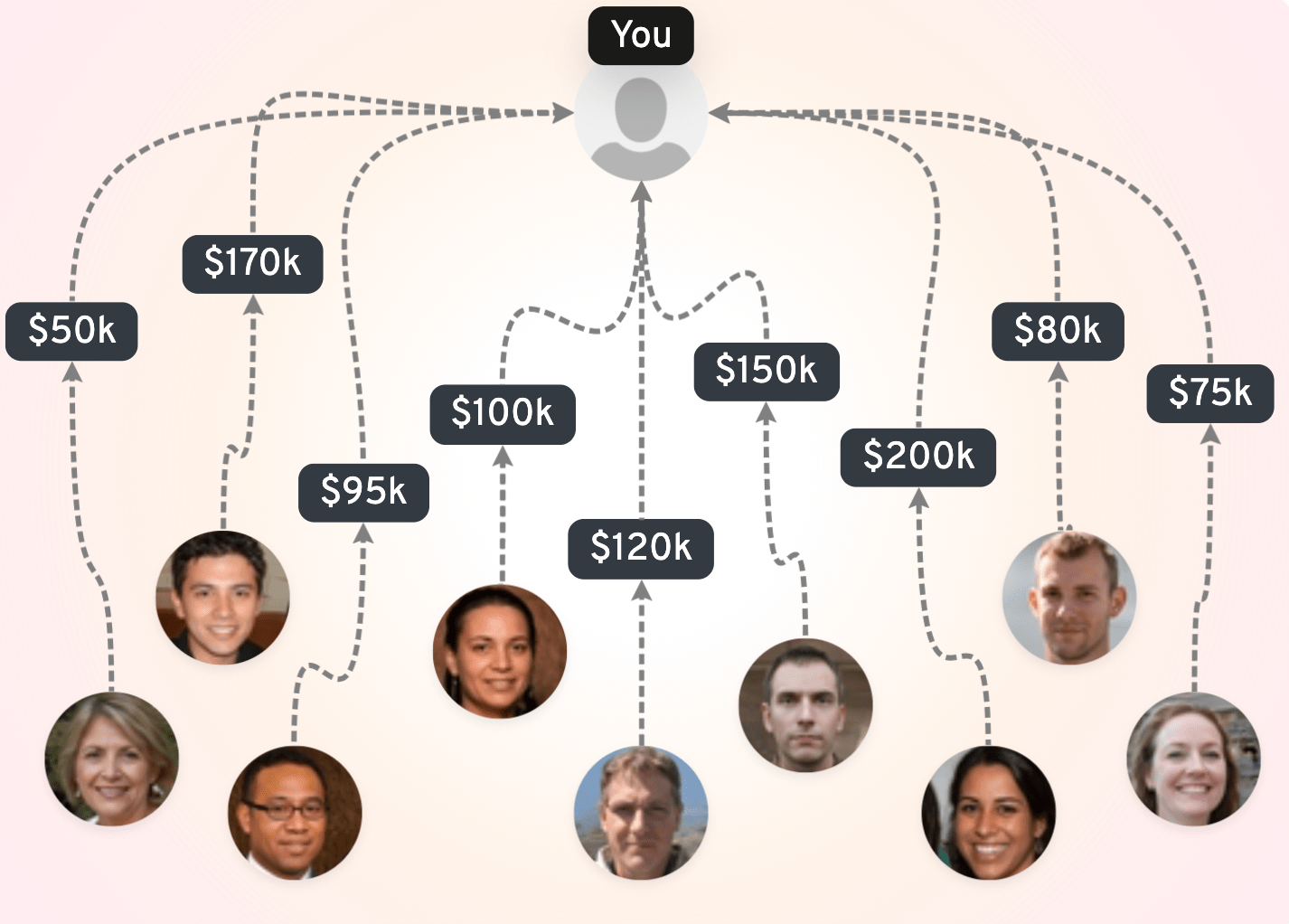

Find your ideal investors now 🚀

Browse 10,000+ investors, share your pitch deck, and manage replies - all for free.

Get Started

#6. Chicago, IL — 37/50

Chicago doesn’t market itself as a startup city, but it operates like one. It’s one of the strongest B2B and fintech ecosystems in the country, shaped by decades of industry depth across finance, logistics, healthcare, manufacturing, and food systems. For founders building real businesses with real customers, Chicago is one of the most underrated places to build in the United States.

