I’ve spent years watching founders chase “top VCs” without realizing how many ways you can define “ top”. A big AUM doesn’t mean they’ll reply to your cold email…and a great reply rate doesn’t mean they’re right for your stage. At OpenVC, we look at it from every angle: assets, exits, unicorns, founder feedback, and more.

This is our full breakdown of the top venture capital firms in 2025.

So let's jump into it!

Top VC Firms by Assets Under Management (2025)

When you think of “top” VC funds, the classic way to measure would be by AUM. So, let’s begin with ranking the largest players in the industry landscape. Here, you’ll spot several of the tier-1 VC firms that most founders aim to partner with.

1. Tiger Global Management - $69.5 Billion

- Founded: 2001

- Total Investments (All-Time): 1,300+

- Stages They Invest In: High-growth

- Portfolio Company Sectors: Tech, cybersecurity, and fintech

2. Sequoia Capital - $60 Billion

- Founded: 1972

- Total Investments (All-Time): 1,700+

- Stages Invested In: Seed to Growth stages

- Portfolio Company Sectors: Technology, healthcare, consumer services, and financial services

3. Legend Capital - $48.1 Billion

- Founded: 2001

- Total Investments (All-Time): 500+

- Stages They Invest In: Early to Growth stages

- Portfolio Company Sectors: Technology, healthcare, and consumer sectors

4. Andreessen Horowitz (a16z) - $46 Billion

- Founded: 2009

- Total Investments (All-Time): 1,100+

- Stages Invested In: Seed to Growth stages

- Portfolio Company Sectors: SaaS, healthcare, fintech, consumer, and enterprise software

5. New Enterprise Associates (NEA) - $28 Billion

- Founded: 1977

- Total Investments (All-Time): Over 1,100 investments since inception

- Stages They Invest In: Seed to Growth stages

- Portfolio Company Sectors: Technology, healthcare, and energy

6. Dragoneer Investment Group - $25.6 Billion

- Founded: 2012

- Total Investments (All-Time): 160+

- Stages Invested In: Growth stages

- Portfolio Company Sectors: SaaS, internet, software, and consumer sectors

7. Lightspeed Venture Partners - $25 Billion

- Founded: 2000

- Total Investments (All-Time): 1,000+

- Stages They Invest In: Seed to Growth stages

- Portfolio Company Sectors: Enterprise software, consumer, and healthtech

8. Bessemer Venture Partners - $20 Billion

- Founded: 1911

- Total Investments (All-Time): 390+

- Stages They Invest In: Concept through Series A, and all stages of growth

- Portfolio Company Sectors: Enterprise, consumer, and healthcare

9. Accel - $19 Billion

- Founded: 1983

- Total Investments (All-Time): 300+

- Stages They Invest In: Seed to Growth stages

- Portfolio Company Sectors: AI, consumer brands, fintech, and manufacturing

10. Khosla Ventures - $15 Billion

- Founded: 2004

- Total Investments (All-Time): 1,000+

- Stages They Invest In: Seed to Growth stages

- Portfolio Company Sectors: Focus on technology, healthcare, and clean energy

Find your ideal investors now 🚀

Browse 10,000+ investors, share your pitch deck, and manage replies - all for free.

