Fabrice Grinda: Built $3B+ OLX , $200M+ Zingy, and Angel Investor in 300+ Startups 🚀

This is episode 18 of The OpenVC Podcast. In this episode, Fabrice Grinda, co-founder of OLX ($3B+ valuation) and FJ Labs (900+ active investments), takes us through his wild journey from building and exiting billion-dollar companies to becoming one of the most active angel investors in the world.

ABOUT

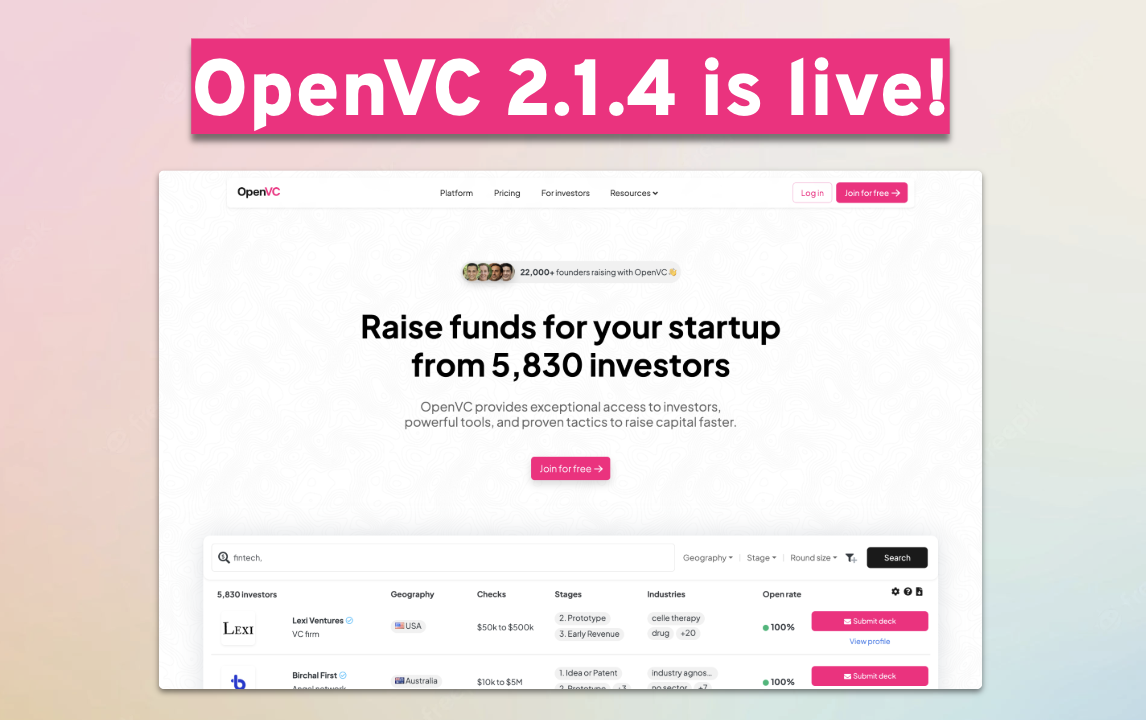

OpenVC is a radically open platform that helps tech founders connect with the right investors.

Visit OpenVC

Get Intercom

FREE for 1 year