Highlights

- One of the strongest B2B, fintech, logistics, and healthcare ecosystems in the U.S.

- Home to major incumbents (CME Group, Cargill, McDonald’s, Boeing, Walgreens, AbbVie) that actually partner with startups

- Dense bench of operators from Braintree, Grubhub, Groupon, Relativity, Cameo, G2, and Tempus

- Highly active pre-seed and seed landscape

Scores

Funding Environment — 8/10

Affordability — 7/10

Ecosystem Strength — 8/10

Talent Pool — 7/10

Quality of Life — 7/10

Total — 37/50

What Makes Chicago a Top Startup Hub

Chicago’s value proposition is simple: if you’re building a company that sells to businesses (especially in fintech, logistics, healthcare, or enterprise SaaS), Chicago gives you ample customers, talent, and operators. This is one of the few markets where early-stage founders regularly get pilots with Fortune 500 companies because the companies are headquartered here, and the relationships are accessible.

Funding in Chicago is more disciplined and less momentum-driven than on the coasts. Rounds don’t inflate on narrative alone. But when founders have traction, the city’s funds move fast, bring real operational guidance, and often lead rounds instead of waiting for SF validation. Chicago’s angel community is stronger than people realize, too, especially among fintech and logistics operators. On OpenVC, our database now includes over 130 investors based in Chicago.

Chicago has everything a major city has to offer: food, sports, universities, staple events, and so much more. If you are already in the Midwest, it’s a no-brainer to at least consider Chicago as your startup’s home.

Chicago’s weaknesses are real: winters are brutal, and hiring top-tier ML talent can require looking outside the city. The ecosystem is growing (not explosive), and founders who need constant “tech scene buzz” may not find it. But for practical founders building durable companies, Chicago is certainly one of the most structurally underrated markets in America.

#7. Denver, CO — 36/50

Denver’s appeal starts with something simple: it’s an easy place to live well. The city blends outdoor access, a steady influx of young professionals, and a growing tech presence that has quietly become one of the strongest in the Mountain West. It’s big enough to have range but small enough that people still feel connected to the community.

Highlights

- Strong talent pipeline shaped by Colorado’s highly educated workforce

- Cluster of high-quality startups across SaaS, fintech, climate, and outdoor/active lifestyle tech

- Easy hiring from Boulder, Fort Collins, and Colorado Springs

- Exceptional quality of life with year-round outdoor access

Scores

Funding Environment — 7/10

Affordability — 7/10

Ecosystem Strength — 7/10

Talent Pool — 7/10

Quality of Life — 8/10

Total — 36/50

What Makes Denver Stand Out to Startups

Denver is one of the most educated cities in the country, with more than half the population holding a bachelor’s degree or higher. That translates into a talent market shaped by people who are analytical, outdoorsy, and used to balancing work with lifestyle. Many of the city’s strongest operators come from companies like Gusto, Ibotta, SonderMind, Guild, and HomeAdvisor.

The broader Front Range corridor adds another layer of depth. Boulder brings university research and engineering talent. Fort Collins adds hardware and energy expertise. Colorado Springs provides access to defense and cybersecurity operators. Hiring across these cities is common and gives Denver more range than its population alone suggests.

Denver’s tech ecosystem isn’t the loudest, but it’s pretty consistent. Pre-seed and seed rounds get done, often backed by local funds and a growing angel network. Climate tech, outdoor tech, and SaaS have especially strong traction here, helped by proximity to national labs, energy companies, and a community that truly understands sustainability and the outdoors. Denver investors move steadily, not chaotically—which founders either appreciate or move on from.

On the lifestyle side, Denver’s strengths are obvious: four seasons, mountains within an hour, hundreds of miles of trails, and a low cost of living that still sits below major coastal markets. Commutes are manageable, neighborhoods feel livable, and the city has enough cultural range—breweries, music venues, sports—without trying to be a coastal metropolis.

#8. Philadelphia, PA — 36/50

The City of Brotherly Love doesn’t try to present itself as a “startup city.” It never has. What makes Philly compelling is that it’s a major metro with real economic depth, world-class universities, and one of the strongest healthcare and life sciences footprints in the country. It’s a practical, serious city that quietly produces strong companies, winning operators, and stable teams.