Get Started

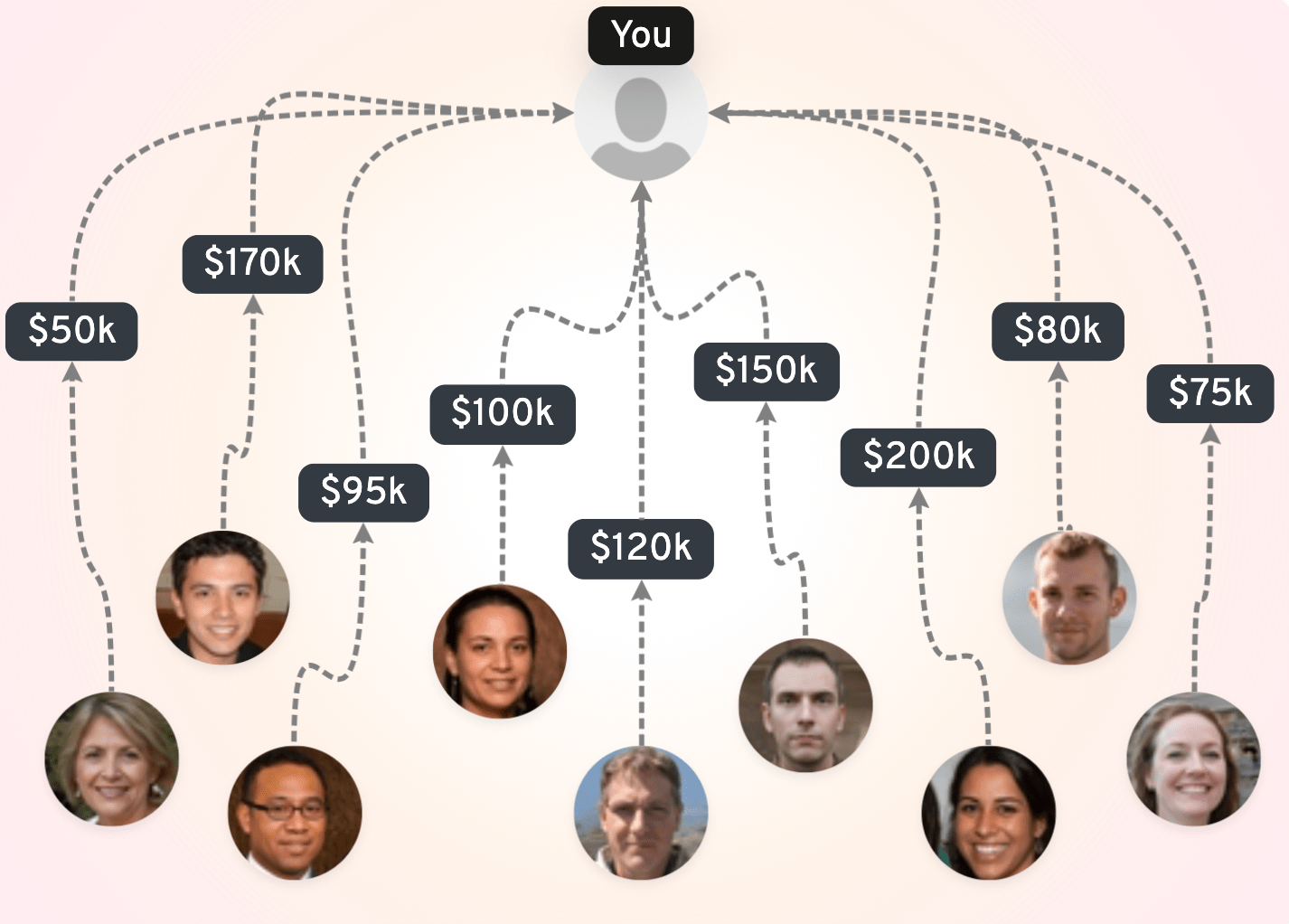

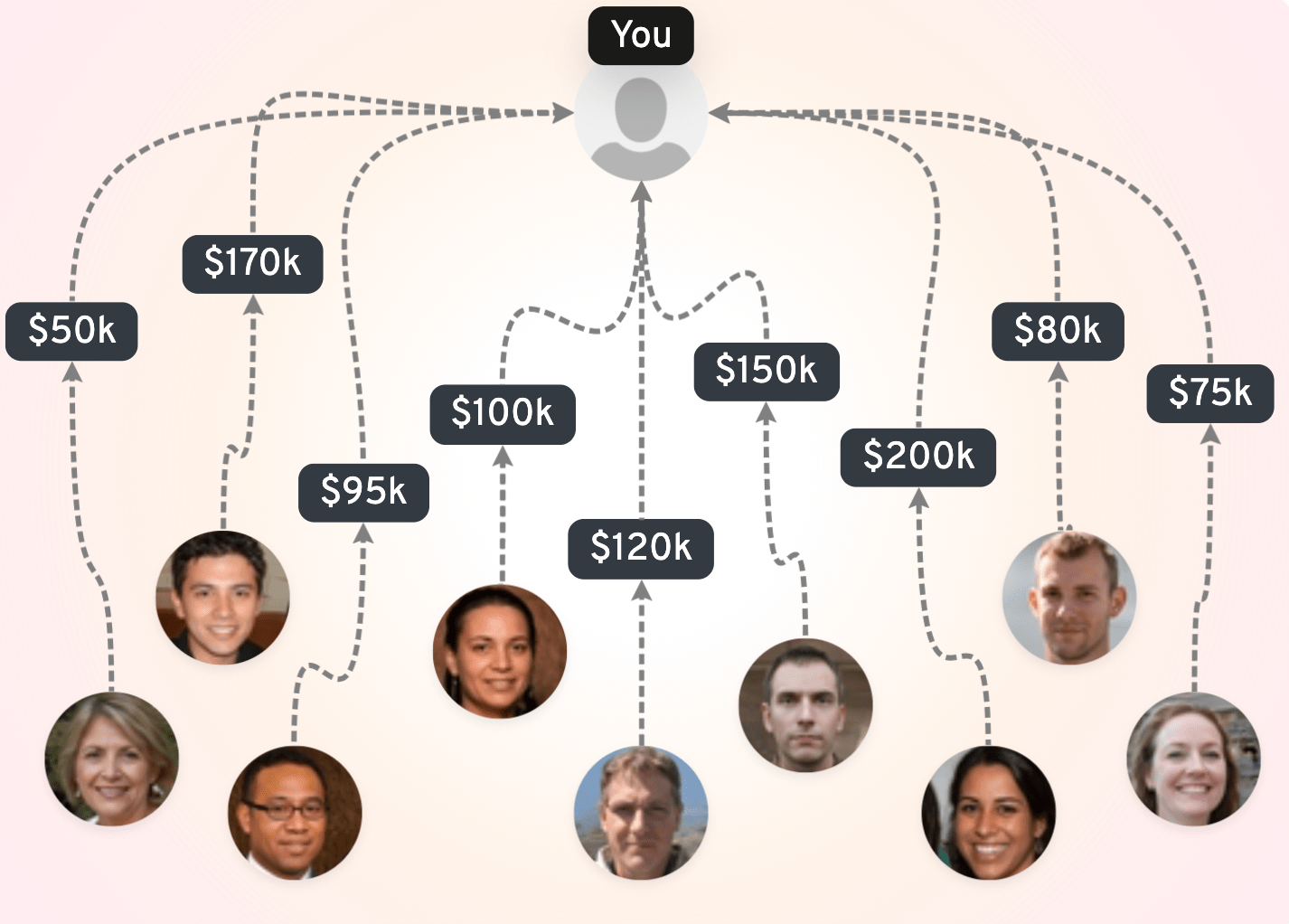

Top VC Firms by Reply Rate to Cold Outreach

Next, let’s go with a ranking that every founder actually cares about: the top venture capital funds that actually respond to cold outreach. Based on our data at OpenVC, here are the 10 VCs with the highest number of replies to cold outreach in 2025:

If you’re tired of sending messages into the void, OpenVC is your best solution. Sign up for free and reach out to investors like these in just a matter of minutes. Get started now!

Top VC Firms by Investment-to-Exit Ratio

VCs don't invest out of the goodness of their hearts. They want exits. So ranking the best venture capital firms by their investment-to-exit ratio seems fitting.

Here is a list of the top ten VC firms by their investment-to-exit ratio as of August 2022 according to Clacified :

- GV Ventures. Investment to exit ratio - 23.86%

- Bessemer Venture Partners. Investment to exit ratio - 22.92%

- Insight Partners. Investment to exit ratio - 22.68%

- Index Ventures. Investment to exit ratio - 21.91%

- Sequoia Capital. Investment to exit ratio - 21.28%

- Accel. Investment to exit ratio - 19.77%

- Lightspeed Venture Partners. Investment to exit ratio - 18.79%

- General Catalyst. Investment to exit ratio - 16.82%

- Andreessen Horowitz. Investment to exit ratio - 16.71%

- GGV Capital. Investment to exit ratio - 15.14%

Top VC Firms by Unicorn Startups in Portfolio

A unicorn company is a privately held company that is valued at $1billion or more. That’s right. $1 billion or more. According to Crunchbase, there were 1,539 unicorn companies with an aggregated $943 billion raised and $5.1 trillion in value as of June 2024.

So who are the top VC investors who’ve backed the most unicorns?

- Tiger Global Management

- Accel

- Andreessen Horowitz

- Sequoia Capital

- Insight Partners

- Lightspeed Venture Partners

- Y Combinator

- Coatue

- Softbank Vision Fund

- Index Ventures

For a live list of current VCs and their unicorn investments, Crunchbase has a unicorn board that is frequently updated, complete with companies, their lead investors, total funding, and more.

