Serial Founder, Angel Investor & VC: Max Fleitmann

This is episode 13 of The OpenVC Podcast. In this episode, Max talks about how he started building websites at 13 and later scaled his edtech company, StudyHelp, to millions in revenue before exiting. Now leading Wizard Ventures, he shares insights on acquiring and scaling internet startups, driving traffic, and crafting effective pitch decks.

Co-founder at Twin Path Ventures: John Spindler (& ex co-founder of London Co-Investment Fund)

This is Episode 8 of The OpenVC Podcast. In this episode, John Spindler shares his journey from founder to investor, overseeing £85M+ in investments across 150 startups. With a 60x angel investment win, he breaks down AI startup evaluation, frontier AI opportunities, and key investment strategies.

F4 Fund General Partner: Joakim Achren, co-founder of Next Games (ultimately acquired by Netflix)

This is episode 7 of The OpenVC Podcast. In this episode, Joakim Achren, founder of Next Games (160+ employees, acquired by Netflix), built hit games for Stranger Things and The Walking Dead. Now leading F4 Fund with 28+ angel investments, he shares insights on gaming VC, fundraising, and emerging platforms.

ABOUT

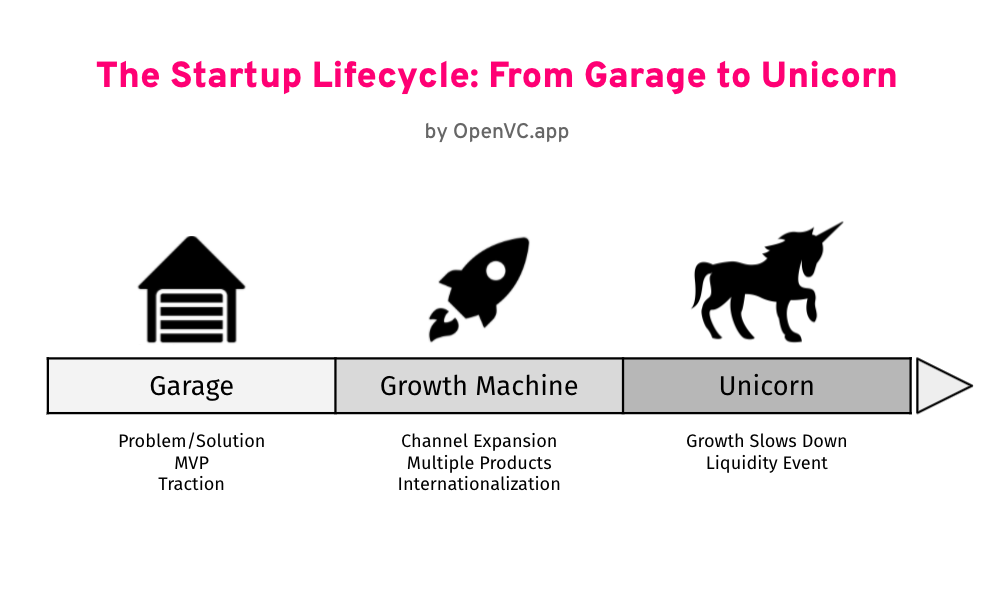

OpenVC is a radically open platform that helps tech founders connect with the right investors.

Visit OpenVC