Highlights

- One of the top life sciences, biotech, and healthcare clusters in the U.S.

- Access to talent from Penn, Drexel, Temple, Villanova, and Princeton

- Extremely competitive cost of living for a major East Coast city

- Near other key cities like NYC and DC

Scores

Funding Environment — 7/10

Affordability — 7/10

Ecosystem Strength — 7/10

Talent Pool — 8/10

Quality of Life — 7/10

Total — 36/50

Why Founders Choose Philly as a Top Startup City

Philadelphia sits at the intersection of affordability, education, and industry depth. The city has one of the highest concentrations of medical schools, hospitals, and research institutions in the country, which creates a natural environment for biotech, healthtech, and medical device startups. The University of Pennsylvania, CHOP, and Jefferson Health alone create an R&D engine that most cities would kill for.

The corporate landscape is another underappreciated advantage. Philly is home to major players in healthcare, insurance, financial services, supply chain, and education — which means early pilots, customer conversations, and partnerships are far more accessible than founders expect. Companies like Comcast, GSK, AmerisourceBergen, Independence Blue Cross, and Vanguard anchor the region with real economic mass.

Talent is solid and surprisingly loyal. Philadelphia benefits from a steady output of engineering, design, and business grads from top universities, and unlike New York or Boston, people tend to stay. The city also pulls talent from New Jersey and Delaware, giving early-stage teams more hiring range than the raw population suggests.

Philadelphia’s weaknesses are straightforward: it’s not a hype-driven market, and the local Philly investor base is more conservative than the coast’s. From a quality-of-life perspective, it’s an excellent fit if you want all four seasons, care about sports, and appreciate a strong food culture.

#9. Atlanta, GA — 35/50

Atlanta is one of the most commercially powerful cities in the United States, and its startup ecosystem reflects that reality. This is a market shaped by Fortune 500 headquarters, supply chain infrastructure, payments companies, cybersecurity depth, and one of the strongest pools of Black and multicultural founders anywhere in the country. Atlanta doesn’t move on hype — it moves on industry.

Highlights

- National innovation hub for the tech industry

- Major corporate presence: Coca-Cola, Delta, UPS, Home Depot, NCR, Cox, Equifax

- Deep talent from Georgia Tech and a fast-growing AI and cybersecurity research pipeline

- One of the most diverse and community-driven startup ecosystems in the U.S.

Scores

Funding Environment — 6/10

Affordability — 7/10

Ecosystem Strength — 7/10

Talent Pool — 8/10

Quality of Life — 7/10

Total — 35/50

Why Atlanta is a Growing Startup Hub in the US

Atlanta’s edge comes from its various industries. Payment companies have operated here for decades (think Global Payments, Equifax, Fiserv, NCR), and that experience compounds. If you’re building fintech, fraud prevention, cybersecurity, logistics, or enterprise SaaS, this is one of the few cities where corporate buyers, experienced operators, and early technical hires are all within reach.

Entrepreneurs here regularly land pilots with large enterprises. Atlanta’s Fortune 500 cluster is unusually accessible, and relationships matter. This is a city where people actually take meetings, make intros, and show up. That’s a real structural advantage for B2B founders.

Capital is improving, but still catching up. Funding rounds happen, but investors in Atlanta are more traction-driven than narrative-driven, which works well for founders who prefer a grounded approach.

Atlanta offers space, greenery, diverse neighborhoods, four seasons, and a strong cultural identity. Cost of living is reasonable for a major metro, though rising in fast-growing areas like Midtown and Westside. Traffic is real, but the tradeoff is a city that gives founders room to build, raise families, and still plug into a serious tech ecosystem.

#10 Raleigh–Durham, NC — 35/50

The Research Triangle is one of the most academically dense regions in the United States. Anchored by Duke, UNC, and NC State, the area has built a reputation for strong research, entrepreneurship, and a talent base that skews analytical and highly educated. Raleigh–Durham isn’t loud or attention-seeking, but consistently produces under-the-radar.