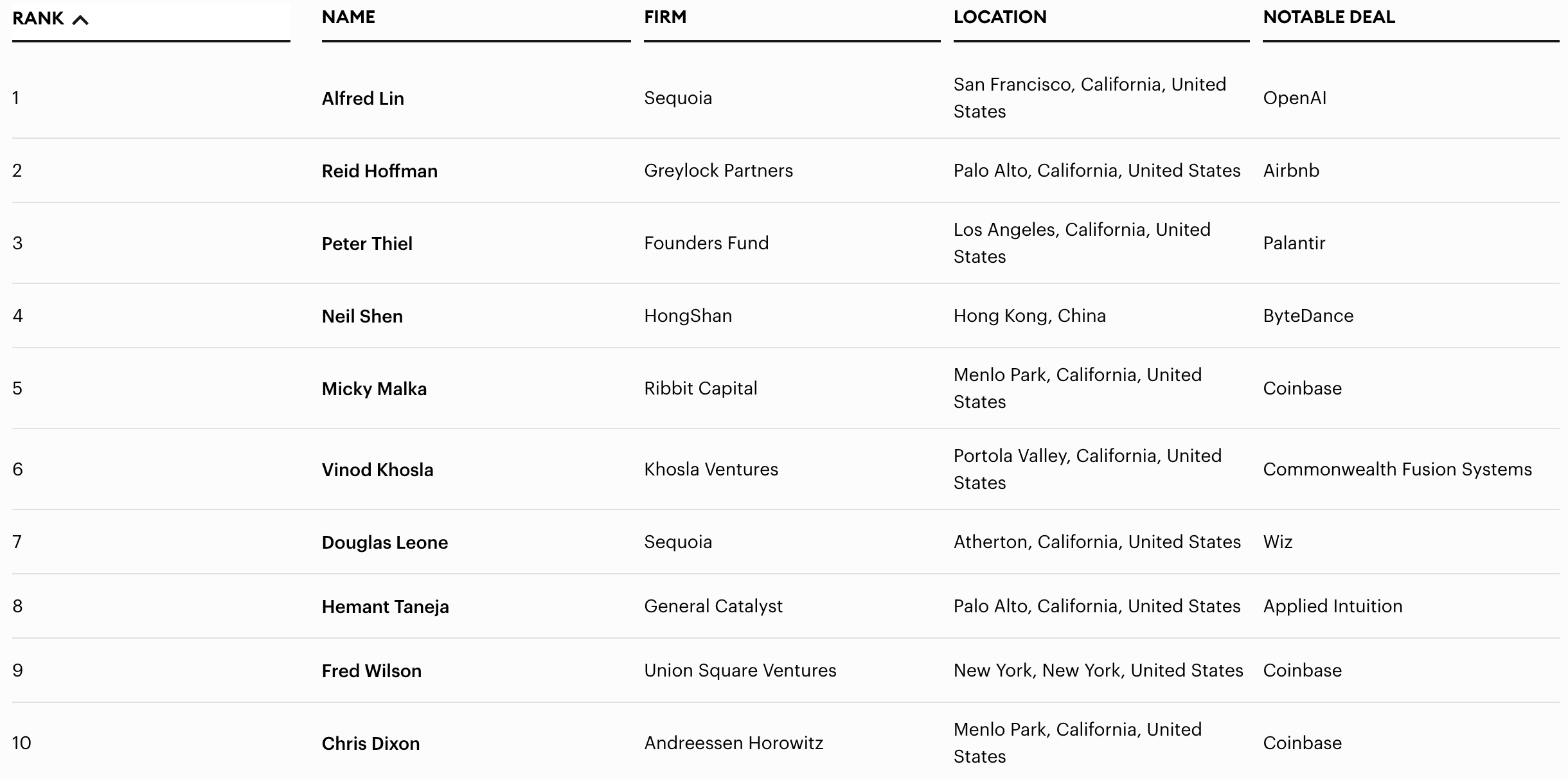

Top VC Investors in the Midas List (2025)

Every year Forbes and TrueBridge Capital Partners come together to create the Midas List. This is the definitive ranking of the top 100 tech investors in the world. In order to qualify, investors are ranked by their portfolio companies that have gone public or been acquired for at least $200 million over the past five years.

Alternatively, the portfolio companies have at least doubled their private valuation since initial investment to $400 million or more over the same period. Both Forbes and TrueBridge put a premium on true exits (I.E. liquid exits, show me the money) over unrealized returns. Large multiples on money invested for early-stage investors or large sums of cash returned for growth-stage specialists are also taken into account. Both play a role for top Midas List investors.