Highlights

- Major hub for biotech, pharma, AI, healthcare IT, and enterprise software

- One of the most educated workforces in the country

- Steady inflow of engineering and research talent from Duke, UNC, and NC State

- Favorable business environment with lower costs of living

Scores

Funding Environment — 7/10

Affordability — 7/10

Ecosystem Strength — 7/10

Talent Pool — 7/10

Quality of Life — 7/10

Total — 35/50

Why Raleigh–Durham Is a Growing Startup Ecosystem

Raleigh–Durham feels much more like a quiet university town than your typical tech hub. The Triangle’s real advantage is proximity: three world-class universities within 30 minutes of each other, each pumping out talent that’s unusually technical, research-minded, and loyal to the region

What surprises most people is how steady and mature the operator base is. SAS has been here since the 1970s. Red Hat grew up here. IBM has been in RTP long enough to shape multiple generations of engineers. Even Epic Games (in nearby Cary) adds a different flavor of technical and creative talent. This isn’t a market where people job-hop every nine months, and that stability makes early hiring easier than in more frenetic cities.

The investment culture is very different from coastal markets. You won’t see inflated valuations or “we’ll preempt at the deck stage” behavior. Investors in Raleigh-Durham want data, customers, or a technical thesis that makes sense. Some founders find that frustrating; others appreciate that it keeps the ecosystem grounded and forces companies to focus on fundamentals early.

And then there’s the lifestyle part, which matters more here than most places. The Triangle is quiet, green, and livable. You can buy a house without giving up your burn rate. You can get to campus, downtown, nature, or the airport in under 30 minutes. If you want a city that’s constantly buzzing, this isn’t it. But if you want to build with focus, hire people who stick around, and plug into one of the most research-heavy regions in the country, Raleigh–Durham makes a lot more sense than its national profile suggests.

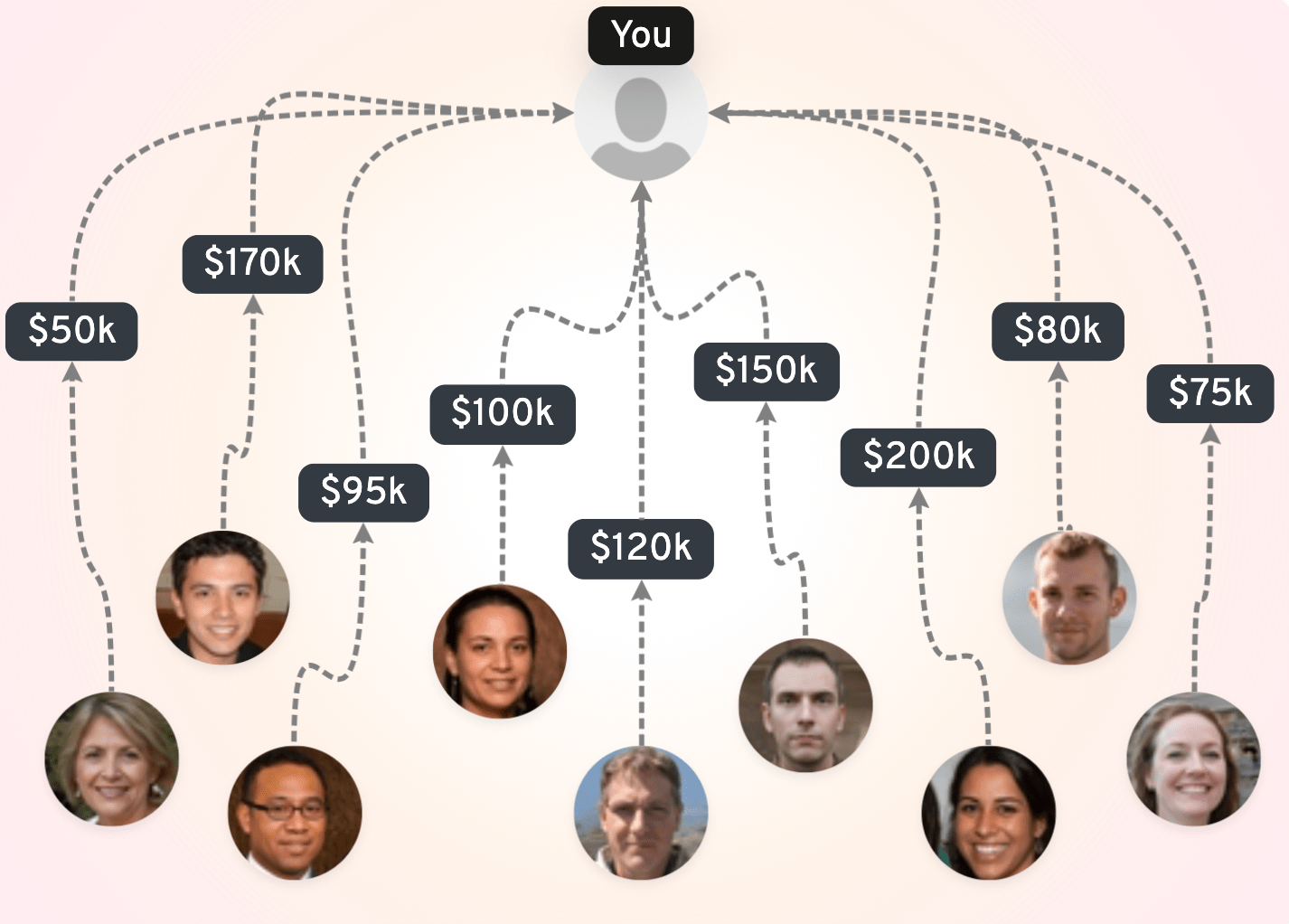

Find your ideal investors now 🚀

Browse 10,000+ investors, share your pitch deck, and manage replies - all for free.

Get Started

#11. Dallas–Fort Worth, TX — 34/50

Dallas–Fort Worth is one of the most underestimated startup regions in the country. While it doesn’t shout like Austin or attract headlines like Miami, the economic gravity here is enormous — Fortune 500 HQs, deep enterprise talent, and large industries that actually buy software. For founders selling into B2B, Dallas often works better in practice than cities ranked above it.

Highlights

- One of the largest concentrations of Fortune 500 headquarters in the U.S.

- Quietly strong in B2B SaaS, fintech, cybersecurity, energy, logistics, and real estate tech

- Reasonable cost of living for a major metro, especially compared to coastal hubs

Scores

Funding Environment — 7/10

Affordability — 8/10

Ecosystem Strength — 7/10

Talent Pool — 6/10

Quality of Life — 6/10

Total — 34/50

Why Dallas–Fort Worth is Drawing Startup Entrepreneurs

DFW is a market built for practical founders. If your business depends on understanding enterprise pain points — closing contracts, navigating procurement, integrating into legacy systems — you’ll find people here who have lived that life for decades.

The operator density is real. Alumni from companies like AT&T, Southwest Airlines, American Airlines, Texas Instruments, McKesson, Sabre, and countless mid-market players create a talent pool with a deep understanding of how big organizations actually make decisions.

Capital availability is improving, but still measured. Local Dallas investors often want traction or clear use cases before leaning in. It’s not a city where a great deck carries you; it’s a city where revenue does. National firms will invest here, but they usually come in once the business shows customer pull. For many founders, this dynamic is stabilizing — Dallas forces you to build something real before pretending you’re farther along than you are.

Quality of life is a mixed bag depending on personality. The region is affordable and clean, with great schools and space to grow, but the sprawl is real and the commute times are significant. The culture is business-forward but less social, experimental, or creative than Austin or LA. For founders optimizing for family, cost, and steady growth, it’s a great fit. If you want stimulation and constant ecosystem buzz, look elsewhere.

#12. Salt Lake City, UT — 33/50

Salt Lake City is one of the most efficient tech ecosystems in the U.S. Utah’s “Silicon Slopes” reputation isn’t just branding — the region has produced multiple billion-dollar companies without relying on coastal attention or inflated spending. It’s a place where companies get built quietly, quickly, and with a discipline that surprises founders who only know the Bay Area playbook.

Highlights

- One of the strongest bootstrapped and capital-efficient tech cultures in the country

- Operator depth from Qualtrics, Pluralsight, Podium, Lucid, Divvy, and Ancestry

- A young, highly educated population with strong engineering and sales talent

- One of the most naturally beautiful metro areas to live in

Scores

Funding Environment — 6/10

Affordability — 7/10

Ecosystem Strength — 7/10

Talent Pool — 6/10

Quality of Life — 7/10

Total — 33/50

Why Salt Lake City is a Standout Startup Hub

The operators in SLC know how to build without burning millions, because the region never had the luxury of coastal capital in the first place. Most of Utah’s breakout companies were built by teams that learned how to sell early, iterate fast, and stay disciplined. That mindset still shapes the ecosystem today.