The list is data-driven and results from submissions by hundreds of investment partners, as well as public data sources. Below are the top ten venture capitalists for 2025.

- Alfred Lin, Sequoia

- Reid Hoffman, Greylock

- Peter Thiel, Founders Fund

- Neil Shen, HongShan

- Micky Malka, Ribbit Capital

- Vinod Khosla, Khosla Ventures

- Douglas Leone, Sequoia

- Hemant Taneja, General Catalyst

- Fred Wilson, Union Square Ventures

- Chris Dixon, Andreessen Horowitz

For the full list, you can click here.

Top VC Funds by ELO Score

Founder’s Choice uses an Elo-based algorithm (yes, like chess!) to rank venture capital firms, based on the founders who actually worked with these VCs. Here are their top ten as of October 2025.

- Khosla Ventures

- Union Square Ventures

- Two Sigma Ventures

- Andreessen Horowitz

- First Round Capital

- Bowery Capital

- Y Combinator

- Hoxton Ventures

- Hyde Park Venture Partners

- Tribe Capital

Leading VC Firms Focused on Female Founders

As stated previously, female founders don’t get much in the way of VC investment. Here are ten venture capital firms that are trying to change this by making it their mission to invest in female founders, according to 2025 OpenVC data :

Top VC Firms by Social Media Followers

Twitter is a great place to keep up to date with the latest investments and startup news. Plus, you learn about the early-stage landscape as well as get social with them. Here is a list of VC firms with the highest follower counts on Twitter/X.

- Y-Combinator. 1.5M followers

- Andreessen Horowitz. 885k followers.

- Sequoia Capital. 733k followers.

- GV. 528K followers

- Accel. 268k followers.

- Greylock. 246k followers.

- Kleiner Perkins. 236k followers.

- First Round. 221k followers.

- True Ventures. 113k followers.

- Bessemer. 105k followers

Feel free to follow and begin learning and even engaging with them today.

(And yes, I call it Twitter, not "X")

Top VC Firms by Headcount

The larger the VC firm, the larger the headcount. Here is a list of the top VC firms by employees according to their LinkedIn company pages.

- Plug and Play. 1,322.

- Accel. 1,236

- Andreessen Horowitz. 889.

- IDG Capital. 565

- First Round Capital. 359

- Sequoia Capital. 357.

- Kleiner Perkins. 297.

- GV. 273

- Bessemer Venture Partners. 267

- Tiger Global Management. 244

Top VC Firms by US State

There are plenty of US-based venture capital companies based outside Silicon Valley (we feature 3,000+ in OpenVC’s USA investor list).

Additonally, CBInsights has a complete dataset of every top venture fund broken down by state. A few of the top contenders include:

- California Investors : Andreessen Horowitz

- Massachusetts Investors : Accomplice

- Delaware Investors : Sierra Ventures

- New York Investors : Lerer Hippeau

- Colorado Investors : Foundry Group

- Florida Investors: Florida Funders

The rest can be seen on the map below.

Top VC Firms in Latin America (2019-2025)

Latin America is a growing market that is seeing a record-breaking influx of VC. According to Pitchbook, these are the 10 most active VCs in Latin America by deal count for the period 2019 - 2025.

- Bossanova Investimentos

- Canary

- FJ Labs

- Kaszek

- DOMO.VC

- Monashees

- Latitud

- Norte Ventures

- Magma Partner

- Valor Capital

Want to see more investors in the region? Check out our complete LATAM investor list.

Top VC Firms in Asia

Asia is a massive hub for both VC and innovative startups. Here is a list of 10 prominent venture capital firms in Asia, courtesy of Startupstash.

- Wakermaker Partners

- East Ventures

- Sequoia Capital China

- Qiming Venture Partners

- CyberAgent Capital

- Gobi Partners

- Brand Capital

- Shenzhen Capital Group

- Zhen Fund

- JAFCO Japan

You can also browse 1,400+ more investors in OpenVC’s complete Asia Investor List.

Conclusion

The fundraising journey is never easy but it helps to know which VCs to approach. Fortunately, our free and open platform has VCs broken down by industry, check size, company stage, thesis, and more.

Start by exploring our 150+ curated investor liststo identify the investors most aligned with your startup and fundraising goals. Once you’ve found the right fits, you can submit your deck directly to VCs who are not only influential in your industry but also personally meaningful to your journey.

Find your ideal investors now 🚀

Browse 10,000+ investors, share your pitch deck, and manage replies - all for free.

Get Started