Hiring is a major strength. The talent pool is young, educated, and unusually loyal. Local graduates from BYU and the University of Utah tend to stick around, and companies consistently report longer-than-average tenures. There’s also a strong sales and customer success talent base, which is why so many SaaS companies choose to scale teams here.

Utah’s operator network is another underappreciated advantage. Alumni from Qualtrics, Divvy, BambooHR, Lucid, and Podium play a massive role in advising, angel investing, and helping early founders avoid rookie mistakes. It’s not a loud or self-promotional ecosystem, but it’s one where founders actually get hands-on help from people who’ve built meaningful companies.

SLC may not be a perfect fit for every founder. Salt Lake is not a top-tier biotech or deeptech hub, coastal VCs aren’t based here, and founders building highly technical products often end up hiring remotely. Cultural fit also matters; SLC’s social norms, pace, and lifestyle don’t work for everyone. But for SaaS, SMB tools, fintech adjacencies, consumer subscription businesses, and companies prioritizing capital efficiency, Salt Lake City consistently overdelivers.

#13. Minneapolis–St. Paul, MN — 32/50

Minneapolis–St. Paul doesn’t chase the spotlight, but it quietly checks boxes most founders overlook: stable talent, affordable living, and deep corporate adjacency across healthcare, retail, food, and manufacturing. It’s a place where companies grow at a measured pace, with customers who will tell you the truth and operators who genuinely want to build durable businesses.

Highlights

- Exceptional talent pool in healthcare, medtech, retail, supply chain, and manufacturing

- Strong engineering culture with high retention

- Affordable, livable, and grounded — no hype, no extremes

- Close-knit and friendly networks for aspiring entrepreneurs

Scores

Funding Environment — 5/10

Affordability — 8/10

Ecosystem Strength — 6/10

Talent Pool — 6/10

Quality of Life — 7/10

Total — 32/50

Why Minneapolis–St. Paul is a Top City for Entrepreneurs

If you’re building in healthcare, medtech, wellness, food systems, retail, logistics, or manufacturing, the Twin Cities might quietly be one of the best places in the country to start. This region is home to giants: Target, Best Buy, Medtronic, General Mills, UnitedHealth Group, 3M, Cargill (nearby), Ecolab, Securian, and more. That concentration of industry matters — founders can validate enterprise needs without leaving the metro.

What MSP lacks in flash, it makes up for in livability. Housing is affordable, commutes are manageable, schools are strong, and the city punches way above its weight in culture, food, arts, and parks. Winters are objectively intense — founders coming from warm-weather cities should be aware — but the quality of life during the rest of the year is undeniable.

Funding is the region’s weak spot. There are active funds in Minneapolis, but the number of firms willing to lead early rounds is limited, and coastal capital tends to engage only once traction is clear. Founders here often build with revenue discipline by necessity, which creates sturdier companies but sometimes slower ramps.

Minneapolis–St. Paul is not trying to be the next Austin or Miami. It’s not optimizing for hype or migration. It’s a slow-burn ecosystem that works exceptionally well for founders building real products for real industries — especially those who don’t need constant noise to stay motivated.

#14. Portland, OR — 32/50

Portland isn’t trying to compete with Austin or Miami either. Founders come here because it gives them something few cities offer anymore: space to think, consistent engineering talent, and a lifestyle that doesn’t burn people out. Portland has a reputation for creativity and counterculture, but underneath that is a serious technical backbone built by decades of semiconductor, hardware, cloud, and open-source work.

Highlights

- Deep engineering and hardware talent from Intel, HP, Nike, Tektronix, Puppet, and AWS

- Strong culture of craftsmanship, ethics, and long-term product thinking

- Highly livable city with easy access to nature, outdoors, and meaningful work–life balance

- More affordable than most coastal tech markets

Scores

Funding Environment — 6/10

Affordability — 7/10

Ecosystem Strength — 6/10

Talent Pool — 6/10

Quality of Life — 7/10

Total — 32/50

Why Portland is a Top Startup Scene

Portland attracts a certain type of entrepreneurial person who wants to build products without getting sucked into tribal tech drama. There’s a quiet confidence to the ecosystem: fewer pitch competitions, more whiteboards; less noise, more craft. It’s the kind of city where engineers stay at companies because they like the work, not because the valuation jumped 3x last quarter.

The talent story is underrated. Intel’s massive presence in Hillsboro has shaped Portland’s technical DNA for decades, producing world-class engineers in hardware, semiconductors, supply chain, and manufacturing. Nike’s HQ brings strong design, consumer product, and brand talent. AWS and Puppet have anchored cloud and DevOps expertise in the region. The result is a city where technical hires tend to be senior, thoughtful, and exceptionally grounded.

Like many other similar-sized cities, funding is the weakest part of its ecosystem, but not in an unsalvageable way. There are local venture capital firms in Portland, but the city doesn’t have a strong “lead early rounds at scale” culture. Founders often raise from Seattle, SF, or remote-first firms. The upside is cultural: companies built here tend to be disciplined, product-led, and durable because they aren’t optimized for burn.

As a place to live, Portland is undeniably strong if you value nature, outdoor access, and a less hectic pace. Good food, good coffee, genuinely interesting neighborhoods, and one of the best parks-and-trails systems in the country. The downsides? Slower ecosystem velocity, fewer meetups, and a founder community that feels more fragmented than cohesive. It works best for builders who already know what they want to make, and not so much for those who need the energy of a major hub to stay motivated.

#15. Phoenix, AZ — 32/50

Phoenix is what happens when a city hits critical mass in population, talent migration, and industry diversity all at once. Over the last decade, the metro has grown faster than almost any major U.S. region, and with that growth comes a startup ecosystem that’s finally finding its shape. Phoenix isn’t a polished tech hub yet — but it’s quickly becoming the go-to home base for founders who want affordability, scale, and a massive labor market without the noise of a bigger city.

Highlights

- One of the fastest-growing metro populations in the U.S.

- Strength in fintech, proptech, healthcare, logistics, and SMB software

- Large universities (ASU, U of A) feeding a steady talent pipeline

- Affordable living with new pockets of tech density in Tempe, Scottsdale, and Chandler

Scores

Funding Environment — 5/10

Affordability — 8/10

Ecosystem Strength — 5/10

Talent Pool — 7/10

Quality of Life — 7/10

Total — 32/50

Why Phoenix is One of the Best Places to Start a Business

Phoenix is a city defined by scale. The metro adds tens of thousands of new residents every year, and that influx has quietly changed the environment for early-stage companies. Startups here have access to a broad population of engineers, operators, university grads, and career switchers — not elite pedigree talent, but a huge, diverse labor pool that startups can shape. ASU alone produces more engineering and business grads than some entire states.

The sector strengths are clearer than people expect: fintech, proptech, healthcare services, logistics, and SMB tools all have momentum. Companies like Carvana, Offerpad, Axon, PayPal’s local presence, and a cluster of insurance and financial services firms have created meaningful operator pipelines. It’s particularly friendly to new businesses solving mundane-but-important operational problems.

Funding opportunities are there, but not consistent. Investors in Phoenix exist, but the density isn’t there. Most founders who raise meaningful seed rounds still source capital from LA, SF, or Austin. The flip side is that founders here learn to build with discipline, and teams often operate with a “prove it with revenue” mindset earlier than coastal peers.

Quality of life is a strong selling point if you can tolerate heat. For many founders, Phoenix offers something rare: a big-city market that still feels accessible. Housing is reasonable, commutes are manageable, and neighborhoods like Tempe, Arcadia, and parts of Scottsdale have started to build a recognizable tech identity. It’s not a city overflowing with meetups or accelerators, but the pieces are coming together for 2026 and beyond.

Final Thoughts for Founders

No ranking can tell you exactly where to build. But it can help you narrow the field.

The truth is simple: every city on this list can support a great company, but not every city will be great for you. If you need deep technical talent, go where the researchers are. If you need distribution, choose a city built around storytelling and brand. If your product depends on enterprise buyers, put yourself where big companies actually sit. And if you just need space, affordability, and a sane lifestyle to execute for years, lots of underrated cities will outperform the obvious choices.

Use this list as a starting point, not a conclusion. Talk to founders who actually live in these places. Visit the neighborhoods where early-stage teams cluster. Pay attention to who’s raising rounds, who’s hiring, and where the real operator communities live. Geography won’t build your company, but the right environment will make every hard thing just a little bit easier.

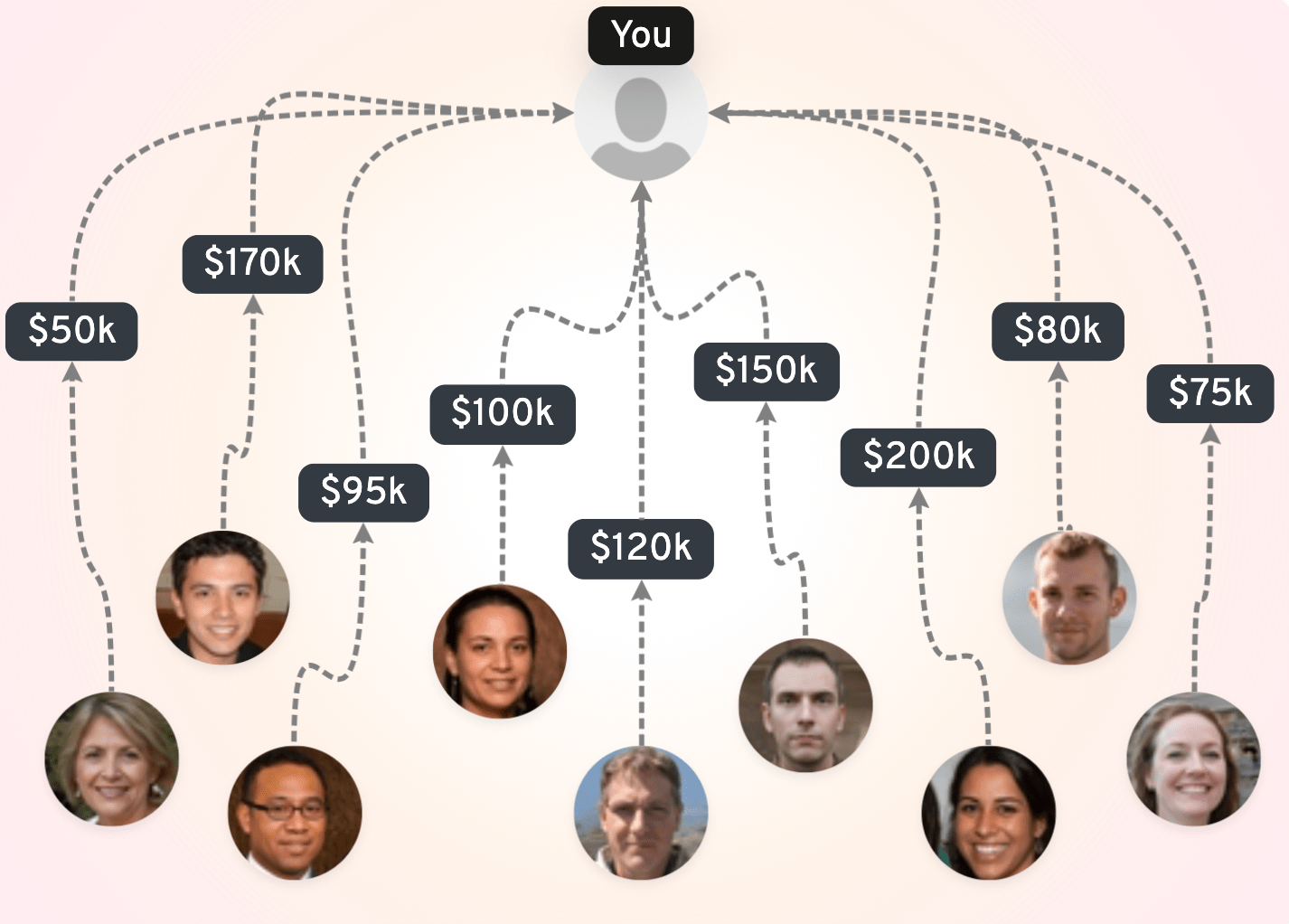

Find your ideal investors now 🚀

Browse 10,000+ investors, share your pitch deck, and manage replies - all for free.

Get Started